Child support and Welfare to Work reforms

The economic consequences for single-parent families

You are in an archived section of the AIFS website

May 2010

Download Family Matters article

Abstract

The 2006–08 reforms of Australia’s social security and child support schemes saw significant changes to the income support eligibility requirements for single resident parents (mostly women) as well as to the calculation of child support. This paper models and examines the combined economic effect of the reforms on the assessed rates of child support, and on the disposable income and effective marginal tax rates of single parents. The modelling indicates that, for the scenarios examined, single resident parents fulfilling basic work requirements under the social security reforms will be financially worse off than before the combined reforms, with improvements in net disposable income only occurring for single parents who can achieve national average earnings or better. The paper goes on to discuss the policy and practical implications arising from these combined effects, particularly for the most affected groups: women and children. In particular, the authors discuss: the financial disincentives for single parents to work arising from these changes; the impact on the care of children; what “fairer” sharing of the costs of children between parents means in practice; how parenting practices and traditional divisions of paid work interact with these financial reforms; and the opportunities for carer parents to achieve improved financial situations under the changes.

Many single-parent households in Australia rely heavily on both social security payments and child support. From 1 July 2006 to 1 July 2008, sweeping reforms saw significant changes to the income support eligibility requirements for single-resident parents (known as the Welfare to Work [WTW] reforms), as well as to the calculation of child support. The combined financial effects of the changes were not modelled as part of either of the reform packages, although the two are linked in their aims. In this paper, we examine whether these changes have significant implications for the after-tax income of single parents, and consequently for the economic wellbeing of children in those households, by modelling the combined effect of these changes.

The child support regime was established originally on the basis of two key goals: first, to improve the living standards of children in poverty;1 and second, to reduce the taxpayers' costs of support to single-parent families.2 Linked to the introduction of the child support scheme were changes to social security payments, in particular to Family Tax Benefit (FTB) payments. The goals of the latest child support reforms include sharing the "real" costs of children fairly between parents within a new social framework of increased workforce participation of mothers and a wider policy agenda of encouraging shared parental responsibility (Ministerial Taskforce on Child Support, 2005). The WTW changes focus on reducing the welfare bill in light of projected rates of social welfare dependency and Australia's ageing population. Despite the potential significance of these combined changes to low-income single-parent households, the intersection of the reforms was not considered.

The concerns that led to the introduction of the child support scheme have not abated. The number of sole-parent families has continued to increase, with a corresponding decrease in the number of couple families (Australian Bureau of Statistics [ABS], 2007d). This increase is projected to continue into the future; it is forecast that the current 5:1 ratio of female-headed sole-parent households to male-headed sole-parent households will continue to 2026 (ABS, 2007d). Australian sole-parent families continue to suffer financial stress in terms of their household income and net worth position and experience high rates of relative income poverty and relative deprivation (ABS, 2007a; Saunders, Naidoo, & Griffiths, 2007; Smyth & Weston, 2000). Hence, although the 1988-89 child support reforms, together with subsequent reforms to family payments, resulted in an improvement in the position of single-parent families, and consequently child poverty, these families continue to experience high rates of relative poverty and suffer short- and long-term financial hardship.

In examining the impact of these reforms and their potential for achieving their goals, it is important to remember that 87% of one-parent families with children under 15 were headed by mothers in 2006 (ABS, 2007a). The WTW reforms, then, as they impact on sole parents, predominately affect women, as do the child support measures if one of their goals is the alleviation of relative poverty. The policy implications of this become clear in our discussion of the modelling.

It is outside the scope of this paper to determine if the combined reforms fulfil their intended goals; rather we consider their potential in this regard. In other words, we examine the impact of the reforms on the income position of those affected, all other things being equal, but do not consider how affected households may change their behaviour as a consequence of the economic incentives they face and thus what the impact of the reforms may be on the final economic position of low-income women.

The paper reports the findings of our modelling of the changes on a set of standard or historically typical child support cases. The modelling is therefore undertaken with reference to Child Support Agency data.3 We examine the effect of the combined reforms on the disposable incomes and effective marginal tax rates (EMTRs) of resident parents on a no-behavioural-change basis, thus addressing the issue of how the combined measures have affected the income position of women and the economic incentives they face as a consequence of the measures. We also point to trends in caring, education standards and workforce participation for men and women and link our discussion of income and economic incentives to such trends to provide a richer context to the findings. We conclude that the effects of the combined changes have the potential to undermine the aims of the reforms for low-income women and we suggest areas that require further consideration by policy-makers.

Independently of the present study, the Department of Families, Housing, Community Services and Indigenous Affairs (FaHCSIA) undertook an analysis [FaHCSIA Study] of actual new child support assessments and FTB payable on the basis of these assessments (see FaHCSIA, 2008, 2009). That study did consider payees affected by WTW changes as a separate cohort, but the combined impact of changes considered together was not modelled. Rather, changes in child support and FTB for that population were reported. Total reductions in disposable income, the points at which they occur, and how payee income levels affect those changes were not considered, nor were the resulting EMTRs from the combined effect of the child support and WTW changes. We discuss the findings of the FaHCSIA study further below and note that those findings are not inconsistent with the results of our analysis.

