Reforming the Australian welfare state

You are in an archived section of the AIFS website

December 2000

Download Research report

Overview

Edited by Peter Saunders

The Australian welfare system is changing. A new agenda is emerging and radical reforms are in the air. This timely collection of essays addresses this new agenda and reflects on the case for radical reform. It includes contributions from prominent Australian academics and political leaders, as well as people working in the voluntary sector and those employed by the Canberra government. It brings together both advocates of reform and opponents. It also includes key writers from the United States and the United Kingdom where debates about welfare reform have both reflected and influenced thinking within Australia.

Preface

This book is published at a time when Australia, in common with a number of other western countries, is reassessing its welfare system. The book brings together Australian and international authors representing a variety of different interests and perspectives in the welfare field. Its aim is to contribute to the Australian debate over welfare reform by clarifying the issues that are at stake and presenting relevant and up-to-date evidence which bears upon the core arguments.

The Australian Institute of Family Studies has a particular interest in the issue of welfare reform because any change to the welfare state has important implications for Australian family life. In many ways, the modern welfare state and the family can be seen as functional substitutes for each other. Obviously the state cannot supply the affection that we look for in family life, any more than the family can supply the range of services and level of support that the state can provide. But in general, the more the state welfare system does, the less the family is likely to be required to do, and vice versa. This is why welfare policy and family policy are so closely linked – change in one will normally imply change in the other.

In December 1999, the Institute began to explore these links by publishing a special issue of its research magazine, Family Matters, devoted to ‘Families, welfare and social policy’. The feedback on this special issue was extremely positive, and this prompted us to commission a number of essays from leading figures in the welfare field in order to explore in more depth some of the main issues which lie at the heart of the current welfare debate. The current volume is the result.

Most of the essays published here were specially written or revised for this volume. Earlier versions of chapter 2, by Lawrence Mead, chapter 3, by Frank Field, and chapter 4, by Alan Buckingham, originally appeared in the December 1999 special issue of Family Matters (no. 54). However, the Mead and Buckingham essays have subsequently been revised, developed and updated for this book, and only Field’s essay remains essentially unchanged.

Two of the chapters are based on articles which have been published elsewhere. Anna Yeatman’s essay on mutual obligation in chapter 8 is a substantially revised version of a paper first published in the Proceedings of the 1999 National Social Policy Conference. Peter Dawkins’ discussion in chapter 11 of issues considered in the Reference Group’s Interim Report is an edited version of an article which appeared in the April 2000 issue of the Melbourne Institute Quarterly Bulletin of Economic Trends.

The Family Matters December 1999 special issue contained articles by Noel Pearson and Lucy Sullivan, who both also contribute chapters to this book (chapter 7 and chapter 9 respectively), but in both cases these authors have chosen to produce entirely new pieces for inclusion here. The chapters by Frances McCoull and Jocelyn Pech (chapter 5), Don Siemon and Fiona MacDonald (chapter 10), Michael Raper (chapter 12), and Wendy Stone and myself (chapter 6) are all also published here for the first time, as is my introductory essay (chapter 1).

This is the first time I have edited a book of essays. Folk wisdom has it that such a task should be avoided if at all possible, for an edited book moves at the glacial pace of the slowest contributor, and even when all the essays are submitted, the editor still ends up spending weeks and even months having to mould them all into a common style while negotiating with authors reluctant to rework their material.

Such, however, was not my experience here. I am enormously grateful, therefore, to all of the contributors to this book for producing such excellent material under exceedingly tight deadlines, and for the alacrity with which they responded to subsequent editorial queries.

I should also like to thank David Stanton, the Director of the Australian Institute of Family Studies, and Peter Whiteford, of the OECD in Paris, for their very helpful comments on an earlier draft of the whole manuscript. I acknowledge and thank Alan Fettling, the Director of IP Communications, for his interest and initial encouragement of the project, and I appreciate Meredith Michie’s professionalism, as the Institute’s editor, in steering the book through to final publication.

Welfare policy is a contentious area of public debate and governance, and the issues being addressed in this book often stir strong passions. In homage to the Popperian spirit of open and critical argument, the book brings together contributors representing different positions in the debate who have been allowed as much freedom as is practicable to develop and express their own arguments in whichever way they believe is most appropriate. It is therefore the case that none of the opinions and arguments expressed in the chapters that follow should be taken to represent the views of the Australian Institute of Family Studies.

Peter Saunders

Australian Institute of Family Studies

May 2000

Notes on the contributors

Alan Buckingham is Lecturer in Sociology in the School of Social Sciences at the University of Sussex, England. Brought up by his divorced and jobless mother on a Local Authority housing estate in South East England, he recently completed a doctoral thesis on the underclass in Britain, and the main findings from this work have been published in the British Journal of Sociology. He is currently writing a book with Peter Saunders about quantitative research methods.

Peter Dawkins has, since 1996, been the Ronald Henderson Professor and Director of the Melbourne Institute of Applied Economic and Social Research at the University of Melbourne. He is well known for research in the areas of labour economics, social economics and industrial relations, and has published extensively in these areas. He has been prominent in policy debates about unemployment and the tax and welfare system. In August 1997 he addressed a special meeting of the Federal Cabinet on the subject of unemployment, and in October 1998 he was one of five economists who sent a letter to the Prime Minister outlining a plan for reducing unemployment. In October 1999 he was appointed to the Reference Group on Welfare Reform set up by the Minister for Family and Community Services.

Frank Field is a Labour Member of Parliament in the United Kingdom and was formerly Director of the Child Poverty Action Group. In the House of Commons he has been Labour’s front bench spokesman on education and social security, he has chaired the Social Security Select Committee and, from 1997 to 1998, he was Minister for Welfare Reform, Department of Social Security, in the Blair government. He has published extensively, including two recent titles on welfare reform, both published by the Social Market Foundation (Reforming Welfare in 1997, and Reflections on Welfare Reform in 1998). He has been awarded an Honorary Doctorate of Law from Warwick University, and a Doctorate of Science from Southampton University.

Fiona MacDonald is a research and policy worker with the Social Action and Research directorate of the Brotherhood of St Laurence which she joined as a member of the Future of Work project team in the mid 1990s. The Brotherhood of St Laurence provides a range of services for people with low incomes and works for an Australia free of poverty through community education, research, social action and advocacy. Her work there has been mainly in the areas of employment and unemployment, industrial relations and wages, young people and labour market disadvantage, and on the longitudinal study of the life chances of children. She holds a B.Sc, a Grad. Dip in Couns. Psych. and a M.SocSci.

Frances McCoull is a Project Officer working in the Strategic Policy and Analysis Branch in the Commonwealth Department of Family and Community Services in Canberra. She has eight years experience in policy development and research related to income support. She is currently working on a project investigating trans-generational income support dependence in Australia.

Lawrence Mead is Professor of Politics at New York University, where he teaches public policy and American government. He has been a visiting professor at Harvard, Princeton, and the University of Wisconsin. Professor Mead is an expert on the problems of poverty and welfare in the United States, and the politics of these issues. His works include Beyond Entitlement (1986), The New Politics of Poverty (1992), The New Paternalism (1997), and From Welfare to Work: Lessons from America (1997). These books set out much of the theory and practice for recent welfare reform in the United States.

