The economic consequences of divorce in six OECD countries

March 2015

Download Research report

Overview

This report presents a cross-national comparison of the short- and medium-term economic effects of divorce.

Estimates for men and women are derived from longitudinal data from Australia, Germany, Korea, Switzerland, the United Kingdom, and the United States.

It details how the main sources of income for women change following divorce, and the relative contribution of these sources. The findings show that though divorce has a negative effect on the equivalised household incomes of women in all of these countries, the extent and duration of these negative effects differ markedly between the nations.

The report concludes by briefly considering the possible causes of these differences.

Key messages

-

In all of the countries studied divorce had, on average, negative effects on the equivalised household incomes of women. However, the extent and duration of the negative effects of divorce differed markedly between countries.

-

In all of the study countries, the effect of divorce on the equivalised household income of men was smaller than the effect on women in terms of post-separation income relative to pre-separation income and the income it would have been had they remained married.

-

Although, using the available data, it is not possible to definitely explain the differences between countries, the analysis presented in this paper provides some insights.

-

The average economic effects of divorce, particularly for women, are heavily influenced by the social security, labour market, family model and family law systems of each country.

-

While the social security system and institutional arrangements such as child support and spousal maintenance do influence women’s post-divorce economic outcomes, women’s labour market earnings and the extent to which re-partnering occurs represents the most important force explaining cross-country differences.

Divorce is a key life course risk that typically has significant economic consequences, as well as possible negative effects on health and wellbeing. In OECD countries, institutional arrangements have been established to help manage the consequences of divorce and reduce its economic effects. These include family law measures, child support (maintenance), spousal maintenance (alimony) and the social security system.

It has been demonstrated that estimates of the economic effects of divorce based on cross-sectional data can be quite misleading, and that longitudinal data that track people pre- to post-divorce are needed to obtain accurate estimates of the economic effects of divorce. Longitudinal estimates for some countries have consistently found that divorce has negative economic consequences, particularly for women. Nevertheless, having comparable estimates for a range of countries of the economic effects of divorce and the extent to which these effects change in the years following divorce is important to assist in the evaluation and further development of policies to alleviate the consequences of divorce.

This paper uses longitudinal data to estimate the short- and medium-term economic effects of divorce in the USA, the UK, Switzerland, Korea, Germany and Australia during the first decade of the 21st century. While the data, collected during the 2000s, were generally consistent with the findings from the existing literature, they reveal that the effects of divorce differ between the six countries included in this study.

In all of the countries studied, divorce had, on average, negative effects on the equivalised household incomes of women. However, the extent and duration of the negative effects of divorce differed markedly between countries:

- In the USA and Korea, divorce had a substantial negative effect on women's equivalised household incomes in the short term, and there was no evidence of recovery over the medium term.

- In the UK, Germany, Australia and Switzerland, divorce had a substantial short-term negative effect, although smaller than that experienced by women in Korea and the USA. In the UK, Germany and Australia, women's incomes started to recover, but their incomes were still substantially lower six years after divorce than they would have been had they remained married.

- In Switzerland, women's income recovered very quickly to what we estimated it would have been had they remained married.

In all of the study countries, the effects of divorce on the equivalised household income of men were smaller than the effects on women in terms of post-separation income relative to pre-separation income and the income it would have been had they remained married.

Although, using the available data, it is not possible to definitely explain the differences between countries, the analysis presented in this paper provides some insights:

- The role played by government benefits differs between countries. In the UK, Germany and Australia, government benefits are very important in reducing the effects of divorce on women's equivalised household incomes. In the USA, Switzerland and Korea, government benefits play a far smaller role in offsetting the negative effect of divorce on women's post-divorce incomes.

- The effects of divorce on income vary with different institutional settings and labour markets. For example, the economic consequences of divorce for women in Switzerland are much smaller because of a combination of higher labour market earnings for women in Switzerland and a greater contribution from a new partner's income.

- Re-partnering rates and contributions from a partner's income to post-divorce household income vary substantially across the study countries. In Germany and the USA, partner income makes a relatively small contribution to women's post-divorce household income, while it is much more significant in Switzerland and Australia, and to a lesser extent in the UK and Korea.

This study has demonstrated that the average economic effects of divorce, particularly for women, are heavily influenced by the social security system, labour market, family models and the family law system of each country. While the social security system and institutional arrangements such as child support and spousal maintenance do influence women's post-divorce economic outcomes, what is most important in explaining cross-country differences is women's labour market earnings and the extent to which re-partnering occurs.

Divorce is a key life-course risk, which typically has significant economic consequences, as well as possible negative effects on health and wellbeing. In OECD countries, institutional arrangements have been established to help manage the consequences of divorce, and reduce its economic effects. These include family law, child support (maintenance) and spousal maintenance (alimony) and the social security system.1

It has been demonstrated that estimates of the economic effects of divorce based on cross-sectional data can be quite misleading, and that longitudinal data that tracks people pre- to post-divorce is needed to obtain accurate estimates of the economic effects of divorce (e.g., de Vaus, Gray, Qu, & Stanton, 2014). There are longitudinal estimates of the economic costs of divorce for Australia, the UK, the Netherlands, the USA and Canada, among other countries.2 These studies have consistently found that divorce has negative economic consequences, particularly for women. Despite the number of single-country longitudinal studies of the economic effects of divorce, there are few longitudinal cross-country studies.

Among the earliest longitudinal cross-country studies are Burkhauser, Duncan, Hauser and Bernsten (1990) comparing Germany and the United States, and Fritzell (1990) comparing Sweden and the USA. In a more recent study, Andreß, Borgloh, Bröckel, Giesselmann, & Hummelsheim (2006) examined the economic effects of divorce on household income in Belgium, Germany, the United Kingdom, Italy and Sweden using data collected between the mid-1980s and the early 2000s. The analysis by Andreß et al. (2006) covered up to five years before and after divorce. Uunk (2004), using longitudinal data from 14 European Union (EU) countries collected over the period 1994-2000, estimated the short-term (one year after divorce) economic effects of divorce. These studies generally found that divorce had a greater negative effect on women than men and that there were differences between countries in the extent of the negative effects of divorce and the differences between men and women.

Having comparable estimates for a range of countries of the economic effects of divorce and the extent to which these effects change in the years following divorce is important to assist in the evaluation and further development of policies to alleviate the consequences of divorce.

This report extends the existing literature by using longitudinal data for the USA, the UK, Switzerland, Korea, Germany and Australia, collected during the first decade of the 21st century, to estimate the short- and medium-term economic effects of divorce. These countries have been chosen because comparable longitudinal data are available. They are also interesting countries to compare because of their differing family models, patterns of female labour force participation, family law and social security systems.

This report makes several contributions to the literature. First, it provides comparable estimates of the effects of divorce over the short- and medium- term for six OECD countries using longitudinal data. Second, it uses data from the 2000s, which is much more recent than that used in the previous studies that are based upon data from the 1980s and 1990s. Third, it methodologically extends the work of Andreß et al. (2006), the existing study that includes the largest number of countries, to take into account what couples' incomes would have been in the absence of divorce, using data from non-divorced couples to estimate the counterfactual.