The new legislative framework

In 1988-89, Australia replaced a court-based, discretionary child maintenance scheme with an administrative scheme delivered by the Child Support Agency (CSA). One of the key features of the new scheme was child support assessment by formula. This radical change came in the wake of research showing, first, significant increases in the number of sole-parent families (Fehlberg & Maclean, 2007; McDonald, 1994) and, second, the poverty outcomes associated with sole-parent families (Attorney-General's Department, 1984; Cass, 1986; Fehlberg & Maclean, 2007; Gillespie, 1989). The formula was simple to apply but attracted trenchant criticism, with many arguing that the rates of support generated were too high. In 2004, the Commonwealth Government established the Ministerial Taskforce on Child Support to review the scheme and the formula. The resulting report, In the Best Interests of Children: Reforming the Child Support Scheme (known as the Parkinson Report), noted that there is a new social context and this includes greater emphasis on shared parental involvement, with child support being concerned with encouraging both parents' participation in raising children, rather than simply enforcing one parent's financial obligation (Ministerial Taskforce on Child Support, 2005). It also refers to mothers' substantially increased workforce participation, which leads to children being supported from both parents' incomes.

As a consequence of the Parkinson Report, three stages of reforms were enacted. The third stage of reforms, which commenced on 1 July 2008, is the most comprehensive and includes a new formula4 premised on the following:

- the costs of caring for children, based on research undertaken as part of the review (see Henman, Percival, Harding, & Gray, 2007);

- the use of both parents' income, after deduction of equal self-support amounts;

- recognising the non-resident parent's care of a child for 14% or more of the time (compared to 30% under the old formula); and

- treating first and subsequent families with greater parity.

To understand the practical financial implications of these reforms, some key principles of the new formula need to be explained. First, both parents' incomes are included after deducting the same self-support amounts. The parents' incomes are combined to provide a total figure, which is then used as the basis for calculating the child's costs of care, using a prescribed table. In that table, the costs vary according to the number (up to a maximum of three) and ages of children (reflecting research showing teenagers cost at least twice as much as younger children), but are capped, to recognise that parents do not continue to spend the same proportion of their income on their children as income increases. Under the new formula, parents will share these costs according to their proportion of combined parental income. However, that sharing must account for any costs already met by a parent when they have the child in their care, and that is calculated according to the amount of care a parent has of the child. This "cost percentage", as it is called, is deducted from the parent's percentage of the combined parental income, to generate the "child support percentage". So, for example, if a parent should pay 50% of the costs based on their share of income, and has 24% of the care, then their child support percentage will be 26%. This percentage is applied to the cost of children to arrive at the rate of child support. Hence, the rate of child support is essentially an intersection between the costs of children (given the parents' combined income), each parent's share of income and each parent's share of care.

The child support changes coincide with reforms to Family Tax Benefit entitlement rules. Previously, a parent with more than 10% but less than 30% of care could claim the child-specific components of the FTB. Now, this benefit cannot be claimed unless the parent has care for 35% or more of nights in the year. As is currently the case, the Maintenance Income Test will still apply in respect to FTB Part A, reducing the resident parent's entitlement to "the more than base rate" benefit and rental assistance by 50 cents for each dollar of child support received. As noted by Fehlberg and Maclean (2007), this is consistent with the original policy goal of reducing the state's cost of support for children.

It was predicted that, as a result of the changes to the formula, child support would reduce in more than half of cases. However, as the Parkinson Report noted, some resident parents receiving less child support will now receive more FTB, although these are often not the predominant sources of financial support for single-parent households. For example, CSA figures (2005-06) show that the child support rate was $260 or less per year in 37.8% of cases (i.e., at or below the then statutory minimum amount), the average liability for one child was $55.16 per week (excluding those cases with a nil child support liability) and the average taxable income for a resident parent was $23,253 (Child Support Agency, 2006). Thus, there will be many resident parents for whom the receipt of various government benefits will play a crucial part in determining their overall standard of living.

Welfare to Work (part of the Australian Government's 2005-06 Budget) contained a range of measures aimed at increasing rates of workforce participation and reducing "welfare dependency" for particular groups - including sole parents (who, as noted above, are predominately women) - by requiring those groups to seek part-time work. The reforms, which took effect on 1 July 2006, were underpinned by three new "work first principles" (as they apply to sole parents). These are that:

- paid employment provides the best form of family income;

- income support recipients of working age should have an obligation to participate in the workforce, depending on their capacity and taking into account their caring responsibilities; and

- services should focus on assisting recipients into the workforce.