Noel Pearson is a history and law graduate of the University of Sydney, and his thesis on his home town of Hope Vale has recently been published in Maps Dreams History by the History Department of the University. He was part of the indigenous negotiating team during the drafting of the Native Title Act in 1993, and was the Executive Director of the Cape York Land Council until July 1996 when he was elected its Chairman. He resigned as Chairman at the end of 1997, but he remains an adviser to the Cape York Land Council, as well as to a number of other indigenous organisations in the Cape York region of Queensland.

Jocelyn Pech is Director of Participation Projects in the Commonwealth Department of Family and Community Services, and is currently seconded to the Department’s Welfare Review team. In her usual role, she is responsible for a team undertaking applied policy research on emerging issues of concern to government and the community – including the current project on trans-generational income support dependence.

Michael Raper was elected President of the Australian Council of Social Service (ACOSS) in November 1997 and was reelected in 1999. (ACOSS is the national peak council for the community welfare sector and brings together through its membership the major national charities and church groups, consumer groups, social justice groups, community service organisations and State and Territory Councils of Social Service.) The position of ACOSS President is an honorary one and he combines this with his employment as Director of the New South Wales Welfare Rights Centre, a position he has held since 1990. The Welfare Rights Centre specialises in Social Security law, policy and administration, and deals with over 4000 low income and disadvantaged clients each year. He has recently completed the 3rd edition of the Independent Social Security Handbook.

Peter Saunders is Professor of Sociology at the University of Sussex and is currently on secondment as Research Manager at the Australian Institute of Family Studies. His books include Social Theory and the Urban Question (1986), Social Class and Stratification (1990), A Nation of Home Owners (1990), Privatization and Popular Capitalism (1994), Capitalism: A Social Audit (1995) and Unequal But Fair? (1996). He has held visiting academic positions at the University of Bremen (Germany), Brown University (USA), the University of Canterbury (New Zealand), the University of Melbourne, and the Australian National University, and he is a member of the Board of the Institute for the Study of Civil Society in London.

Don Siemon is Acting Director of Social Action and Research at the Brotherhood of St Laurence. His policy and research interests include poverty measurement; child care; social security policies – particularly those affecting families and young people; tax and budget policies; provision and pricing of essential services; and the restructuring of human services. He holds a B.E and M.EngSci and has worked for community sector organisations in the overseas aid, environment, consumer, welfare and publishing fields prior to joining the Brotherhood of St Laurence in 1992. Past directorships include the Renewable Energy Authority of Victoria (Energy Victoria), Community Technology Ltd, and Australian Society Publishing Company Ltd.

Wendy Stone is a Research Fellow at the Australian Institute of Family Studies where she has been working on studies of housing, social polarisation and, most recently, the importance of ‘social capital’ in understanding patterns of family engagement in economic, community and political life. She is author of numerous Institute reports and publications and is currently a doctoral candidate in the Sociology Program at the University of Melbourne, where she is undertaking research investigating social exclusion and labour market inequalities and the role of social networks in mediating poverty.

Lucy Sullivan has an Honours Degree in English and a Doctorate in Psychology. Specialising initially in cognitive psychology and learning theory, her more recent work has been on policy issues relating to parenting, child rearing and family wellbeing. She is currently a Research Fellow working in the Taking Children Seriously program of the Centre for Independent Studies, where her major publications have included State of the Nation and Rising Crime in Australia. She is working on a study of taxation policy as it affects the family, and a series of analyses of family welfare issues is in preparation. She has previously published articles in Australian and international journals including The British Journal of Sociology, The Journal of Medicine and Law, The Australian Journal of Social Issues and The Medical Journal of Australia.

Anna Yeatman is Professor of Sociology at Macquarie University in Sydney. She is the author of Bureaucrats, Technocrats, Femocrats (1990) and Postmodern Revisionings of the Political (1994), and her new book, The Politics of Individuality, is to be published by Routledge. She is also editor or co-editor of a number of collections including Activism and the Policy Process (1998), The New Contractualism (1997), and Justice and Identity (1995).

Chapter 1. Issues in Australian welfare reform

By Peter Saunders

On 29 September 1999, the Minister for Family and Community Services, Senator Jocelyn Newman, announced the Federal government’s intention to reform the Australian welfare system. Pointing to the ever-increasing numbers of Australians claiming welfare support, she argued that rising rates of welfare dependency were not only placing an increasing burden on government expenditure, but were also damaging the self-esteem and future life chances of many of the recipients themselves. She made clear her view that, in most circumstances, it was better for people to be active than to be idle, and she emphasised her government’s commitment to reversing the trend of increasing welfare dependency by encouraging people wherever possible to be more self-reliant.

At the close of her speech, the Minister announced the establishment of a Reference Group of welfare experts to advise her on the various options for reform. The Group was to report by June 2000, following which she would bring forward a Green Paper setting out specific proposals for change. The Reference Group was required to develop proposals for reform which were efficient, equitable and consistent with the principle of ‘mutual obligation’.

In essence, the idea of mutual obligation is that individuals who receive financial support from the welfare system should normally be expected to do something in return. This principle is already embedded in Australia’s Work for the Dole policy, under which people under the age of 35 who have been unemployed for a year or more can be required to work on community projects or attend literacy and numeracy classes as a condition of receiving their benefits. It is also a feature of the Youth Allowance system, under which young people are required to work or participate in education or training schemes as a condition of receiving financial support. The Minister’s intention in launching her welfare reform initiative was that this principle of mutual obligation should be extended as far as possible throughout the welfare support system, encompassing groups such as lone parents and those on Disability Support Pension, and excluding only those past retirement age.

The Minister’s announcement of her intention to reform the welfare system provoked widespread comment, and within weeks of its establishment, the Welfare Reform Reference Group, chaired by the Chief Executive of Mission Australia, Patrick McClure, had received submissions from more than 360 organisations and individuals throughout Australia. In March 2000, the Group produced an Interim Report in which it responded to some of these submissions and outlined some of its own ideas for reform (Reference Group on Welfare Reform 2000).

The Interim Report called for a fundamental change to the welfare system. One of its key proposals was that the current complex and fragmented system of pensions, benefits and allowances targeted at different categories of claimants should, over time, be replaced by a single Participation Support payment. The value of this payment could vary according to the needs and circumstances of different individuals, but the distinctions between different categories of claimants (job-seekers, those on disability pension, lone parents etc.) would disappear. The payment would normally be conditional upon some agreed form of ‘economic participation’ (such as paid work, education, training) or ‘social participation’ (such as child-rearing, care for an elderly relative, community work) on the part of the recipient, although some claimants (such as those with severe disabilities) would be exempted from any expectation of reciprocity. Peter Dawkins, a member of the Reference Group, discusses the rationale for this proposal, as well as some of the other ideas canvassed in the Interim Report, in chapter 11 of this volume.

The Reference Group’s final report, due to be completed in June 2000, should be followed in due course by a Green Paper setting out the government’s detailed reform proposals. The publication of both the final report and the Green Paper is certain to generate much comment and controversy, for welfare policy is an area that stirs the emotions on all sides of politics. In this debate, however, it is important that there should be light as well as heat, for the issues are often complex, and there are strong and persuasive arguments both for and against the sorts of changes that are now being proposed.

The main aim of this book is to contribute to the debate by clarifying some of the core issues which lie at the heart of contemporary arguments and disputes about welfare reform in Australia. To this end, essays have been solicited from a wide range of contributors – academics, politicians, those working in the voluntary sector, and those employed within the public service – who represent different interests and perspectives in the welfare field and who end up arguing for very different positions in the debate. The book includes both advocates of reform and opponents – those who believe that the welfare system has swollen to a point where it must be rethought, and those who believe that it is still doing too little to help people who are least fortunate.