The analysis is presented separately for men and women. A gender-based analysis is important for several reasons. First, in all of the countries examined, children are much more likely to spend the majority of their time with their mother post-divorce. Second, as noted above, divorce tends to have differential economic effects on men and women.

This report is structured as follows. In the next section a brief overview of the family law, social security and labour market contexts of each country is provided. In section 3 the data used in the report are summarised. Section 4 presents the estimates of the effects of divorce on equivalised household income. In section 5 reasons for differences in the economic effects of divorce for women are examined via different patterns in source of income, employment rates and re-partnering. The final section draws conclusions on the basis of the results.

Footnotes

1 Throughout this report, the term "divorce" is used in a broad sense to refer to both relationships that were legal marriages (de jure marriage) as well as de facto marriages (cohabiting relationships).

2 See for example, Avellar and Smock (2005); de Vaus, Gray, Qu, and Stanton (2010); de Vaus, Gray, Qu, and Stanton (2014); Gray and Chapman (2007); Fisher and Low (2012); Gadalla (2009); Jarvis and Jenkins (1999); Jenkins (2008); and Manting and Bouman (2006).

The family law systems differ between the UK, Germany, Australia, Korea, the USA and Switzerland. This section provides an overview of key aspects of the systems in each country that are particularly relevant to understanding the economic effects of divorce.

Most of the countries (the UK, Germany, Australia, the USA and Switzerland) have "no-fault" divorce systems. In Korea divorce is either by the mutual consent of the spouses or there are fault-based grounds for judicial divorce. There is no provision for no-fault divorce in Korea.

2.1 Child maintenance (support) and spousal maintenance (alimony)

One factor that may influence financial living standards following divorce where there are dependent children is in the payment of child support (child maintenance). All countries in this study require child support payments to be made following parental divorce. The countries differ in terms of whether there are rules for determining the amount of payments. Australia, the UK and Switzerland have specific rules for determining the amount of payments, the USA has formal guidelines, in Germany the amount is based mostly on discretion informed by "support tables", and in Korea there are no fixed rules or methods for determining the amount of child support payable. There are different arrangements for children of unmarried and married parents in Germany and Switzerland (OECD Family Database).

There are also differences between the countries in whether it is a requirement for spousal maintenance (alimony) to be paid. In Australia, spousal maintenance is generally not paid. In the USA there is a system of spousal maintenance, but how it is determined varies between states. In the UK maintenance is common and often lifelong. In Germany there are limited provisions for spousal maintenance.

Data from the Luxembourg Income Study suggests that in 2004 there was considerable variation across countries in the extent to which child maintenance (child support), spousal maintenance (alimony) and advance maintenance payments by public authorities (relevant in some countries) contributed to disposable income. Among the countries considered in this report, the proportion of household income from these sources was 14% in Australia, 21% in Germany (2000 figures), 16% in the UK, 35% in Switzerland and 19% in the USA.3 Comparable data for Korea could not be found, although it does appear that the amounts of child support and spousal maintenance received in Korea will be towards the lower end.

2.2 Division of property (assets)

While there are differences in the family law systems between these countries, in broad terms separating couples can either come to a separation agreement that covers the division of property themselves, and if they cannot agree then a court will determine the division of property. The countries differ in the extent to which there are rules or guidelines for the division of property. It was not possible to obtain comparable cross-country data on property settlements. Countries differ in terms of whether pre-marriage assets are divided and in the extent that contributions to the creation of assets and need are taken into account. The division of assets following divorce has implications for the flows of income derived from assets.

Footnotes

3 Data from the OECD Family Database, retrieved from PF1.5: Child Support (Table PF1.5: Child Support) <www.oecd.org/els/family/41920285.pdf>.

3.1 Data

Data from longitudinal household panel studies for each of the countries are used. An overview of the surveys used in this report is available from Ohio State University.4 The surveys used are all part of the Cross-National Equivalent File (CNEF), which provides equivalently defined variables for each of the studies (see Frick, Jenkins, Lillard, Lipps, & Wooden, 2007). One of the strengths of the CNEF for estimating the economic consequences of divorce is that it provides a comparable measure of disposable income (after tax) across countries.

All of the surveys collect data annually with the exception of the Panel Study of Income Dynamics (PSID) in the USA, which collects data biennially. In order to generate the most closely comparable estimates of the effects of divorce on economic wellbeing across the study countries, the analysis is based mainly upon data collected in 2000 and onwards. The exceptions are Australia, which started in 2001 (the year the HILDA survey started), and the USA, for which the data analysed starts in 1999.

The analytical sample is restricted to survey respondents who were aged between 20 and 54 years at the time the first wave of data was analysed (generally 2000). The younger age cut-off point has been selected because in some of the countries examined relatively few longer-term relationships were established before the age of 20 years. The upper-age cut-off point was chosen to allow a focus on divorces that occur to people of working age. Those who were 54 years at the time the first wave of data was analysed remain of working age for most of the subsequent waves of data.

The analysis sample of those who divorced consists of respondents who were married (either in a de facto or legally married relationship) at the first wave and who separated at some point after the first wave and during the period included in the analysis (see Table 1 for details for each country). The non-divorce analysis sample includes respondents who have participated in the survey since the first wave of data and who did not divorce during the period included in the analysis. For the analysis of the effects of divorce on income, the counterfactual of what would have happened had the respondent not divorced is constructed using data from non-divorced couples.

Respondents who had only one observation after divorce and non-divorced respondents with only two waves of data are excluded from the analysis sample (except for the USA where the interviews were biennial). While the term "divorce" is used in this report, it refers to both separations and divorce, the length of time since divorce refers to the length of time since separation, with divorce only being formalised sometime after separation (e.g., in Australia there is a mandatory 12-month period following separation before the application for divorce can be made).

| Country | Survey | Years and waves used | No. of years of post-divorce data |

|---|---|---|---|

| UK | British Household Panel Survey (BHPS) | 2000-06, Waves 10-16 Annual data collection | Min: 2 Max: 6 |

| Germany | German Socio-Economic Panel (SOEP) | 2000-11, Waves 17-28 Annual data collection | Min: 2 Max: 7 |

| Australia | Household, Income and Labour Dynamics in Australia (HILDA) | 2001-11, Waves 1-11 Annual data collection | Min: 2 Max: 7 |

| Korea | Korea Labor and Income Panel Study (KLIPS) | 2000-08, Waves 3-11 Annual data collection | Min: 2 Max: 7 |

| USA | Panel Study of Income Dynamics (PSID) | 1999-2009, Waves 29-35 Biennial data collection | Min: 2 Max: 6 |

| Switzerland | Swiss Household Panel (SHP) | 2000-11, Waves 2-13 Annual data collection | Min: 2 Max: 7 |