As the reforms apply to resident parents, there are two major effects. First, they change the nature of the parent's entitlement to benefits. Second, income support is contingent upon the beneficiary fulfilling certain workforce participation requirements. Sole resident parents with a dependent child under 16 were previously eligible for Parenting Payment Single (PPS). Now, only single parents with children under 8 are eligible for PPS, except in exceptional circumstances. Parents of older children are instead eligible for an "enhanced" Newstart Allowance (NSA). Those already receiving PPS will remain eligible for PPS until the youngest child turns 16 but will nevertheless be required to meet work participation requirements. The change in eligibility from PPS to NSA impacts on the maximum payment rate, income test and payment cut-off levels, the waiting and preclusion periods and the cut-offs for tax offsets. Single parents continue to be eligible for concessions and income supplements such as the Pensioner Concession Card, but may qualify for fewer pensioner concessions and supplementary benefits.

In terms of the goal of increasing the workforce participation of beneficiaries, the reforms assume single resident parents have a capacity to work a minimum of 15 hours per week once their youngest child reaches 8 years of age.5 The parents must then generally fulfil job search requirements to remain eligible for income support.

In 2006-07, there were two further important budgetary provisions relevant to sole resident parents. Supplementing 2005-06 proposals regarding child care placements, the Australian Government (2006) announced plans to uncap the number of outside-school-hours care and family day care places, leading to an estimated 25,000 additional child care places. The 2006-07 Budget also provided for child care assistance for eligible parents returning to work or undertaking relevant study, to meet the gap between the cost of child care and the ordinary government subsidy. Finally, changes to tax rates and FTB were announced.

Responses to Welfare to Work

In response to WTW, the Australian Council of Social Services (ACOSS) noted that the Australian Government had not: conducted pre-budget consultations over the design of the package, released a discussion paper or equivalent, called for submissions or provided an appropriate period for consultation with stakeholders (one month was allowed). ACOSS urged the government to reconsider its plan to reduce payments to those affected and asked that it instead undertake comprehensive reforms of the income support system generally, to "avoid income poverty, to improve fairness and to remove counterproductive disincentives to participation" (ACOSS, 2005, p. 4).

Various organisations, including the National Council of Single Mothers and their Children, the National Centre for Social and Economic Modelling (NATSEM) (Harding, Vu, Percival, & Beer, 2005) and the Brotherhood of St Laurence have raised concerns about the potentially negative financial impact of the WTW proposals on sole resident parents. NATSEM identified a number of significant financial disadvantages - notably, differences in the maximum payment rates and the cut-off points - finding the net effect was a significantly lower disposable income for single parents (Harding et al., 2005). A later analysis by the Brotherhood of St Laurence (cited in Overington, 2006) confirmed this, despite adjustments under the subsequent budget. These financial disadvantages are exacerbated by likely work-related costs, such as child care (notwithstanding possible rebates) and transport costs. These analyses focus, however, solely on the effects of WTW, ignoring the impact of the child support reforms on the net income of sole resident parents, the relationship between child support and FTB and the impact on effective marginal tax rates. This is not surprising, as the WTW reforms were well in train before the child support reforms were known.

Modelling the combined impact of the reforms on single-parent households

Our aim was to build a tax benefit-child support simulation model (TBCSSM) that allowed us to consider the impact of the combined reforms on the level of child support and the resident parent's disposable income, as well as estimate the effective marginal tax rates of resident parents. We adopted the standard approach in the literature of applying the TBCSSM to typical child support cases, and examining the impact of the reforms for varying levels of private income (that is, earnings from paid work).6 The TBCSSM estimates the impact that WTW and child support changes have on child support levels, disposable income and marginal effective tax rates, but does not incorporate their impact on ancillary effects, such as changes to eligibility for state concessions. Where the resident parent's private income is zero, it is assumed these parents were receiving Parenting Payment Single before the reforms and Newstart Allowance after the reforms.

Drawing on Child Support Agency (2006) data, our typical CSA case is based on the following assumptions:

- There is one eligible child and this child is aged between 6 and 12 years (for those shifted onto NSA, we assume the child is aged over 8). Available CSA data show that 60.6% of cases involved one child.7

- The non-resident parent has less than 14% care of the child. In 90.9% of cases, the resident parent had sole care (i.e., more than 30% care, the threshold under the old formula).

- The non-resident parent has no other biological children (relevant dependants), as occurred in 92.1% of CSA cases.

Our simulation model allows for the assessment of the disposable income effects of the child support and WTW changes for any given assumption regarding the non-resident parent's income. For the purposes of the present paper, however, we focus on two specific scenarios: first, where the non-resident parent's income is $45,505 per annum, reflecting annualised average weekly earnings as at August 2007 (Scenario 1);8 and second, where the non-resident parent's income is $30,241, reflecting the average child support income of non-resident parents (Scenario 2).9 The TBCSSM then simulates receipt of child support and disposable income for the resident parent for varying levels of private income (for the resident parent), given these two possible non-resident parent's income levels.