Such divergent views can, of course, be evaluated against each other in terms of their factual accuracy and the logical consistency of their arguments, but the fundamental principles from which they derive, and the basic axioms upon which they stand, often turn out to be irreconcilable. Rather than trying to effect some spurious synthesis between competing positions, this book sets out to inform and contribute to the debate by mapping and clarifying some of the main arguments and evidential claims which bear upon it, identifying common ground where it exists. It is then for the reader to weigh the evidence, evaluate the arguments, and come to an informed conclusion.

Some chapters present detailed empirical evidence to support their position, while others adopt a more discursive approach. Most of the chapters deal specifically with the Australian welfare system, but some focus on what has been happening in the United States and the United Kingdom, for many of the problems being confronted in Australian public policy are also being addressed outside Australia, and there are some striking similarities in the issues and debates currently taking place across all of the English-speaking ‘Anglo’ countries.

With the exception of Peter Dawkins in chapter 11, the various contributors do not discuss specific reform proposals in any detail, for it is not the intention of this book to engage with the particular ideas put forward by the welfare reform reference group. Rather, the book seeks to address some broader questions about how the present welfare system is working, whether and why it may need changing, and how it impacts on different aspects of family and community life in Australia.

In this opening chapter, I review some of main themes running through the various contributions that follow. I begin by addressing the crucial ethical question of whether it can ever be right to reduce welfare payments to people deemed to be in need of them, for opponents of current reform proposals often base their arguments in the moral claim that it is ‘wrong’ to reduce the level of payments or to try to push welfare claimants into jobs. I then go on to consider three crucial issues raised by the current debate: the recurring problem in the Anglo countries of how to prevent people from abusing the welfare system; the argument that provision of welfare may have encouraged people to abandon self-sufficiency; and the possibility that long-term reliance on welfare support fosters a ‘culture of dependency’. Finally, the chapter considers whether Australia has anything to learn from recent changes to welfare systems in other parts of the world such as the United States where dramatic policy shifts seem to have produced dramatic reductions in the numbers of people claiming government support.

Is it ‘immoral’ to reduce the size of the welfare state?

The Interim Report of the Welfare Reform Reference Group makes a point which has often been made before in discussions of social policy – namely, that the modern welfare state not only helps meet the material needs of individuals and their families, but also expresses and contributes to the overall cohesion of Australian society. Drawing on the contemporary language of ‘social capital’ (see Winter 2000 for a review), the Report suggests that, properly organised, the welfare system can help combat social inequality, crime and social disadvantage, and can thereby help to foster the bonds of trust and reciprocity that are essential for the development of strong communities.

This idea of the welfare state as a cohesive social force has a long pedigree. Perhaps the most influential example of it is found in T. H. Marshall’s essay, ‘Citizenship and social class’, published in Britain in 1950. Marshall argued that the ‘social rights’ of welfare entitlement which evolved through the nineteenth and twentieth centuries were, together with earlier legal and political rights, one of the three defining elements in the modern idea of citizenship. In his view, the capitalist market system fragments society by emphasising individual self-interest, but the welfare state unifies it by granting equal rights of entitlement to everybody. Seen in this way, the welfare state functions as a form of social cement, tempering the individualism of the market with a good strong dose of social altruism.

This image of the welfare state as the human face of the capitalist market system is crucial to understanding the nature of popular support for it in countries like Australia and Britain, as well as the unease which often surrounds attempts to reform it. These are individualistic and acquisitive cultures, wedded to the principles of private property, competitiveness and market exchange, yet in both countries we also find widespread popular support for the collectivistic principles of the welfare state. It seems that most people feel that the collectivity has a duty to support those who cannot support themselves in the marketplace, and the idea of withdrawing such support and telling people to fend for themselves (such as has happened to some extent in the United States in recent years) is generally seen as callous and uncaring.

The welfare state thus has a moral dimension underlying it – it is seen by many as a necessary feature of a decent and compassionate society, and in Australia it is strongly associated with the idea that everybody deserves ‘a fair go’. Indeed, in chapter 9, Lucy Sullivan suggests that the welfare system is an integral part of Australia’s very sense of nationhood.

It is, of course, open to argument whether the welfare state can really be seen as ‘moral’ when it involves individuals delegating their duty to help others to a third party – the state – acting notionally in their name. Hayek (1967), for example, believes that morality depends upon the exercise of free choice by individuals, in which case the compulsory levying of taxes to pay for the support of the poor and needy cannot be deemed moral. Indeed, to the extent that state welfare crowds out voluntary and charitable activity by individuals, it could be argued that it weakens rather than strengthens social morality (Saunders 1993). Nevertheless, those who argue for an expansion of welfare provision coupled with increased spending have traditionally justified their demands by tapping into the idea that state welfare provision is an ethical as much as a practical imperative.

In the 1960s and 1970s, this expansionist lobby held the initiative. Studies were published to show that the welfare system was falling short of its moral imperative and purpose – it was not redistributing income and wealth as radically as it should, ‘poverty’ (variously defined) was still widespread, and middle-income groups were benefiting more from tax breaks than were the poor from receipt of benefits and state services. Governments in Britain and the United States, as well as in Australia, responded by increasing welfare spending and introducing a raft of new welfare rights aimed at eliminating deprivation and enhancing ‘social justice’.

With the advance of the so-called New Right in the 1980s, however, socialists and social democrats were forced to switch from attacking the welfare state for its inadequacies to defending it against those who sought to reduce its scope and influence. There is still a vociferous lobby in support of increasing the size and generosity of the welfare system in Australia, but it is no longer setting the reform agenda, and through the Keating and Howard years of the 1990s, it has become increasingly re-active rather than pro-active.

In chapter 10, for example, Fiona MacDonald and Don Siemon of the Brotherhood of St. Laurence respond to the current reform initiative by arguing that, rather than looking to expand Work for the Dole policies, the government should be reforming the welfare system with the aim of eradicating poverty and strengthening community life through enhanced provision of health, housing and education facilities. They think it shameful that the level of welfare benefits in Australia is still so low that up to a half of all children living in households where nobody is employed are living in poverty. Similarly, Michael Raper of the Australian Council of Social Service argues in chapter 12 that more than 60 per cent of the unemployed are living below the poverty line and that attempts to extend or tighten up Work for the Dole requirements are ‘morally repugnant’. In both of these chapters, the argument is essentially that the main thrust of the current reform agenda is misplaced. Rather than focusing on the need to make welfare recipients ‘participate’ in some way in return for their payments, these authors believe there is a much more pressing need to raise the level of the payments themselves.

Notwithstanding such demands, few people expect the government’s review of the Australian welfare system to result in a significant expansion of provision. Rather, despite Ministers’ assurances to the contrary, fears have been expressed that the review may end up cutting back welfare support to those in need. Arguments in support of expanding the welfare system have today been marginalised as a result of the continuing influence of a ‘neo-liberal’ critique of welfare which emerged in all of the Anglo countries during the 1980s and which has to varying degrees come to influence the social agendas of parties of the left as well as parties of the right ever since.