Table 2 provides information on the analysis sample for men and women according to whether they divorced. For women, the sample size for partnered respondents who did not separate since the initial time period ranges from 2,803 for Switzerland to 4,946 for Germany. For men, the non-separated sample at the initial time point ranges from 2,580 in Switzerland to 4,452 in Germany. Given that the proportion of couples that divorce over any given 12-month period is relatively small, this means that only a relatively small proportion of the sample will be in the "divorced" sample. In order to generate a large enough sample to support the analysis, divorces are cumulated over a period of six to ten years for these countries.

| Time | UK | Germany | Australia | Korea | USA | Switzerland |

|---|---|---|---|---|---|---|

| Divorced men | ||||||

| Pre-divorce time | 270 | 406 | 578 | 70 | 498 | 255 |

| Post-divorce (Time 1) | 270 | 406 | 578 | 70 | 255 | |

| 2 | 270 | 406 | 578 | 70 | 498 | 255 |

| 3 | 201 | 337 | 487 | 60 | 197 | |

| 4 | 135 | 278 | 392 | 42 | 326 | 160 |

| 5 | 79 | 236 | 322 | 29 | 124 | |

| 6 | 22 | 197 | 261 | 17 | 210 | 93 |

| Non-divorced men | ||||||

| Start (or initial time) | 3,804 | 4,452 | 3,049 | 2,882 | 3,473 | 2,580 |

| 1 | 3,804 | 4,452 | 3,049 | 2,882 | 2,580 | |

| 2 | 3,804 | 4,452 | 3,049 | 2,882 | 3,474 | 2,580 |

| 3 | 3,456 | 4,082 | 2,690 | 2,645 | 2,330 | |

| 4 | 3,196 | 3,762 | 2,466 | 2,421 | 2,986 | 2,067 |

| 5 | 2,921 | 3,456 | 2,259 | 2,137 | 1,797 | |

| 6 | 2,161 | 2,973 | 2,075 | 1,815 | 2,562 | 1,580 |

| Divorced women | ||||||

| Pre-divorce time | 469 | 551 | 629 | 122 | 750 | 312 |

| Post-divorce (Time 1) | 469 | 551 | 629 | 122 | 312 | |

| 2 | 469 | 551 | 629 | 122 | 750 | 312 |

| 3 | 340 | 465 | 538 | 95 | 233 | |

| 4 | 229 | 403 | 457 | 77 | 535 | 186 |

| 5 | 138 | 338 | 374 | 58 | 143 | |

| 6 | 53 | 269 | 316 | 37 | 377 | 117 |

| Non-divorced women | ||||||

| Start (or initial time) | 3,832 | 4,946 | 3,249 | 3,157 | 3,461 | 2,803 |

| 1 | 3,832 | 4,946 | 3,249 | 3,157 | 2,803 | |

| 2 | 3,832 | 4,946 | 3,249 | 3,157 | 3,461 | 2,803 |

| 3 | 3,546 | 4,551 | 2,934 | 2,901 | 2,539 | |

| 4 | 3,316 | 4,207 | 2,700 | 2,670 | 3,022 | 2,254 |

| 5 | 3,069 | 3,877 | 2,498 | 2,374 | 1,953 | |

| 6 | 2,286 | 3,351 | 2,317 | 2,053 | 2,627 | 1,738 |

Source: CNEF database

3.2 Measures of economic wellbeing

The measure of economic living standards analysed in this report is equivalised household income.5 Equivalised household income is net household income (after tax and government transfers) adjusted for the number of household members and the household composition using the current OECD equivalence scale.6 Missing income is imputed, and the analysis in this report is based upon the income measure that includes imputed values for missing income. While there are some differences between the surveys in the income measures, they are broadly comparable (Frick et al., 2007).7 In this report, all incomes have also been adjusted for the effects of inflation (expressed in 2010 local currency) using the country specific consumer price index.

The proportion of disposable income that is derived from government transferred payments is also examined in order to better understand the extent to which the economic consequences of divorce are offset by increased levels of government financial support, and how this differs between countries.8

3.3 Educational attainment and employment of divorced and non-divorced

Table 3 provides information on the educational attainment and employment rates of men and women at the period before divorce for those who divorced and at the wave first observed for those who did not divorce during the period included in this study.

| Men | Women | |||

|---|---|---|---|---|

| 15+ years of education | Employed | 15+ years of education | Employed | |

| UK | ||||

| Non-divorced | 17.9 | 87.2 | 17.5 | 69.3 |

| Divorced | 16.6 | 79.1 | 13.9 | 67.1 |

| Germany | ||||

| Non-divorced | 25.3 | 92.0 | 19.6 | 65.8 |

| Divorced | 23.9 | 87.2 | 16.1 | 71.7 |

| Australia | ||||

| Non-divorced | 26.6 | 91.3 | 28.8 | 73.3 |

| Divorced | 17.5 | 88.2 | 20.1 | 65.0 |

| Korea | ||||

| Non-divorced | 38.4 | 91.2 | 26.2 | 45.5 |

| Divorced | 14.3 | 85.7 | 8.2 | 65.6 |

| USA | ||||

| Non-divorced | 31.7 | 92.5 | 31.7 | 73.0 |

| Divorced | 17.8 | 82.7 | 17.0 | 71.2 |

| Switzerland | ||||

| Non-divorced | 42.4 | 96.7 | 21.0 | 73.6 |

| Divorced | 46.7 | 95.7 | 30.4 | 86.2 |

Source: CNEF database

In the UK and Germany, men who divorced had similar levels of educational attainment to those who did not divorce. In Australia, Korea and the USA, men who divorced had substantially lower levels of education than those who remained married, and in Switzerland, those who divorced were more likely to have 15 or more years of education than those who remained married.9 For women, the cross-country pattern was similar to men. In the UK and Germany, women who divorced had a slightly lower educational level than those who did not divorce. In Australia, Korea and the USA, women who divorced had substantially lower educational attainment than those who remained married. In Switzerland, women who divorced had substantially higher levels of educational attainment than those who remained married.

In Germany, Australia and Korea, the employment rates of men who divorced were slightly lower than those who remained married. There was little difference in the employment rates pre-divorce of those who divorced and those who remained married in Switzerland. In the UK and the USA, men who divorced had a lower employment rate pre-divorce than those who remained married.

Women in the UK, Australia and the USA who divorced were less likely to be employed pre-divorce than women who remained married. In Korea, women who divorced had much higher pre-divorce employment rates than those who did not divorce, and in Germany and Switzerland, those who divorced also had higher employment shortly prior to divorce than those who did not divorce.

Footnotes

4 See the Ohio State University User Package for the Cross-National Equivalent File <cnef.ehe.osu.edu>.

5 While the division of property following divorce may have an influence upon income (via the returns generated by assets), comparable longitudinal data on assets is not available in the CNEF and hence the effect of divorce on assets is not considered in this article.

6 The standard OECD equivalence scale, which adds 1.0 for the first adult, 0.5 for subsequent adults and 0.3 per child, is used in this report. See Gray and Stanton (2010) for a discussion of equivalence scales.