Impact of reforms on child support, disposable income and EMTRs: Scenarios 1 and 2

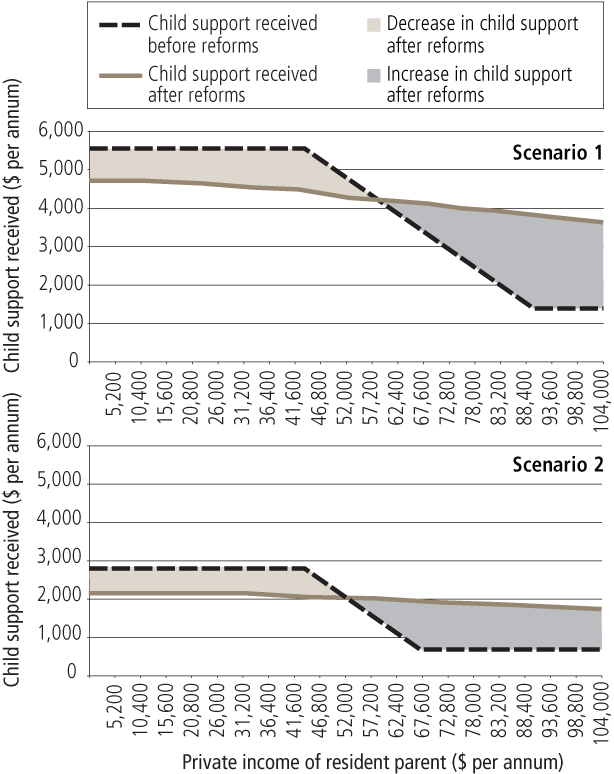

In both scenarios, resident parents with low incomes received less child support after the reforms than they received before the reforms (Figure 1). In Scenario 1, resident parents earning between $0 and $47,580 annually lost approximately $833-1,112 over this income range between the pre-reform and post-reform period. In Scenario 2, resident parents earning $52,000 or less lost between $14 and $734 in child support. As private income exceeds $58,656 (Scenario 1) and $52,156 (Scenario 2), the amount of child support received post-reform increases. For example, under Scenario 1, a resident parent earning $91,000 now receives an extra $2,421 in child support than before the reforms.

Figure 1: Child support received by resident parent: Non-resident parent's income $45,505 per annum (Scenario 1) and $30,241 per annum (Scenario 2), one child aged 6-12 years

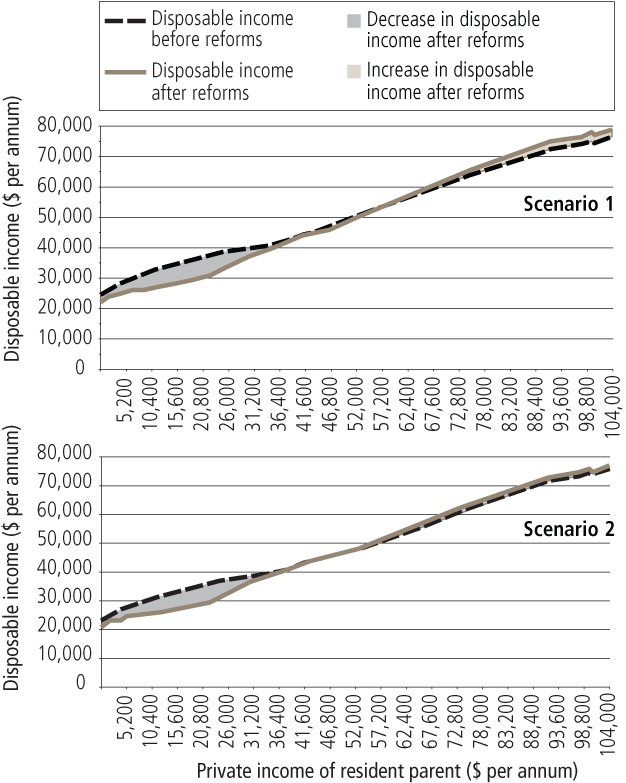

Disposable income is that portion of income from earnings and income support payments remaining after the payment of income tax and the Medicare levy, and the receipt of tax offsets and rebates (Figure 2). The disposable income of resident parents in both scenarios is considerably lower after the child support and WTW reforms, for a range of private incomes. Under Scenario 1, on a private income of $0, the loss in disposable income is $2,140 ($2,048 under Scenario 2), increasing to $6,726 ($6,595 in Scenario 2) lost income at a private income level of $22,308; the loss then decreases to $1,044 at an income of $36,140 (the loss decreases to this level at an income of approximately $35,100 under Scenario 2). In Scenario 1, the losses for those on $0 private income with maximum benefit entitlements are slightly offset by an increase of $419 in FTB Part A ($327 for Scenario 2). For Scenario 1, the disposable income is comparable for private incomes of between $36,192 and $58,604, the loss being less than $1,040.