This neo-liberal attack on welfare rested on two main arguments. The first was that the cost of modern welfare state systems was spiralling and that radical cuts would be needed to prevent social security and other welfare budgets from absorbing an ever increasing proportion of total national income. The second, and arguably more important, was that the modern welfare state was not a ‘moral system’, as the political left had been claiming for so long, but rather had evolved into a system which was encouraging individual self-interest and eroding social solidarity. For the first time, therefore, the conventional belief that there was a moral imperative driving the expansion of welfare was confronted head-on.

Far from promoting social cohesion, as people like Marshall had claimed, neo-liberals argued that the modern welfare system was creating social fragmentation. The true spirit of the modern welfare state was not altruism but self-interest, for the huge welfare budget was encouraging more and more people to get as much as they could for themselves out of the communal pot. Nor was the system particularly effective at helping the poor. Indeed, rather than solving social problems, the welfare state had created new ones, for it had fostered the emergence of a new ‘underclass’ which had grown dependent upon state handouts while the employed population laboured under increasingly onerous levels of taxation in order to support it.

Such arguments led neo-liberals to conclude that it was not only economically ‘rational’ for governments to cut their welfare budgets, but also that it was in some sense morally ‘right’ for them to do so. For too long, governments had been buying votes by expanding hand-outs to ever-increasing numbers of beneficiaries, indulging idleness by giving people money over long periods of time without demanding that they do anything to improve themselves or their condition, and exacerbating social divisions by taking money away from those who behaved ‘responsibly’ in order to support the increasing numbers of those who did not. The welfare state, in short, was not a moral system at all. Rather, it was a well-intentioned but ill-conceived system that, far from encouraging an altruistic concern for others, had actually ended up encouraging envy and stimulating selfishness.

How do you stop welfare free-riders?

Ever since increasing demands on parish relief prompted the British authorities to reform the Poor Law in 1834, governments in the Anglo countries have been struggling to find a way to separate those who really need and ‘deserve’ help from those who do not. The dilemma is simple: once government puts in place a system of social support to help those who cannot provide for themselves, it thereby immediately establishes an incentive for those able to work to abandon self-reliance and seek government aid instead. The problem is how to help the first group without encouraging the second.

This is a problem that has been addressed by modern ‘game theorists’ who refer to it as the ‘free-rider’ dilemma (see Olsen 1965; McLean 1987). Logically, the problem arises in any social group when the individual interests of its members come into conflict with their common interests as members of the group. The larger and more impersonal the group, the more individuals are likely to be tempted to pursue their individual interests at the expense of other members, and to ignore the collective interests that they share. Welfare state systems are a case in point.

Game theory recognises that, in the provision of public goods such as social security systems, the collective utility is maximised if everybody plays by the rules and cooperates. This means that it is in our common interests that we should all contribute what is required of us, and that nobody should claim from the system unless they really need to. Provided nobody exploits the system, contributions stay low and everybody is covered against future mishaps. However, once individuals begin to break ranks, or to ‘defect’ (the term used in game theory), then the system swiftly breaks down and everybody ends up losing. Fearful of missing out, group members scramble to claim their share of the collective resource before others can get hold of it, and very soon everybody is trying to take out more resources than they put in, leading to the collapse of the system (Hardin 1977).

Despite the fact that everybody loses from such behaviour, it is a fundamental axiom of game theory that ‘rational utility maximisers’ will tend to pursue their own individual interest at the expense of the common good (and thus, in the long-term, at their own expense too). This is because, for as long as others continue to play by the rules, any given individual stands to gain a lot more if they defect than if they cooperate, and once people start defecting, others lose out unless they do likewise. This means that collective welfare systems have an inherent tendency to generate self-interested behaviour which eventually undermines them.

This problem seems to have been particularly acute in the welfare systems of the Anglo countries, and they have developed their own distinctive strategies for trying to cope with it.

Despite the significant differences in their systems of welfare, the English-speaking countries (the United States, Australia, New Zealand, Canada and the United Kingdom) have been said to form a distinctive cluster – what Esping-Andersen (1990) calls a ‘liberal welfare regime’ – when compared with other advanced welfare states.[1] According to Esping-Andersen, these Anglo-Saxon liberal regimes share in common an emphasis on social assistance as a safety net, use of means testing to target payments specifically to those in need, enforcement of strict entitlement rules, and a concern to discourage malingering by setting benefit levels below minimum earnings. This suggests that these countries have traditionally sought to solve the free-rider problem mainly by means testing (in order to target help to the most needy), and by setting low levels of benefit, or attaching unattractive conditions to receipt of benefit (in order to deter people who are not in real need from claiming).

These systems contrast vividly with the conservative or corporatist regimes found in Catholic Europe (where welfare support is based on entitlement through social insurance administered by the state, and benefits are graduated according to the scale of contributions that have been made), and even more starkly with the social democratic regimes associated with Belgium, Holland and Scandinavia (where all citizens are included in a single, universal scheme which has traditionally offered high levels of benefit funded by high levels of personal taxation).

Esping-Andersen sees the key difference between these different types of systems as lying in the degree to which they make it possible for individuals to escape the requirement to perform paid labour in order to survive (what he calls ‘commodification’). Comparing the age pension, sickness and unemployment benefit provisions across eighteen different countries, he showed that the Anglo-Saxon countries have the most ‘commodified’ welfare systems while the Scandinavian nations have the most ‘decommodified’ systems. In the Anglo countries, welfare is deliberately restricted so as to make it a less attractive option than working. In the social democracies of Scandinavia, by contrast, the welfare system comes much closer to a fully decommodified system where ‘citizens can freely, and without potential loss of job, income or general welfare, opt out of work when they themselves consider it necessary’ (Esping-Andersen 1990: 23).

All of this raises an obvious question. What is it about countries like Denmark and Sweden that has enabled them to operate these relatively decommodified welfare systems without (apparently) encountering the crippling problem of mass free-riding which would almost certainly arise if such a system were introduced in any of the Anglo countries?

Part of the answer may be that the Scandinavian countries do suffer from relatively high levels of free-riding, but they choose not to make a fuss about it. Certainly these countries have higher levels of welfare receipt among their working age populations than does Australia, and this would seem to support this possibility. But even if this is part of the answer, it simply pushes our question back one stage, for we then need to explain why free-riding is not seen as a particular problem, especially if it is actually more widespread than in the liberal welfare regimes.

The more fundamental explanation for why these relatively decommodified systems do not collapse under the weight of free-riders probably lies in the fact that they have evolved much more collectivistic cultures than the Anglo countries have.[2] This means that they have less need to rely upon official controls and enforcement because individuals and communities are more inclined to regulate themselves and their members. If this is the case, then it follows that social democratic welfare regimes based on generous entitlements and high quality provision are probably only sustainable in countries where, for whatever reason, individuals are prone to recognise a strong commitment to the interests of the collectivity. Indeed, such regimes will only emerge in the first place in cultures like those of Sweden where individuals are already predisposed to monitor, police and regulate their own and their neighbours’ inclinations to ‘defect’.