7 The surveys differ in the time period for which income is collected. The BHPS collects income from labour earnings for the month prior to the survey, the SOEP collects income from different sources for the last calendar year, HILDA collects income for the financial year prior to the survey, KLIPS asks about average monthly income, PSID for calendar year and the SHP for calendar year (though household labour income can be based on different yearly or monthly reference periods). Net household income for the BHPS is not available for 2007 and 2008.

8 Income from public transfers expressed as a percentage of disposable household income may exceed 100%. In these cases, public transfers as a percentage of disposable household income are set to 100%. Amount of government benefits received in the BHPS is imputed.

9 The measure of education from the BHPS differs to that for the other countries. For the UK, the education measure is based on highest qualification. "15+ years of education" refers to degree or higher, "12-14 years" refers to other professional qualifications (incl. the teacher qualification, nursing qualification, and other higher qualifications below degree). The education variables are not included in the CNEF because of a lack of comparability with that in other surveys and in this report we have derived the education measure directly from the BHPS dataset. While the lack of comparability of the education measure between the UK and the other countries means that it is not possible to compare education levels in the UK with those in other countries, the relative education levels among the divorced and non-divorced within the UK are valid.

4.1 Analytical approach

This section presents the estimates of the effects of divorce on equivalised household income over the first six years following divorce. The effects of divorce are estimated separately for men and women. It should be noted that household income does not capture non-cash benefits such as government-funded education and health care, and so on.

The basic methodological approach used to track the changes in income following divorce has been outlined in the introduction. While comparing the post-divorce economic position to the pre-divorce situation provides information on how incomes change following divorce, it may not provide an accurate estimate of the economic effects of divorce. There are several reasons for this, including that equivalised household incomes typically change over the life course and so would have changed in the absence of divorce; and for several of the countries examined there were significant changes in real household incomes during the 2000s.

The approach taken in this report uses longitudinal data to track how economic circumstances are affected by divorce. The analysis also makes use of the information from respondents who remained married, in order to estimate what the trajectory of income would have been for respondents who divorced had they remained married. Because the human capital and other characteristics of those who divorced differ (Table 3 on page 9), on average, to those who did not divorce, it is probable that the income trajectories of these two groups will differ and so the approach of assuming that couples who divorce will have had the same increase in household income as couples who remain together is probably not valid. The approach taken in this report to dealing with this issue is to use regression analysis to "hold constant" the effects of a range of observable characteristics (such as education) that are expected to affect changes in income.

4.2 The effects of divorce on equivalised household incomes

This section presents estimates of the effects of divorce on equivalised household income. The regression results are converted into predicted incomes, which hold constant differences in characteristics between those who divorced and those who did not divorce.

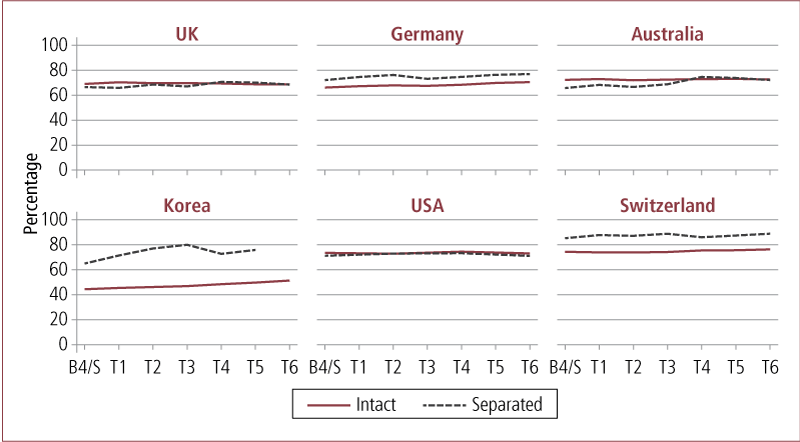

Figure 1 shows the estimated equivalised household income profiles pre- and post-divorce and what estimated income would have been in the absence of divorce. The estimates for each country are shown as separate panels in the figure. Equivalised household incomes for each time point are expressed relative to income at the first time point (pre-divorce income for those who separated). This means that at the first time point income is 100. A value greater than 100 means that income was higher at that time point than it was at the initial time point and a value less than 100 means that it was less than it was at the initial time point. This indexing of income provides a focus on the relative effects of divorce on incomes across countries.

Figure 1: Time profile of relative equivalised household income by divorce status, gender and country

Notes: "B4" refers to before separation for the separated, and "S" refers to first observed wave for the intact sample. Income figures are predicted from the regression models using the average characteristics of the divorced sample. Results of the underlying regression models are provided in the appendix.

Source: CNEF database

Men

The effect of divorce on equivalised income can be viewed in two ways. If viewed compared to pre-divorce income, the equivalised income of men in all countries was unaffected in the short term by divorce. Indeed, equivalised income of divorcing men increased immediately following divorce in Korea, Germany and the USA. The other way of assessing the effects of divorce is against the counterfactual of what would have been the case had these men not divorced. This is the way in which we will assess the effect of divorce in the discussion that follows. When viewed in this way, divorce had little short-term negative effect on the equivalised household incomes of men in the UK, Germany, Australia and Switzerland. But in Korea and the USA, divorce had a substantial negative effect - the estimated equivalised income of non-divorcing men increased sharply compared to that of divorcing men.

Over the medium term, in Australia and Switzerland, men's post-divorce equivalised household incomes were similar to what they would have been had they remained married. However, in the UK and Germany, over the medium term, men's post-divorce equivalised household income fell behind what was estimated it would have been had they remained married. In the UK, five years after divorce, men's equivalised household incomes were estimated to be 10% lower than they would have been had they remained married and in Germany they were 7% lower than they would have been had they remained married. In the USA, the short-term negative effect of divorce on income was sustained over the medium term and, six years after divorce, the equivalised household income was estimated to be 23% lower than what it was estimated it would have been had they remained married.

For men, divorce is estimated to have a substantial and longer lasting negative effect on equivalised household incomes in the UK and the USA. In Australia and Switzerland, divorce had only a very small effect upon men's incomes, although there was a moderate short-run fall in Australia that was quickly recovered. In Germany, there was a moderate negative effect that was sustained.

Women

In all countries except Korea, in the short term following divorce, women experienced a substantial fall in equivalised household incomes compared to their pre-divorce incomes. The falls in income compared to pre-divorce income were: Germany, 35% of pre-divorce income; the USA, 30%; the UK, 26%; Australia, 21%; and Switzerland, 19%. In Korea, there was only a very slight fall in equivalised household incomes compared to pre-divorce incomes (5%).

In all of the countries except the USA and Germany, women's equivalised household incomes returned relatively quickly to their pre-divorce levels, and in Australia and Korea they were higher than their pre-divorced levels. In the USA and Germany, there was only a partial recovery of pre-divorce incomes.