Figure 2: Disposable income of resident parent: Non-resident parent's income $45,505 per annum (Scenario 1) and $30,241 per annum (Scenario 2), one child aged 6-12 years

Thus, the modelling shows that the largest decline in disposable income for both scenarios occurs where the resident parent has an income of approximately $22,360 and the loss in disposable income is substantial. The loss is partly the result of $6,337 less in income support. Prior to WTW, resident parents were able to earn up to $38,220 before their PPS payment cut out entirely. However, with the shift for such parents to NSA, the entitlement to payment ceases when private income reaches $22,308. While PPS is withdrawn at the rate of 40¢ in the dollar for earnings over $4,072 (one child) per annum, under the previous policy the parent would still receive $6,358 of their PPS at this level of income.

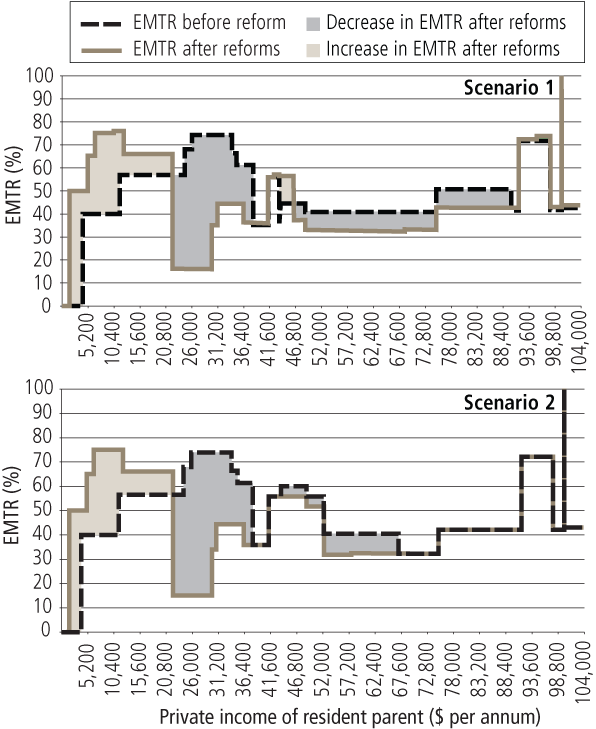

The next consideration is the effective marginal tax rates faced by resident parents. An EMTR measures the proportion of an extra dollar of private income that is lost due to benefit withdrawal or net payment of income tax and Medicare charges. Our simulation model takes into account the effect of income tests associated with income support payments and any tax offsets, such as pensioner, beneficiary and low-income tax offsets. For example, an EMTR of 60% means that for every $1 in private earnings, 60¢ is lost through income tax payments and/or withdrawal of income support payments; the disposable income remaining is 40¢ (Figure 3).

Figure 3: EMTRs faced by resident parent: Non-resident parent's income $45,505 per annum (Scenario 1) and $30,241 per annum (Scenario 2), one child aged 6-12 years

The EMTRs faced by resident parents are higher for low-income earners ($0-22,308) as a result of the reforms. Prior to the reforms, sole parents with private income between $4,160 and $11,492 faced EMTRs of around 40%. This reflected the income test of the parenting payment: when sole parents in receipt of PPS earned more than $4,072 (one child), their pension was reduced by 40¢ for each dollar earned above this amount. When their private income ranged from $11,596 to $24,492, the EMTR faced before the reforms was 56.5%. The increase was due to the payment of income tax and the receipt of the pensioner tax offset. The pensioner tax offset was more generous than the NSA beneficiary tax offset and cut out at a much higher level of earnings, since PPS cuts out at higher earnings. Between earnings of $24,596 and $25,896, the low-income tax offset started to withdraw, so the EMTR was higher at 67.9%. The EMTR rose to 73.9% at earnings between $26,000 and $33,852.

After the reforms, under both scenarios, and at private income levels between $1,664 and $4,992, the EMTR is 50% (compared to 0% or 40% before the reforms, over this range). This is due to the harsher NSA income test. Earnings above $1,612 reduce the NSA received by 50¢ for each dollar earned between $1,612 and $6,500. At a private income of around $5,096, the EMTR increases to 65%. This is due to the cumulative effect of the 50% taper rate for NSA, and a combination of the payment of income tax and receipt of the beneficiary tax offset. For each additional dollar, parents are left with 35¢ after the reforms. At $6,552 of private income, the EMTR peaks at 75%. The income test for NSA sees the withdrawal rate rise from 50¢ to 60¢ in the dollar for earnings above $6,500. At a private income of $12,376, the EMTR falls to 66% due to the cutting out of the beneficiary tax offset. At private income levels above $22,308, the EMTR faced by resident parents after the reforms falls to the same as or a lower level than those faced by standard tax payers.

For both scenarios, between incomes of $22,308 and $38,272, EMTRs were lower as a result of the reforms. Estimated EMTRs were higher before the reforms since recipients continued to receive PPS up to $38,220 of earnings. As such, EMTRs reflected the withdrawal rates of the PPS and the pensioner tax offset.