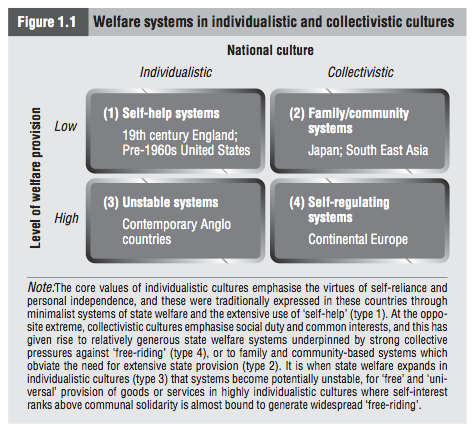

Generous welfare regimes based on a high level of trust will, however, prove extremely unstable if introduced into individualistic cultures where self-regulation in the interests of the collectivity is less developed, and where group pressures to conformity are likely to be much weaker (see Figure 1.1). It is notable in this respect how difficult it has been for the authorities in Australia and Britain to encourage people to inform upon those they know to be abusing the welfare system – ‘dobbing’ and ‘snooping’ have often been regarded in these more individualistic and privatised cultures as reprehensible rather than an act of civic duty.

Figure 1.1 Welfare systems in individualistic and collectivistic cultures

| National culture | ||

Individualistic | Collectivistic | ||

Level of welfare provision | Low | (1) Self-help systems 19th century England; Pre-1960s United States | (2) Family/community systems Japan; South East Asia |

High | (3) Unstable systems Contemporary Anglo countries | (4) Self-regulating systems Continental Europe | |

Note: The core values of individualistic cultures emphasise the virtues of self-reliance and personal independence, and these were traditionally expressed in these countries through minimalist systems of state welfare and the extensive use of ‘self-help’ (type 1). At the opposite extreme, collectivistic cultures emphasise social duty and common interests, and this has given rise to relatively generous state welfare systems underpinned by strong collective pressures against ‘free-riding’ (type 4), or to family and community-based systems which obviate the need for extensive state provision (type 2). It is when state welfare expands in individualistic cultures (type 3) that systems become potentially unstable, for ‘free’ and ‘universal’ provision of goods or services in highly individualistic cultures where self-interest ranks above communal solidarity is almost bound to generate widespread ‘free-riding’.

Compared with other parts of the world, the Anglo countries are peculiarly individualistic in their cultures. MacFarlane (1978) has traced the origins of Anglo individualism as far back as the twelfth century when he believes that England was already a nation of ‘rampant individualists’, and it seems that this distinctive inheritance has survived to this day. For example, in his review of the cultures of contemporary capitalism, Albert (1993) draws a sharp distinction between the more collectivistic and cooperative institutions and practices of the ‘Rhine model’ countries and the much more individualistic and competitive character of the ‘Neo-American’ model of capitalism practiced in the Anglo countries. He shows how this distinction is reflected in a wide variety of institutional differences including their financial systems, their systems of industrial relations, and their welfare systems.

Perhaps the most convincing evidence that a cultural divide underpins the distinction between the Anglo countries, with their liberal welfare systems, and the continental Catholic and Scandinavian nations, with their corporatist and social democratic welfare systems, can be found in a huge attitudinal survey of fifty national cultures conducted by Hofstede (discussed in Smith and Bond 1993). He found that the western, developed countries tended to be much more individualistic than Asian nations and those with less developed economies, but within the western bloc he also reported that the Anglo countries were more strongly individualistic than the others. The United States ranked as the most individualistic culture in the world, with Australia second, Great Britain third, and Canada fourth. The Scandinavian and Germanic countries ranked much lower (although the Netherlands scored as high as Canada). Thus, the same clustering of Anglo countries reported by Esping-Andersen in his analysis of welfare systems, and by Albert in his analysis of different capitalist systems, is repeated by Hofstede in his analysis of national cultures.

It is this individualism that helps explain the peculiar character of the contemporary welfare reform debate in the Anglo countries. If it is true that collective systems of welfare entitlement are always likely to be unstable when located in strongly individualistic cultures, then it is no surprise that a renewed concern with monitoring and controlling access to welfare should have arisen in the Anglo nations over the last twenty years as a response to the loosening of control and expansion of eligibility that took place in the 1960s and 1970s. The concern, in essence, is that the system has been swamped by free-riders, and the determination to reform it is being driven by the desire to reintroduce the traditional distinction, which seems to have become blurred, between those who really need help and support and those who are exploiting the common good for their own selfish purposes.

This concern was captured by the Federal Minister for Family and Community Services, Senator Newman, in her speech launching the current welfare reform initiative: ‘There are examples around Australia where job opportunities are available and our entrenched culture of welfare dependency has meant that certain members of our community are not only prepared, but feel entitled to exploit the social safety net instead … [W]here there are jobs available, even though they may fall short of the initial expectations of the job-seeker, it is neither fair nor moral to expect the hard working men and women of this country to underwrite what can only be described as a destructive and self-indulgent welfare mentality’ (Newman 1999a: 5-6). In other words, the collective system is being exploited by free-riders, and reform is needed to protect the interests of those who are still playing by the rules.

The welfare systems in countries like Australia, Britain and the United States have become less discriminatory and more generous since the 1960s. What we are seeing now is an attempt to pull them back into a form which is more consistent with the strongly individualistic cultures of these countries. Today as so often in the past, there is a growing suspicion that the welfare system is supporting too many people who could and should be supporting themselves. It is for this reason that these countries have been leading the search for new ways of getting welfare claimants back into the workforce.

Does the welfare system encourage idleness?

In June 1998, over four and three-quarter million Australians were receiving income support payments (this and subsequent statistics are taken from the Department of Family and Community Services 1999a and 1999b). This represents a five-fold increase since 1965 when there were fewer than a million.

Just under half of those in receipt of payments in 1998 were above retirement age, and nearly 400,000 more were receiving student assistance. This leaves over two and a quarter million people in other categories, most of whom were unemployed (35 per cent), on Disability Support Pension (24 per cent), or receiving Parenting Payment (27 per cent, of whom 16 per cent were lone parents). It is these three groups around which most of the discussion about welfare reform revolves.

All three of these groups have swollen in size since the mid-sixties. Those receiving the Disability Support Pension or its equivalent have increased more than five-fold in this period, with most of the increase coming in the last fifteen years, when numbers doubled. The number of single parents receiving payments has increased by a factor of twelve since 1965, from under thirty thousand to well over one-third of a million. Their numbers have also been rising steeply in recent years, from a quarter of a million ten years ago to nearly four hundred thousand today. Finally, those on unemployment allowances have increased from 13 thousand to 790 thousand since the mid-sixties, a factor of sixty, although most of this increase occurred in the late seventies and early eighties. Between 1985 and 1998, the number of people claiming unemployment allowances increased from just over half to just over three-quarters of a million.

Today, more than 18 per cent of the population of workforce age is receiving income support payments as compared with just 3 per cent in the early- and mid-sixties. Welfare spending has grown much faster over this period than population size, the economy or government revenues – GDP per head has doubled since 1960, the real value of taxes has tripled, but the real cost of welfare spending has gone up five-fold (Warby and Nahan 1998). It is not difficult to see why the government is worried about these trends.

It is sometimes suggested that these figures exaggerate the extent to which dependency on income support has ‘really’ grown or is ‘really’ a problem. Travers (1998) points out that some of the increase in the number of recipients of Parenting Payment reflects improved rates of take-up following government publicity campaigns, rather than an increase in the number of poor parents needing support. Similarly, Henman (1999) argues that as the nation has become wealthier so the government has quite rightly become more generous and has extended help to a broader range of people including those who are earning low incomes. The rise in the number of people working part-time has also increased the number of workers who receive a top-up on their wages through the income support system.