However, when post-divorce incomes are compared to what we estimate household incomes would have been in the absence of divorce, the picture is very different for some countries. In the UK, women's equivalised household incomes fell by 30% in the year following divorce compared to what it was estimated it would have been had they remained married. While there was some relatively quick recovery in equivalised household incomes, after five years post-divorce they remained about 20% below what we estimate their equivalised household income would have been had they remained married.

In Germany, there was a similar recovery to the UK in equivalised household incomes of women, so that the six years post-divorce equivalised household income was estimated to be 19% lower than it would have been had they never divorced. In Australia the initial (T1) substantial relative effect of divorce reduces so that six years later the effect is only half the initial effect (measured relative to what was estimated their income would have been in the absence of divorce). In Switzerland, there was a short-term negative effect and then recovery (in fact, a slight improvement).

In the short-run, divorce had a substantial negative effect on the equivalised household incomes of women in all six countries examined. In all countries, with the exception of Switzerland, the negative effects of divorce on income persisted six years after divorce. In the UK, Germany and Australia, the negative effects of divorce on equivalised household incomes was roughly halved six years after divorce compared to the effect in the year following divorce. In Korea and the USA, incomes dropped substantially following divorce, with no sign of recovery, and remained much lower than what they would have been in the absence of divorce.

Divorce had a much greater negative effect on equivalised household incomes of women than men in all the countries except Switzerland, where it had relatively little effect on men or women, other than in the short run for women.

The estimates reported in the previous section reveal that the effects of divorce on equivalised household incomes are very different between countries, particularly for women. This section examines how the sources of income change following divorce, and the relative contribution of the different sources of income. This provides insights into the reasons why the effect of divorce on financial living standards differs between countries. Given the extent of the fall in income for women after divorce, the analysis in this section is restricted to women.

Pre-tax (gross) household income (from the perspective of a specific household member) can be categorised as being derived from: (a) own income (e.g., labour market income, investment income); (b) income from adults in the household (e.g., partner); (c) government payments; and (d) private transfers (including child support and spousal maintenance). Table 4 provides detailed information on the sources of divorced women's household incomes shortly prior to divorce, two years, four years and six years after divorce.

| UK (%) | Germany (%) | Australia (%) | Korea (%) a | USA (%) | Switzerland (%) b | |

|---|---|---|---|---|---|---|

| Government payments | ||||||

| Pre-divorce | 18.5 | 14.1 | 20.0 | 1.8 | 4.0 | 3.6 |

| 2 years post-divorce | 34.0 | 23.8 | 33.6 | 1.4 | 7.3 | 5.0 |

| 4 years post-divorce | 31.3 | 25.3 | 27.4 | 1.4 | 8.4 | 5.8 |

| 6 years post-divorce | 31.2 | 22.4 | 25.4 | - | 9.4 | 4.3 |

| Private transfers | ||||||

| Pre-divorce | 1.7 | 0.5 | 0.8 | 3.1 | 3.1 | 4.8 |

| 2 years post-divorce | 4.1 | 6.1 | 5.2 | 5.9 | 10.6 | 11.0 |

| 4 years post-divorce | 3.1 | 5.8 | 3.8 | 12.5 | 10.5 | 8.7 |

| 6 years post-divorce | 1.9 | 4.5 | 3.3 | - | 7.1 | 9.4 |

| Own income | ||||||

| Pre-divorce | 30.5 | 25.5 | 26.2 | 52.9 | 33.4 | 37.7 |

| 2 years post-divorce | 44.7 | 51.0 | 43.5 | 72.9 | 65.3 | 57.6 |

| 4 years post-divorce | 42.0 | 44.7 | 42.4 | 72.4 | 62.2 | 56.9 |

| 6 years post-divorce | 39.4 | 44.1 | 42.2 | - | 57.5 | 55.1 |

| Partner's income | ||||||

| Pre-divorce | 48.4 | 54.3 | 45.4 | 42.2 | 56.6 | 58.4 |

| 2 years post-divorce | 5.4 | 3.5 | 8.9 | 19.8 | 0.0 | 11.5 |

| 4 years post-divorce | 10.2 | 5.8 | 14.4 | 13.7 | 7.1 | 17.5 |

| 6 years post-divorce | 13.7 | 9.0 | 17.8 | - | 12.9 | 19.6 |

Note: Partner's income is set to zero if there is no partner. a For Korea, partner's income was the residual after three other sources due to a large number of respondents whose partner's income was missing (around two-thirds pre-divorce). The number of separated women at T6 for Korea was too small to allow statistically reliable estimates and therefore the results are not presented for Korea for this time point. b For Switzerland, a relative high proportion of separated respondents were missing partner's labour earning before divorce, the mean value of partner's income should be taken with a caution.

Source: CNEF database

In all of the study countries the main source of income pre-divorce was partner income (ranging from, an average of 45% of household income in Australia to 58% in Switzerland) and the second largest contributor was own income. There were substantial differences in the contribution of government benefits pre-divorce, with government benefits contributing the largest proportion to women's pre-divorce household incomes in Australia (20%), the UK (18%) and Germany (14%), and contributing only a small amount in Korea, the USA and Switzerland. Private transfers only contributed a small amount to household incomes pre-divorce in all of the countries.

In the UK, following divorce, the proportion of women's household income derived from government benefits increased sharply (from an average of 18% pre-divorce to 34% two years post-divorce) and then remained at just over 30% of household income out to six years post-divorce. While private transfers did increase post-divorce, they contributed only a small proportion of household incomes. The contribution of own income increased from 30% to 45% of household income two years post-divorce and then decreased slightly (to around 40%) four to six years after divorce as re-partnering occurred and the contribution of partner's income to women's post-divorce household incomes increased.10

In broad terms, in Germany the changes in sources of income following divorce were similar to those in the UK, although the contribution of government benefits and partner income was relatively lower and own income was relatively more important. This reflected the lower re-partnering rate of women in Germany compared to the UK. The effects of divorce on women's equivalised household incomes (including the post-divorce trajectory) were similar in the UK and Germany (see Figure 1).

In Australia, while divorce had an initial substantial negative effect on women's equivalised household incomes, there was fairly rapid partial recovery in income to what it was estimated income would have been in the absence of divorce. The proportion of income derived from government payments peaked at 34% at two years following divorce and declined to 25% six years after divorce. This decline was due to the increase in the contribution of women's own incomes to their household income and the relatively high rates of re-partnering, which resulted in partner's income becoming an important contributor to post-divorce incomes six-years after divorce (18% of household incomes).