In Scenario 2, as illustrated in Figure 3, the reforms cause resident parents earning between $43,732 and $67,132 to face reduced EMTRs. This is because prior to the child support reforms, at income levels beyond $43,732, the resident parent's income started to impact upon and reduce the child support liability - effectively withdrawing child support received by 50¢ for each dollar over the resident parent's disregarded income amount. The resident parent's income ceases to impact on child support when they earn $67,132, because the reduction is limited to 25% of what the annual rate would otherwise be. Beyond this income level, therefore, the EMTRs faced by resident parents are similar under both policy environments.

Various other scenarios were tested and these showed:

- For one child: where a non-resident parent had an income of $78,000, the resident parent's loss in disposable income peaked at $8,466 for a private income of $22,308.

- For two children: where a non-resident parent had an income of $78,000, the resident parent lost $4,896 in disposable income where their income was nil, reaching a maximum loss of $9,763 where their income was $22,308, the losses decreasing thereafter as their income increased.

- For one child: where a non-resident parent had 30% care (which is equivalent to just over two nights a week, and so has the potential to include only weekends) and an income of $78,000, the resident parent's lost disposable income peaked at $10,848 at an income of $22,308. Where care shifted to 50/50, the peak loss still occurred at these incomes and was $7,107.

The FaHCSIA study mentioned earlier (FaHCSIA, 2008, 2009), which sought to determine whether "receiving parents" (those receiving child support payments) and "paying parents" (those making child support payments) were net financial gainers (or losers) in terms of their combined gross child support and FTB payments after the changes, found that among single parents on income support who also received child support, 51% were net losers, while 33% were net gainers and 16% experienced no change. Of those who were net losers, the FaHCSIA study estimated that three-quarters had a net loss of around $1,000 or less per annum.

It is not possible to directly compare our findings with those of the FaHCSIA study. Our study is based on a case study approach revolving around the resident parent, and assumptions concerning the non-resident parent. It simulates the profile of child support received, their disposable income, and the EMTRs they face as their private income rises. In contrast, the FaHCSIA study examined actual assessments of child support payments and modelled FTB payments across the population and did not simulate changes in such payments according to differences in private income, nor estimate the final disposable income effect of the changes. Nevertheless, both studies suggest that there are gainers and losers from the reforms and that, as a result of the reforms, more low- income resident parents in receipt of income support payments will be worse off financially.

Discussion

Having examined the economic effects of the combined reforms, we can now consider their potential to achieve the schemes' original goals. We have organised the following discussion around the various stated policy goals for child support and its reform and WTW measures. Hence, we first consider the impact of the combined reforms on the financial position of resident parents - a reduction in the relative poverty of sole parents and children being one of the early aims of child support legislation - and of social security reforms post-1989. We then consider whether the reforms shift the burden of the cost of raising children from the state to the parents. Third, we ask whether the reforms operate as an incentive to increased workforce participation, in light of the broader employment trends for men and women. The focus here is on the WTW reforms. Finally, we discuss whether the reforms will foster the overall policy shift in favour of shared care arrangements.

As we have indicated, these observations relate to a typical child support case, based on historical data. Changes in the trends in care arrangements have the potential to translate to an improvement in a resident parent's earning capacity, although only if the change in parenting arrangements is structured around the capacity to work for both parents (see discussion below). However, for the purposes of this paper, the focus is on what has been the most common care arrangement.

Relative poverty

Our modelling lends support to the claim that the combined reforms may act to increase, rather than decrease, the incidence and extent of poverty in single-parent households. State support to single parents has reduced at the same time as child support payments have reduced for resident parents most vulnerable to poverty (that is, those on the lowest of incomes). This has not been ameliorated by meeting the WTW workforce participation requirements. Under either scenario examined, the resident parent with below-average earnings is significantly worse off after the reforms than they were before the reforms. Their child support falls post-reform unless their earnings exceed $58,604 under Scenario 1 or around $52,156 under Scenario 2. At $0 private income, their disposable income drops by around $2,080 for either scenario, with the loss peaking at around $6,726 (Scenario 1) or $6,595 (Scenario 2) at earnings of approximately $22,308. Conversely, disposable income only starts to increase as a result of the reforms for those resident parents earning over about $52,000. Hence, single parents whose circumstances roughly fit those of our case study scenarios face their greatest reduction in income as a result of the reforms at a private income of $22,308.

Such parents are largely limited to casual and part-time employment because of their carer responsibilities, and these positions are more common in the elementary clerical and services areas. Labour of this nature attracts an hourly pay of around $15-20 per hour (Workplace Authority, 2009). A single parent could work around 25 hours per week during school hours. The greatest effect, then, of these reforms occurs around the private income levels that could be expected for mothers performing unskilled, part-time or casual work, during school hours.