All this is true, but as Peter Dawkins demonstrates in chapter 11, it does little to change the overall conclusion that the number of people who rely solely or almost exclusively on income support payments has expanded substantially over the last twenty to thirty years (the periods of most rapid growth being the mid-1970s, the early 1980s, and the first half of the 1990s). As we have already noted, the result is that 18 per cent of the workforce age population is now receiving income support. Even if we now remove from this statistic all those (such as part-time and low-paid workers) for whom income support represents a top-up on wages (defined generously as those for whom welfare payments constitute less than 90 per cent of their total income), this proportion only drops four percentage points, to 14 per cent. In other words, one in seven Australians of workforce age today relies almost entirely on income support payments, and this represents a much higher level of dependency than in the 1960s and 1970s. The blow-out is no statistical artefact – it is real.

Alan Buckingham shows in chapter 4 that these trends are not unique to Australia. They were repeated in the other Anglo countries too, and in many cases they were sharper elsewhere (for example, the rise in numbers claiming disability payments, and the increased number of sole parents claiming welfare support, have both been more marked in the United Kingdom than in Australia in recent years). It was this marked upward trend in rates of dependency on welfare payments that stimulated the neo-liberal reappraisal of welfare which developed in the Anglo countries during the 1980s.

The critique rested on the argument that the welfare system has expanded to a point where it is supporting substantial numbers of people who would once have been expected to support themselves. The evidence for this lay in the statistical trends which we have been reviewing, for these are consistent with the view that increasing numbers of people may have deliberately been opting for government income support rather than for work or other forms of family self-reliance.

The most influential critic of welfare who began arguing for such an interpretation during the 1980s was Charles Murray. In his book, Losing Ground, first published in 1984 and re-issued ten years later, he maintained that the expansion of welfare in the United States in the 1960s had undermined the ethic of personal responsibility and had promoted idleness and dependency by changing the short-term costs and rewards attaching to different patterns of behaviour. His fundamental argument was that people respond rationally to incentives. When the state expands welfare provision, it makes it more profitable to become a claimant, and it makes it correspondingly less attractive to remain in a low-paid, boring job. Even though, in the long term, work may still offer a better prospect than welfare, many poor people respond more readily to short-term signals, and when welfare became more attractive from the 1960s onwards, they reacted as rational utility maximisers, just as game theory predicts that they would.

In the United States, where the main welfare benefit was Aid for Families with Dependent Children (AFDC) paid to single mothers, Murray argued that increased generosity had encouraged precisely the behaviour which was creating the problem which AFDC was intended to resolve. Put simply, AFDC made it easier for poor single women to have children without marrying and thus to put themselves into a situation of long-term welfare dependency. In order to demonstrate this claim, Murray showed how a couple with children stood to improve their income if they split up, leaving the woman to rely on AFDC payments, rather than staying together with the man working in a low-paid job. He further reinforced the point with evidence from a ten-year trial of a Negative Income Tax scheme which was introduced experimentally across several American states. According to Murray, the results showed that provision of a minimum welfare income floor had a devastating effect on the experimental groups as compared with the control groups. They reduced their working hours, they took longer to find a job, and their rates of marriage break-up spiralled.[3]

Applied to Australia, Murray’s analysis would suggest that the six-fold increase in the proportion of the workforce age population in receipt of social security payments since 1960 in large part reflects an increase in the number of people who now choose (quite rationally) to claim benefit rather than work for a living. Rather than indicating an extraordinary sixfold increase in the number of people in need over the last 35 years (a period, incidentally, when the nation doubled its wealth), this would suggest that the expansion of the welfare system has simply created its own demand, and that Australia is now locked into a vicious circle in which provision of benefits and demand for state support chase each other ever upwards.

In chapter 12, Michael Raper strongly rejects this line of argument. He points out that the Australian welfare system, with its tight means testing and eligibility rules, has always encouraged people to work wherever possible, and that welfare payments are in any case set at such a low level that they are unlikely to offer any serious incentive to avoid work where it is available. In his view, the belief that welfare has generated a disincentive to work is ‘pejorative and inaccurate.’ Income support dependency has risen in Australia due to a combination of factors over which individuals themselves have had little or no control. In particular, despite the fact that the national wealth has doubled, there are now fewer jobs available for those with few skills, there is a higher incidence of disability, there has been an increase in early retirement, and more parents now have to raise their children without a partner to help them.

Raper is clearly right to remind us that economic circumstances and the structure of employment opportunities have changed since the 1960s. The Welfare Reform Group’s Interim Report explicitly recognises, for example, that there has been an increasing polarisation between affluent and poor communities, and between households where two or more adults are working and households where nobody is working. The increase in the nation’s wealth has, therefore, gone side-by-side with a sharpening of the income gap between the prosperous and the poor, and it is quite reasonable to suggest that levels of need have therefore risen even as the country as a whole has grown wealthier.

Nevertheless, some of Raper’s arguments and assumptions can be challenged. It is difficult to accept that the huge rise in the number of disability pensioners reflects a real increase in rates of disability today as compared with ten or twenty years ago, especially when we remember that average health levels have improved in this time. Rather, as the Welfare Reform Group’s Interim Report suggests, it is more likely that increasing numbers of non-employed individuals have successfully managed to have themselves re-classified as disabled, for not only is the payment higher than the unemployment benefit, but also there is no requirement on those in receipt of the Disability Support Pension to seek work or undertake training. If this is the case, then it would lend support to Murray’s belief that people will respond ‘rationally’ to unintended incentives in the welfare system, adjusting their behaviour in order to maximise the financial benefits to themselves while minimising the demands that are made upon them.[4]

Nor should we accept without comment Raper’s implicit assumption that increasing rates of single parenthood have nothing to do with the rational choices of the individuals concerned. In chapter 9, Lucy Sullivan argues that changes in the Australian welfare and tax systems over the last thirty years have fuelled the increase in the number of lone parents while eroding the traditional nuclear family. She reviews the impact of welfare changes in Australia since the introduction of the Supporting Mothers Benefit in 1973 and concludes that the federal government has brought in a series of changes that have eroded young men’s incentive to work while making couples on relatively low incomes better off if they separate than if they stay together.

In many ways echoing Murray’s argument that welfare payments have enabled single women to have children without a partner to support them while also encouraging couples to avoid making a long-term commitment to each other, Sullivan goes on to argue that Australian governments have ended up penalising self-sufficient families on low to moderate incomes in order to pay for the spiralling growth in the numbers of single-parent households dependent upon the state for most or all of their income. Thus, she identifies a vicious circle in which increased welfare spending led to higher taxes which dragged larger numbers of traditional families into poverty, thereby further increasing the demand for income support and necessitating another round of tax rises.

Sullivan’s contention that the Australian tax and welfare systems have created perverse incentives that have influenced the way people behave is to some extent supported by evidence presented by Peter Dawkins in chapter 11, as well as in the Welfare Reference Group’s Interim Report (see Appendix 4: 49-50). For example, Dawkins shows that the traditional family type, consisting of an employed husband and a non-employed wife raising two children, faces ‘effective marginal tax rates’ (that is, deductions from income due to tax levied and withdrawal of welfare payments) of between 61 and 104 per cent across a wide range of gross weekly earnings. While recognising that recent tax changes have helped restore incentives for some groups, Dawkins nevertheless leaves us in no doubt of the need for the welfare system also to address this problem, and he reviews a variety of reform options through which this might be achieved.