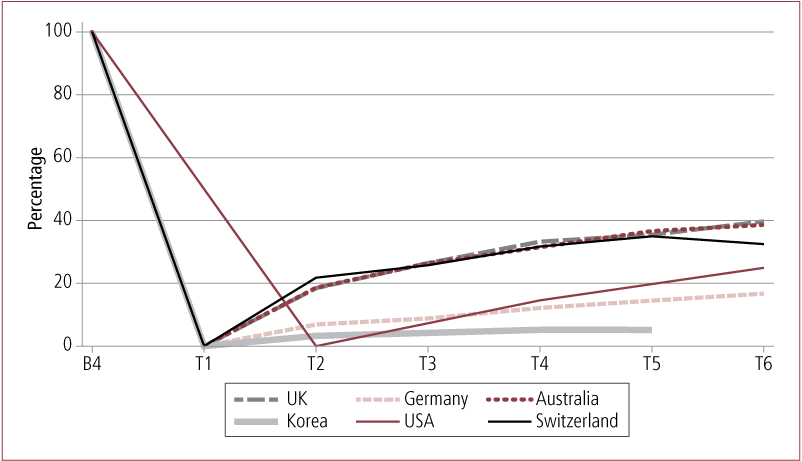

In the USA, divorce had a substantial negative effect on women's equivalised household incomes and the negative effect of divorce increased with time following divorce. The poor economic outcomes for US women following divorce was in part due to the only modest increases in the proportion of income coming from government benefits post-divorce (increase from 4% immediately prior to divorce to 9% six years after divorce). US women were very reliant on their own income, which increased from 33% of pre-divorce household income to 65% two years after divorce and contributed 57% of household income six years after divorce. The contribution from partner's income did increase but remained smaller six years after divorce in the USA than in Australia and Switzerland. Private transfers (largely child support and spousal maintenance) were more important in the USA than in the UK, Germany or Australia. While employment rates of women in the USA were relatively high post-divorce (Figure 2), their earnings, if employed, were low compared to married women.11

In Switzerland, divorce had only a small and short-lived negative effect upon women's equivalised household incomes. This was in spite of government benefits making only a minor contribution to post-divorce incomes (around 5%) and was due to women's post-divorce income resulting from high employment rates (Figure 2), relatively high earnings if employed (see footnote 10) and a relatively high re-partnering rate (Figure 3) meaning that partner income made a significant contribution to women's post-divorce household incomes. Private transfers (child support and spousal maintenance) were also relatively significant in Switzerland.

Figure 2: Time profile of the employment by divorce status and country, women

Note: "B4" refers to before separation for the separated, and "S" refers to first observed wave for the intact sample.

Source: CNEF database

Figure 3: Time profile of repartnering rates by country, women

Note: "B4" refers to before separation for the separated, and "S" refers to first observed wave for the intact sample.

Source: CNEF database

Footnotes

10 Re-partnering has been found, in other studies, to be an important mechanism leading to recovery in economic position following divorce (e.g.,Gray et al., 2011; Mortelmans and Jansen, 2010).

11 Data on the labour market earnings (expressed in 2010 US dollars PPP adjusted) of full-time employed women provides evidence about differences in the earnings of divorced and non-divorced women. The estimates are restricted to full-time employed in order to eliminate the effects of differences in part-time employment rates between countries and between divorced and non-divorced married women. The earnings of full-time employed women are: UK - $32,600 married and $32,000 divorced; Germany - $44,900 married and $43,900 divorced; Australia - $37,200 married and $37,800 divorced; Korea - $23,900 married and $19,800 divorced; USA - $45,800 married and $39,900 divorced; and Switzerland - $54,000 married and $53,400 divorced.

Much of the existing literature has found that divorce has a substantial negative effect on women's equivalised household incomes, at least in the short term, and that the negative effect of divorce on women's financial living standards is larger, on average, than that on men's financial living standards.

The analysis of longitudinal data collected in the UK, Germany, Australia, Korea, the USA and Switzerland during the 2000s, while generally consistent with the findings from the existing literature, reveals that the effect of divorce differs between the six countries included in this study.

In all of the countries studied divorce had, on average, negative effects on the equivalised household incomes of women. However, the extent and duration of the negative effects of divorce differed markedly between countries. In the USA and Korea, divorce had a substantial negative effect on women's equivalised household incomes in the short term and there was no evidence of recovery over the medium term. In fact, in the USA the negative economic effect of divorce continued to increase as the time since divorce increased. In the UK, Germany, Australia and Switzerland, divorce had a substantial short-term negative effect; although smaller than that experienced by women in Korea and the USA. In the UK, Germany and Australia, women's incomes started to recover, but their incomes were still substantially lower six years after divorce than they would have been had they remained married. In Switzerland, women's income recovered very quickly to what we estimated it would have been had they remained married.

In all of the study countries, the effect of divorce on the equivalised household income of men was smaller than the effect on women in terms of post-separation income relative to pre-separation income and the income it would have been had they remained married. Why are there such substantial differences between countries in the effects of divorce on equivalised household income? While, using the available data, it is not possible to definitely explain the differences between countries, the analysis presented in this report provides some insights.

The role played by government benefits differs between countries. In the UK, Germany and Australia, government benefits are very important in reducing the effects of divorce on women's equivalised household incomes. In the USA, Switzerland and Korea, government benefits play a far smaller role in offsetting the negative effect of divorce on women's post-divorce incomes, particularly in Switzerland and Korea. However, it is not the case that higher government benefits post-divorce (as measured by proportion of post-divorce household income derived from government benefits) is necessarily associated with smaller economic effects of divorce for women. In Switzerland, government benefits play only a relatively minor role but the effects of divorce on women's household income was the smallest of the countries examined in this study.

The differences in the institutional setting and labour market can be seen in the effect of divorce on income. For example, while in the USA and Switzerland, government benefits contribute a similar proportion of women's post-divorce household incomes, the economic consequences of divorce for women in Switzerland are much smaller because of a combination of higher labour market earnings for women in Switzerland and a greater contribution from a new partner's income.

Re-partnering rates and the contribution from a partner's income to post-divorce household income vary substantially across the study countries. In Germany and the USA, partner income makes a relatively small contribution to women's post-divorce household income, while it is much more significant in Switzerland and Australia, and to a lesser extent in the UK and Korea.

Perhaps the most important factor in explaining the relatively small effects of divorce on women's equivalised household incomes and the recovery over time in Switzerland and Australia is the female employment rate and earnings if employed, and how this changes over time. In Switzerland, women who divorced had high rates of employment prior to divorce and these remained very high post-divorce. In Australia, women who divorced had lower employment rates than women who remained married but had a substantially faster rate of growth in employment than women who remained married. Women in Korea also had high employment rates, and much higher than women who remained married, but women who divorced and were employed full-time had lower earnings than their full-time married counterparts. In the USA, married and divorced women had relatively high employment rates, but full-time employed, divorced women had lower earnings relative to full-time employed, married women.

While the social security and family law systems are relatively similar in the UK and Australia and the economic consequences of divorce are also broadly similar, when source of income is examined, it is clear that government payments make a greater contribution in the UK than in Australia, whereas, in Australia, own income becomes relatively more important than private transfers. Partner's earnings are also relatively more important.

Outcomes in Germany are broadly similar to the UK and Australia and the relative contribution of the different sources of income to women's post-divorce household incomes is broadly similar between these three countries, although partner income is much less important in Germany than in Australia and the UK, and own income is relatively more important in Germany than in Australia and the UK. These findings highlight that countries with very different social security systems (e.g., Germany and Australia) can produce similar post-divorce outcomes. Although the comparison between Germany and Australia also illustrates the effect that differences in relationship dynamics has upon post-divorce household incomes.