Resident parents of the type examined in our case studies are only advantaged by the reforms in our modelling if they earn more than the "average employee"; that is, more than the "all employees" total earnings of $45,505, as at August 2007 (ABS, 2007b). This is an unlikely income level, given their carer responsibilities and likely educational and employment disadvantages (see below). Finally, the EMTR for parents on private income of $6,552-12,324 will peak at 75%, dropping to 66% for parents with an income of between $12,376 and $22,308. As income rises beyond this point, however, EMTRs were higher pre-reform but fell post-reform, as prior to the reforms recipients continued to receive PPS for up to $38,220 of earnings. As such, pre-reform EMTRs incorporate the withdrawal rates of the PPS and the pensioner tax offset.

The reforms then have the effect of further financially disadvantaging a significant number in a demographic that, by a range of measures, has been found to already suffer financial stress. This is the case even if the WTW reforms have the intended effect of mobilising resident parents into part-time or casual paid employment. The new child support formula treats the income of both parents and their households symmetrically. This assumes a level playing field for both parents which, as discussed below, we consider problematic. The potential effect of the formula, which works on this assumption, combined with the WTW reforms, is to increase the financial disadvantage of resident parents, rather than lifting vulnerable families out of their relative poverty.

Shifting the burden

Our analysis supports Fehlberg and Maclean's (2007) conclusion that the 2008 child support reforms shift the burden of support away from the state and the non-resident parent, towards the resident parent, usually the mother. While there is a general reduction in the cost to the state of maintaining children, this does not translate to an increased burden to both parents in those cases where welfare payments are most likely to be a factor. The reductions achieved through WTW relate only to benefits being withdrawn from low-earning resident parents, who at the same time are having child support withdrawn. As we have seen, meeting workforce participation requirements does not ameliorate the financial loss to these parents until and unless they achieve about average earnings in our simulation. Thus, the shifting of any burden of the costs of raising children from resident to non-resident parents (which only happens where the resident parent has a high income) has little or no impact on the welfare budget.

In addition to this shift of financial burden to the resident parent, this parent also bears the consequences of a loss of earnings and it has never been the intention of child support to compensate for this. The impact is clear, with lifetime earnings of women with children being 28% less than those without (Chapman, Dunlop, Gray, Liu, & Mitchell, 1999). The adverse financial implications of this division of family labour, often initiated while families are intact, most often falls on mothers and is amplified post-separation by the recent reforms. Parents with caring responsibilities who work and earn average earnings - and thus suffer no, or less, financial disadvantage through parenting - may well now find themselves having to bear less of the financial burden of raising their children (in addition to their higher income because of their availability to work). Resident parents whose parenting obligations restrict their earning capacity will not only not be compensated in any way for that financial loss (by the other parent, as may have happened were they living together), but they now receive less government support and less financial assistance from the other parent. That other parent, however, may be suffering no loss of income through any parenting they perform if, as may be the case, care is organised around the work commitments of the former "breadwinner".

While the recent changes promote the original goal for introducing child support of shifting the cost of children from the state to parents, it is suggested that these reforms have the potential to undermine the other stated primary objective of reducing the poverty of children and single-parent families. Instead, the effect is to reduce the financial burden on non-resident parents. This might seem a somewhat perplexing outcome, given that this group is not marked as a particularly disadvantaged group. A key goal of the child support reforms has been to "share more fairly" children's costs and it can be seen that in its implementation this means in most cases that costs have shifted away from non-resident parents to resident parents. Though the potential negative effects for single-parent households were predictable before the child support reform recommendations were made, the Ministerial Taskforce on Child Support (2005) did not model this in light of WTW, though it did suggest the increase in FTB (where it cannot now be split) would partially offset child support reductions. As noted above, there may be a symmetry in the treatment of parental income and households in the new formula. The problem is that there is not a symmetry in the circumstances of parents, because of the loss of earning capacity for resident parents and because of other barriers to work for resident parents, as discussed in the next section.

Creating incentives to work

As we have seen, the combined effect of the reforms for resident parents whose circumstances roughly match those of our case studies, with a private income of over $6,552 (when the non-resident parent's income is around average weekly earnings), operates as a disincentive to work because of the increased EMTRs. In addition, the range of income at which the reforms act to increase the EMTR cover the approximate level of earnings the resident parents would achieve if they were to undertake the 15 hours of work required under WTW. The reforms, then, economically penalise those women whom the WTW reforms are purportedly intending to assist into the workforce. While the employment participation requirements of NSA may provide the necessary stick, the carrot of improved financial circumstances has been removed. It could be said that the reforms, in combination, reflect a punitive approach to welfare provision and arguably even a retreat from the government's previous stated concern to reduce the levels of poverty of children and sole-parent families.

But do the reforms provide an incentive for resident parents to engage in full-time employment, which would improve their situation if it was reasonably well paid employment? Demographic trends of women's education and workforce participation suggest that economic incentives are not the only determinant of women's workforce participation. Flatau and Dockery (2001) found that PPS recipients have a significantly higher probability of being employed while on income support than do other income support recipients. Further, they found that the pattern of engagement of PPS recipients with the labour market is of a more stable nature (long-term part-time employment) than is evident for other income support recipient groups, who exhibit relatively high rates of churning between part-time employment and unemployment. Australian Bureau of Statistics data (2007d)show major increases in the education enrolment and workforce participation levels of females in single-parent families. However, there are high levels of part-time work (as opposed to full-time work), even when compared to partnered females, and a higher proportion were looking for full-time or part-time paid employment (see also Cox & Priest, n. d.).