Sullivan’s argument goes further than this, however. Not only does she claim that the welfare system has weakened the incentive to work, but she also maintains that it has undermined the traditional family by driving it into poverty with high taxation while supporting other, less viable, household types with generous welfare payments. Her argument here echoes Murray’s position that single parenthood is for most people inherently unsustainable without outside financial support. Previous generations knew this, which is why the two principal routes to single parenthood (unmarried pregnancy, and divorce or separation) were by today’s standards uncommon, and why unmarried mothers and divorcees often met with social disapproval. However, when the culture started to change and governments responded by increasing financial support for single parents, single parenthood became economically viable. This meant that more people were able to countenance a course of behaviour which would have been disastrous a generation earlier, and the more common it became, the less social disapproval it attracted.

This argument is much more contentious than the simpler proposition that the tax and benefit system has discouraged work, and in chapter 2 Mead takes issue with it. He claims that there is no evidence that the welfare system caused the weakening of the two-parent family in America, although he does accept that the recent American welfare reforms may result in a fall in the numbers of young unmarried mothers. Mead’s view is that the causes of the increase in rates of single parenting over the last thirty or forty years lie much deeper than Murray’s analysis of economic costs and incentives would suggest, and he emphasises the influence of cultural over economic factors in the explanation of such trends. Most economists today would probably agree with him, for there is actually little evidence that financial incentives have more than a marginal effect on marriage behaviour or fertility rates.

Mead’s argument against Murray seems to cast doubt on Sullivan’s belief that changes in the Australian welfare system have undermined the traditional family form while underpinning less sustainable alternatives. It is true that traditional families on modest incomes can face very high effective marginal tax rates, just as single-parent households have benefited from changes over the last thirty years, but there is little firm evidence to suggest that these financial signals have triggered major changes in social behaviour.

Having said this, we should not lose sight of the fact that lone parenthood would not have been a viable option for most people without the expansion of state benefits (in Australia about three-quarters of lone parents are on income support, and in Britain their dependency rate is even higher at around 90 per cent). Provision of benefits may not have caused the increase in the rate of single parenting, but it has almost certainly enabled it to continue growing.

This appears to be the view of the British Labour MP, Frank Field. He argues in chapter 3 that the main economic cause of the weakening of the traditional family in the United Kingdom was the collapse of manufacturing employment, for this made it more difficult for young men to earn a living sufficient to support a family. Nevertheless, Field goes on to recognise that the British tax and welfare system may have reinforced this trend by benefiting single parents at the expense of two-parent families, for at the same time as young males were becoming less eligible marriage partners, the state was putting in place the means for young women to raise their children without a husband.

Here, it is relevant to note evidence, discussed by Alan Buckingham in chapter 4, that recent American welfare reforms which have abolished unconditional aid to single mothers have begun to reverse the rising trend in pre-nuptial births in the United States. This would certainly seem to suggest that changing welfare incentives can influence individuals’ behaviour with regard to marriage and fertility, although these measures have been fairly draconian, and it may well be that changes at the margin would have much less of an impact.

We should therefore be cautious before we endorse Michael Raper’s rebuttal of the argument that the welfare system has encouraged higher levels of ‘irresponsible’ behaviour. Whether the expansion of welfare since the 1960s has undermined the traditional self-reliant family and promoted the growth of single parenthood remains arguable, but there are strong grounds for believing that it may well have weakened the incentive for claimants to find work. If this is the case, then the next question to be answered is whether those without a job would be likely to respond to stronger work incentives. Put another way, do the jobless really want to find work?

Does long-term reliance on welfare create a culture of dependency?

Murray’s analysis in Losing Ground (1994) basically held that many welfare recipients are rational utility maximisers who have calculated that welfare dependency offers them a better deal than working. However, in Beyond Entitlement (1986) and The New Politics of Poverty (1992), another American welfare critic, Lawrence Mead, took issue with this. He argued that economic calculation is much less significant in influencing people’s behaviour than the values and norms which they share as members of a given culture, or sub-culture. Mead’s analysis subsequently became influential in helping shape the welfare reform agenda in Britain and Australia as well as in the United States, and he summarises his argument in chapter 2.

Mead rejects Murray’s view that many welfare claimants deliberately avoid work. Rather, he suggests that many of them accept work as a goal, but have only a weak sense of personal efficacy. They would in principle like to get jobs and take more responsibility for their own lives, but they feel unable to do so. Even when jobs are relatively plentiful, they find it hard to find and keep them, for they lack the social skills and personal competence to organise their lives in the way that is necessary in order to function effectively in the employment market. They are willing to do ‘the right thing’, but are seemingly incapable of delivering on their promises. Such people are most unlikely to respond in a rational and calculative manner to changes in the trade-off between work and welfare. They are in Mead’s words ‘dutiful but defeated’.

Writing in the context of the United States, where many of those on the welfare rolls are black, Mead attaches no moral ‘blame’ to these individuals, and he accepts that in many cases, the ‘culture of dependency’ which they exhibit can be explained as the product of factors, such as racism, which go back many generations and which lie outside of their power to fix. He is also clear that their capacity to cope has often been blighted by poor parenting and disrupted family lives when they were young. None of this, however, changes the fact that long-term reliance on welfare makes these people’s lives even worse. What they need, according to Mead, is not a fortnightly welfare cheque, but rather a combination of ‘help and hassle’ to break the cycle of dependency and push them into self-reliance.

Mead’s argument is evaluated by Frank Field in chapter 3. Field thinks that Mead over-emphasises the significance of cultural factors and pays insufficient attention to structural labour market problems. Writing from a British context, he is certain that the main problem over the last quarter of a century is that, for certain categories of people, the jobs have simply disappeared.

Field’s critique in some ways echoes the comments of William Julius Wilson in his debate with Mead back in 1987 (Mead and Wilson 1987). In that debate (and in his book, The Truly Disadvantaged), Wilson claimed that the main cause of long-term unemployment among American inner city blacks is that the manufacturing jobs have left town. In his reply to Wilson, Mead insisted that the problem is not so much the non-availability of jobs, but the scarcity of attractive jobs. In the United States, he claimed, there are plenty of jobs that the non-working poor could do, but they are generally in the service sector, pay the minimum wage, and offer few career prospects. Unless they are pushed, Mead believes that many long-term unemployed people will simply find reasons or excuses for avoiding such work, even though it may offer an initial stepping stone to something better down the line.

Mead’s argument may stand up in the vibrant and low-unemployment economy of the United States, but can it equally be applied to Britain and Australia where unemployment rates are significantly higher?

In the case of Britain, Field thinks not. He suggests that in the British inner cities, it was the collapse of traditional male jobs in manufacturing which generated long-term welfare dependency. Mead (in chapter 2) responds to this in much the same way as he responded to Wilson back in the 1980s – he accepts that there are unemployment black spots in Britain, just as there are in America, but he still maintains that the evidence demonstrates that jobs can be found even in the most depressed areas, and even during recessions.

What is perhaps more interesting than the disagreement between Mead and Field is the convergence in their positions. Thus, while insisting that structural economic change caused the problem in the first place, Field agrees with Mead that one result of the prolonged joblessness that followed the collapse of manufacturing in Britain was that many claimants lost what he calls the ‘habit of work’. He agrees with Mead that the resulting ‘culture of dependency’ has become a problem, and he concurs with Mead’s strategy of ‘help and hassle’ as the way to break it. The principal difference between Field and Mead is therefore not in the identification of the problem, but is in their prescriptions for fixing it. According to Field, in areas of high unemployment, governments need to intervene on the demand side (to help create more jobs) as well as on the supply side (to push more people into the labour force), whereas Mead tends to put all his emphasis on the supply side alone.