The economic outcomes of divorce for women in Korea lie between those in the UK, Germany and Australia, on the one hand, and the USA, on the other. While Korean women experience very heavy economic losses following divorce, these do not increase over time due in part to the big increases in the contribution of women's own income and, to some extent, private transfers.

This study has demonstrated that the average economic effects of divorce, particularly for women, are heavily influenced by the social security, labour market, family model and family law system of each country. While the social security system and institutional arrangements such as child support and spousal maintenance do influence women's post-divorce economic outcomes, what is most important in explaining cross-country differences is women's labour market earnings and the extent to which re-partnering occurs.

- Andreß, H.-J., Borgloh, B., Bröckel, M., Giesselmann, M., & Hummelsheim, D. (2006). The economic consequences of partnership dissolution: A comparative analysis of panel studies from Belgium, Germany, Great Britain, Italy and Sweden. European Sociological Review, 22(5), 533-560.

- Avellar, S. & Smock, P. (2005). The economic consequences of the dissolution of cohabiting unions. Journal of Marriage and Family, 67, 315-327.

- Burkhauser, R. V., Duncan, G. J., Hauser, R. & Bernsten, R. (1990). Economic burdens of marital disruption: A comparison of the United States and the Federal Republic of Germany. Review of Income and Wealth, 36, 319-333.

- de Vaus, D., Gray, M., Qu, L. & Stanton, D. (2010). The effect of relationship breakdown on income and social exclusion. In P. Saunders, R. Sainsbury & P. A. Kemp (Eds.), Social security, poverty and social exclusion in rich and poorer countries. Antwerp, Belgium: Intersentia Uitgevers.

- de Vaus, D., Gray, M., Qu, L., & Stanton, D. (2014). The economic consequences of divorce in Australia, International Journal of Law, Policy and the Family, 28(1), 26-47.

- Fisher, H., & Low, H. (2012). Financial implications of relationship breakdown: Does marriage matter? (Institute for Fiscal Studies Working Paper 2012/17). London: Institute for Fiscal Studies.

- Frick, J., Jenkins, S., Lillard, D., Lipps, O., & Wooden, M. (2007). The Cross-National Equivalent File (CNEF) and its member country household panel studies, Schmollers Jahrbuch, 127(4), 627-654.

- Fritzell, J. (1990). The dynamics of income distribution: Economic mobility in Sweden in comparison with the United States, Social Science Research, 19, 14-46.

- Gadalla, T. (2009). Impact of marital dissolution on men's and women's incomes: A longitudinal study, Journal of Divorce and Remarriage, 50, 55-65.

- Gray, M., & Chapman, B. (2007). Relationship breakdown and the economic welfare of Australian mothers and their children, Australian Journal of Labour Economics, 10(4), 253-277.

- Gray, M., de Vaus, D., Qu, L., & Stanton, D. (2011). Divorce and the wellbeing of older Australians, Ageing and Society, 31(3), 475-498.

- Gray, M., & Stanton, D. (2010). Costs of children and equivalence scales: A review of methodological issues and Australian estimates. Australian Journal of Labour Economics, 13(1), 99-115.

- Jarvis, S., & Jenkins, S. (1999). Marital splits and income changes: Evidence from the British Household Panel Survey. Population Studies, 53, 237-254.

- Jenkins, S. P. (2008). Marital splits and income changes over the longer term (ISER Working Paper Series, No. 2008-07). Colchester: Institute for Social and Economic Research, University of Essex.

- Manting, D., & Bouman, A. (2006). Short- and long-term economic consequences of the dissolution of marital and consensual unions: The example of the Netherlands, European Sociological Review, 22(4), 413-429.

- Mortelmans, D., & Jansen, M. (2010). Income dynamics after divorce: A latent growth model of income change on the European Community Household Panel, Brussels Economic Review, 53(1), 85-107.

- Uunk, W. (2004). The economic consequences of divorce women in the European Union: The impact of welfare state arrangements. European Journal of Population, 20, 251-285.

| UK | Germany | Australia | Korea | USA | Switzerland | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Divorced | -0.0453 | -0.0380 | 0.0056 | 0.0796 | 0.0714 | * | 0.1502 | *** | ||||

| Age @ Time 1 a | 0.0038 | *** | 0.0116 | *** | -0.0004 | 0.0020 | 0.0049 | *** | 0.0069 | *** | ||

| Age squared | -0.0006 | *** | -0.0004 | *** | -0.0003 | ** | -0.0006 | *** | -0.0006 | *** | -0.0002 | * |

| Living with children < 15 years @ Time 1 | -0.3148 | *** | -0.1809 | *** | -0.2648 | *** | -0.1649 | *** | -0.292 | *** | -0.344 | *** |

| Education (years) @ Time 1 (ref. = < 12 years) | ||||||||||||

| 12-14 years | 0.1651 | *** | 0.1557 | *** | 0.1666 | *** | 0.2829 | *** | 0.4053 | *** | 0.1799 | *** |

| 15+ years | 0.4243 | *** | 0.4684 | *** | 0.4407 | *** | 0.6587 | *** | 0.7968 | *** | 0.3692 | *** |

| Time b (ref. = Time 1) | ||||||||||||

| Time 2 | 0.0417 | *** | 0.0093 | * | 0.0542 | *** | 0.1863 | *** | -0.0113 | |||

| Time 3 | 0.0789 | *** | 0.0284 | *** | 0.0718 | *** | 0.2452 | *** | 0.2421 | *** | -0.019 | * |

| Time 4 | 0.1052 | *** | 0.0488 | *** | 0.0985 | *** | -0.01 | |||||

| Time 5 | 0.1348 | *** | 0.0446 | *** | 0.1253 | *** | 0.2359 | *** | -0.0054 | |||

| Time 6 | 0.1447 | *** | 0.0483 | *** | 0.1684 | *** | -0.0118 | |||||

| Time 7 | 0.0329 | *** | 0.1910 | *** | 0.3251 | *** | 0.0058 | |||||

| Time 8 | 0.0349 | *** | 0.2029 | *** | 0.0018 | |||||||

| Divorce × Time (ref. = Time 1) | ||||||||||||

| Divorce × Time 2 | 0.0177 | 0.0987 | *** | 0.0160 | -0.0874 | 0.0431 | ||||||

| Divorce × Time 3 | -0.0268 | 0.0355 | 0.0814 | *** | -0.2155 | * | -0.1387 | *** | 0.0371 | |||

| Divorce × Time 4 | -0.0963 | -0.0089 | 0.0886 | ** | 0.0123 | |||||||

| Divorce × Time 5 | -0.1506 | * | -0.0134 | 0.0664 | * | -0.1725 | *** | -0.003 | ||||

| Divorce × Time 6 | -0.0910 | -0.0575 | 0.0539 | -0.0025 | ||||||||

| Divorce × Time 7 | -0.0655 | 0.0309 | -0.178 | ** | -0.0261 | |||||||

| Divorce × Time 8 | -0.0392 | 0.0590 | -0.0264 | |||||||||

| Constant | 2.7829 | *** | 3.0580 | *** | 3.5489 | *** | -0.0380 | 2.9241 | *** | 3.8574 | *** | |

| R2 | 0.1924 | 0.2573 | 0.1639 | 0.1515 | 0.2191 | 0.1924 | ||||||

| No. of clusters | 3,510 | 4,758 | 3,627 | 2,950 | 3,709 | 2,827 | ||||||

| No. of observations | 16,409 | 32,176 | 23,819 | 8,686 | 13,163 | 18,188 | ||||||

Notes: The dependent variable is the natural log of equivalised disposable household income in 1,000s in 2010 local currency. a Age is centred at 38. b Time 1 refers to before divorce for those who divorced and first observation for those who remained married, and thus Time 2 is T1 after divorce and so on. * p < .05; ** p < .01; *** p < .01.