Australian critics of Mead’s position are much less conciliatory than Field is. Michael Raper (in chapter 12) and Fiona MacDonald and Don Siemon (in chapter 10) argue against Mead’s belief that welfare has generated a dependency culture, and they assert that there are simply no jobs available in Australia for most of those on income support to do.

MacDonald and Siemon are of the view that the globalisation of the economy has destroyed many full-time blue-collar jobs in Australian manufacturing while creating in their place more casual work, more part-time work, and more ‘underemployment’, and they doubt Mead’s claim that those without work can graduate to more secure and better-paid jobs if they first get a foothold on the ladder by accepting low-paid, short-term work. They further suggest that groups like single parents lack ‘real opportunities’, not only because there are few jobs available for them to do, but also because there are inadequate provisions of child care services and workplaces are often too inflexible to accommodate employees with family responsibilities.

Similarly, Raper claims in his chapter that the jobs are simply not there for people with low skills, and he sees no point in demanding that they look for work which is not available. Backing up this claim, he points out that there are currently six unemployed people for every notified vacancy in Australia.

According to Peter Dawkins, in chapter 11, these arguments are too simple because unemployed people can and do find jobs even when the unemployment rate is high. Even in a labour market where there were sixteen people chasing every vacancy, Dawkins demonstrates that a job-seeker with average levels of skill and competency would have a better than even chance of finding a job within six months.[5] This is important, for it not only supports Mead’s claim that it is still possible to find work in times and places of high unemployment, but it also reminds us that there is a constant turnover in the composition of those claiming income support.

The debate about welfare dependency really centres on long-term claimants, because it is here that Mead’s concern about welfare breeding a ‘culture of dependency’ is likely to have most purchase. Appendix 3 of the Welfare Reform Group’s Interim Report shows that long-term dependency is surprisingly common in Australia. Taking all categories of workforce age claimants together, 70 per cent of those who were receiving income support in September 1995 were also receiving it nearly four years later, in June 1999.

Long-term dependency is more common in some categories of claimant than in others. The report shows that once people move onto the Disability Support Pension they are unlikely to move off it before retirement – four-fifths of those claiming this pension in March 1999 had been claiming continuously for at least two years. Single parents, too, tend to experience quite long periods in receipt of Parenting Payment – in March 1999, 58 per cent had been on the payment for a continuous two-year period, and 80 per cent had received it for more than two years in total (the equivalent figures for parents who were partnered were 36 per cent and 65 per cent respectively). Although lone parents do move off Parenting Payment as their circumstances change, research conducted by the Department of Family and Community Services (Bagnall 1999) found that 70 per cent of those moving off payments were back again within twelve months.

Turnover rates are considerably higher among unemployed people claiming the Newstart Allowance, only a quarter of whom had been unemployed for a continuous two-year period in March 1999, although more than half of them had been unemployed for more than two years in total. However, the statistics also show that about 7 per cent of people on Newstart in 1995 had moved to the Disability Support Pension by 1999, and this lends support to those who believe that the increase in disability pensioners is at least in part due to transfers from unemployment.

The fact that nearly three-quarters of working age welfare claimants in 1995 were also claiming four years later suggests that long-term reliance on income support in Australia is common. This could be explained by Mead’s claim that prolonged reliance on welfare habituates people to dependency and sustains a dependency culture, for it does seem that there are some people who spend a long time on income support and who may have trouble getting off it. However, these statistics alone cannot demonstrate that such a culture of dependency actually exists, still less that it is to blame for the rising numbers of people who depend for their incomes on welfare payments over relatively long periods of time. To evaluate this claim, we need to turn to research on the values and behaviour of the welfare dependent population itself, and three chapters in this book (chapters 5, 6 and 7) begin to address this.

In chapter 5, Frances McCoull and Jocelyn Pech show that in the United States and the United Kingdom, as well as in Australia, children who grow up in welfare-dependent households are more likely to end up dependent on welfare themselves. Reviewing the international evidence, they find in all three countries that a young person’s probability of unemployment and/or welfare dependency is roughly doubled if he or she comes from a family where the parent or parents were themselves on welfare. In Australia, where they investigate the income support records for over three-quarters of those people who turned sixteen in the first three months of 1996, McCoull and Pech find that high levels of dependency on both unemployment and family payments during late adolescence are significantly associated with both family background and a history of parental reliance on income support. Children of sole parents and children with parents on income support double their chances of becoming ‘heavily welfare dependent’ (defined as being on income support for more than half of the time since their sixteenth birthdays) before they reach the age of twenty.

This research may offer some support for Mead’s argument that long-term joblessness is essentially a cultural problem, for it is consistent with the idea that welfare-dependent parents develop a distinctive set of values and attitudes which they then transmit to their children, thereby predisposing them to a life on welfare support as well. However, McCoull and Pech offer no explanations for the correlations that they present, and we should be wary of jumping to conclusions. The sorts of correlations that they report could, after all, be explained by geographical factors (parents on income support might live in localities with few job opportunities which means that their children would also experience more difficulty finding work), or by individual psychological ones (if joblessness is increasingly associated with low intelligence, as Murray and Herrnstein (1988) suggest, then jobless parents with low IQs will tend to produce more than their share of low-intelligence children who will in turn find it more difficult to find work).

The first step in determining whether the link between parents’ welfare dependency and that of their children is a result of the transmission of a distinctive culture is to see whether such a culture actually exists among young people who are claiming income support. It is this question that Wendy Stone and I address in chapter 6 where we summarise some findings from a series of focus group interviews conducted with groups of 16-19 year-old males and females in Victoria.

This research documented a strong ‘work ethic’ among both school students and those in jobs or training, and it also found that some unemployed young people on the government’s Job Placement, Employment and Training (JPET) schemes were determined to seize their opportunity and equip themselves for work. However, the research also clearly revealed the existence of what we defined as a ‘dependency culture’ among some unemployed teenagers who showed little serious inclination to find a job, little interest in training or pursuing qualifications that might improve their job prospects, and a high level of fatalism which was sometimes underpinned by a hopeless entanglement in a drugs culture. Drawing on Durkheim’s terminology, we summarise what we found as a state of ‘anomie’ characterised by negativity, drift, and lack of structure or purpose. In Mead’s terms, these young people were certainly ‘defeated’, even if they did not appear particularly ‘dutiful’.

Where does this culture of dependency among some unemployed young people originate? Stone and I speculate on whether it is likely to have been passed on from their parents, but given the pattern of fractured family relationships that so many of them reported to us, we rather doubt it. Instead, we tentatively suggest that, while parental influence can certainly explain why so many young people are so strongly committed to a work ethic, it is probably a lack of family influence that explains why a minority have drifted into a dependency culture. If this is right, then the emergence of a dependency culture among young people may represent a ‘default’ position to which they tend to gravitate in the absence of positive socialisation and effective parenting during their formative years.

The young unemployed are only one of the groups where relatively high levels of income support dependency are concentrated. Another consists of indigenous Australians. As McCoull and Pech report, Aboriginal young people are three and a half times more likely than others of their age group to become heavily dependent on welfare during their late teens.