Source: CNEF database

| UK | Germany | Australia | Korea | USA | Switzerland | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Divorced | -0.0696 | * | -0.0886 | *** | -0.0367 | -0.0198 | 0.0051 | -0.0378 | ||||

| Age @ Time 1 a | 0.0012 | 0.0097 | *** | -0.0013 | 0.0072 | *** | 0.0035 | *** | 0.0054 | *** | ||

| Age squared | -0.0008 | *** | -0.0006 | *** | -0.0005 | *** | -0.0003 | * | -0.0005 | *** | -0.0003 | *** |

| Living with children < 15 years @ Time 1 | -0.3052 | *** | -0.1968 | *** | -0.3043 | *** | -0.1355 | *** | -0.2909 | *** | -0.3562 | *** |

| Education (years) @ Time 1 (ref. = < 12 years) | ||||||||||||

| 12-14 years | 0.2012 | *** | 0.1676 | *** | 0.1246 | *** | 0.3331 | *** | 0.4534 | *** | 0.1343 | *** |

| 15+ years | 0.4183 | *** | 0.4185 | *** | 0.3748 | *** | 0.7295 | *** | 0.842 | *** | 0.3501 | *** |

| Time b (ref. = Time 1) | ||||||||||||

| Time 2 | 0.0378 | *** | 0.0140 | *** | 0.0492 | *** | 0.1892 | *** | -0.0068 | |||

| Time 3 | 0.0708 | *** | 0.0276 | *** | 0.0675 | *** | 0.2385 | *** | 0.2367 | *** | -0.0201 | * |

| Time 4 | 0.0932 | *** | 0.0468 | *** | 0.0843 | *** | 0.2718 | *** | -0.0075 | |||

| Time 5 | 0.1181 | *** | 0.0380 | *** | 0.1115 | *** | 0.3183 | *** | 0.2285 | *** | -0.0075 | |

| Time 6 | 0.1299 | *** | 0.0343 | *** | 0.1559 | *** | -0.0213 | |||||

| Time 7 | 0.0228 | ** | 0.1746 | *** | 0.3172 | *** | -0.0037 | |||||

| Time 8 | 0.0179 | * | 0.1953 | *** | -0.0151 | |||||||

| Divorce × Time (ref. = Time 1) | ||||||||||||

| Divorce × Time 2 | -0.3367 | *** | -0.4483 | *** | -0.2901 | *** | -0.2376 | ** | -0.1905 | *** | ||

| Divorce × Time 3 | -0.2124 | *** | -0.2809 | *** | -0.1788 | *** | -0.2954 | *** | -0.5994 | *** | -0.1127 | ** |

| Divorce × Time 4 | -0.1557 | *** | -0.2697 | *** | -0.1172 | *** | -0.2677 | ** | -0.0188 | |||

| Divorce × Time 5 | -0.1938 | *** | -0.2453 | *** | -0.1175 | *** | -0.2456 | * | -0.4023 | *** | -0.0346 | |

| Divorce × Time 6 | -0.1915 | *** | -0.2160 | *** | -0.0753 | ** | 0.0165 | |||||

| Divorce × Time 7 | -0.2068 | *** | -0.1086 | ** | -0.4946 | *** | 0.0430 | |||||

| Divorce × Time 8 | -0.1719 | *** | -0.0865 | * | -0.019 | |||||||

| Constant | 2.8050 | *** | 3.1277 | *** | 3.6192 | *** | -0.0577 | * | 2.8949 | *** | 3.9737 | *** |

| R2 | 0.2085 | 0.2291 | 0.1747 | 0.1450 | 0.2530 | 0.1739 | ||||||

| No. of clusters | 3,888 | 5,379 | 3,876 | 3,279 | 3,909 | 3,108 | ||||||

| No. of observations | 17,923 | 36,537 | 26,031 | 15,342 | 13,954 | 19,971 | ||||||

Notes: The dependent variable is the natural log of equivalised disposable household income in 1,000s in 2010 local currency. a Age is centred at 38. b Time 1 refers to before divorce for those who divorced and first observation for those who remained married and thus Time 2 is T1 after divorce and so on. * p < .05; ** p < .01; *** p < .01.

Source: CNEF database

- Table 1: Overview of data sources

- Table 2: Numbers of divorced and non-divorced respondents at different time points, by gender and country, ages 20–54 years

- Table 3: Education and employment prior to divorce for divorced men and women and at the initial time point for non-divorced men and women, by country, 20–54 years of age

- Table 4: Mean proportions of women’s gross household income pre- and post-divorce from different sources, by country

- Table A1: Results from clustered linear regression of determinants of equivalised household income, by country, men

- Table A2: Results from clustered linear regression of determinants of equivalised household income, by country, women

- Figure 1: Time profile of relative equivalised household income by divorce status, gender and country

- Figure 2: Time profile of the employment by divorce status and country, women

- Figure 3: Time profile of repartnering rates by country, women

Professor David de Vaus is a Senior Research Fellow at the Australian Institute of Family Studies and Emeritus Professor in the Faculty of Social and Behavioural Sciences, University of Queensland. Professor Matthew Gray is Director, Centre for Aboriginal Economic Policy Research, and Research Director, College of Arts and Social Sciences, at the Australian National University. Dr Lixia Qu is a Senior Research Fellow at the Australian Institute of Family Studies. David Stanton is a Visiting Fellow, Policy and Governance, Crawford School of Public Policy, at the Australian National University.

Previous versions of this report were presented at the 2013 Foundation for International Studies on Social Security Conference, Sigtuna, Sweden, the 2013 International Child Support Conference held at the Australian National University, Canberra and the 2014 Australian Institute of Family Studies Conference, Melbourne. The authors are grateful to participants at these conferences for helpful comments on the research.

de Vaus, D., Gray, M., Qu, L., & Stanton, D. (2015). The economic consequences of divorce in six OECD countries (Research Report No. 31). Melbourne: Australian Institute of Family Studies.

978-1-76016-008-1