While measures to increase workforce participation are a very strongly positive determinant of the uptake of employment opportunities for those on PPS, the number of children is a negative determinant (Flatau & Dockery, 2001).10 There is little evidence as to the impact of child support on working patterns of resident parents, although there is a suggestion that child support levels do not have a statistically significant relationship to employment, with the uncertainty of child support as a form of income being cited in a number of studies (Ridge, O'Flaherty, & Deasley, 2007). It would appear then that significant factors in the labour market participation of sole-resident parents include family and social infrastructure barriers to full employment (lack of child care or co-parent support), which may in turn translate to economic disadvantage through child care costs, a lack of power in the employment market place, a limit in the number of hours worked, and a restriction on their capacity for career and educational development. Yet family-friendly employment arrangements are not widespread, especially within unskilled industries (Hall, 2003).

A strategy that reduces resident parents' income is unlikely to effect significant change without concomitant infrastructure support and has the potential of operating in a way that entrenches poverty in such families.11 Further, our simulation results suggest that the reforms in fact add economic disincentives to women's re-entry into the workforce, given their impact on disposable income and EMTRs, unless they are able to generate above average earnings. This is unlikely, given that 60% of sole parents affected by WTW have only Year 10 qualifications and that 86% of occupations require post-secondary qualifications (ACOSS, n. d.; Australian Industry Group, 2006; both cited in Cox & Priest, n. d.). Women's workplace participation, in contrast, is concentrated in low-skilled, repetitive work areas, with poor conditions (Hall, 2003). Those women able to generate higher incomes are likely to already be in the workforce, so the reforms do not in any case operate as an incentive.

We have mentioned that access to affordable child care is one key to the success of these reforms. Single mothers cannot work full-time and stay at home to care for their children. Only if they work full-time in well-paid employment (in addition to their unpaid work as a carer) will they be better off under these reforms. This raises the obvious policy question of the impacts on the children. The current policy environment arguably favours children over 8 years old in single-parent families to either be in institutional care before and after school, to be unsupervised, or in the (probably unpaid) care of family or friends. This is further supported by child support legislation that only treats child care costs as a special expense that might be shared between parents (when only being incurred by one of them) where children are under 12 years of age.12 Cox and Priest (n. d.), however, noted that there is evidence of the need for supervision of older children, and of conflict for parents when they are required to take paid work.

Although these policies apply equally to resident parents, whether mothers or fathers, it appears that their situations may be quite different. Recent data confirm that many fathers are still working long hours during marriage (Human Rights and Equal Opportunity Commission [HREOC], 2005). Thus, where fathers have had better career development while the family was intact, they may be able to capitalise on that after separation if they become the primary carer of a child. Family-friendly policies are more likely in professional positions, which also attract good remuneration (Hall, 2003); that is, the possibility of flexible work arrangements that provide good remuneration will be much higher in this type of work (HREOC, 2005). Most single-parent families are created due to divorce or separation,13 and of all single-parent families, 13% are headed by men. Australian Bureau of Statistics data (2007d) show that more single-parent fathers are in the workforce than single-parent mothers.14 Thus, while the WTW reforms will impact more on mothers post-separation, they do not provide incentives while the parents are living together to restructure their work-parenting balance. In fact, FTB Part B is primarily designed to provide economic aid to single-income families, thereby encouraging traditional time off from employment for one parent (historically the mother) (Cox & Priest, n. d.).

We would argue that the key to reducing welfare dependency for single mothers is in creating an infrastructure to support mothers in the workforce and increase fathers' involvement in the care of their children, whether or not they are separated. The effect of these reforms, however, is to increase the risk of women and children experiencing poverty in the short to medium term after separation, with little guarantee they will prosper financially in the long term.

Fostering shared parenting arrangements

The child support reforms were intended, as an explicit purpose, to support recent "shared parenting" changes to family law legislation (which have been widely discussed in this journal), although the role they were intended to play is unclear. Emerging data and anecdotal evidence strongly suggest that fathers are now spending more time caring for their children post-separation.15 This would appear to fit well with the emphasis on resident parents engaging in (more) paid employment. However, whether this happens depends on how care is shared. Child support decreases the more that care is shared; however, only the number of nights is considered, not the way in which care is structured. If "shared care" is structured around a non-resident parent's work schedule, then this may not necessarily provide the resident parent with time that is easily translated into regular work. Many shared care arrangements under the new formula (that did not qualify as such previously) still involve one parent having the child on weekends, after school and during holidays. Where a parent has a fly-in/fly-out schedule, and that parent has care during their off times, the care would be registered as shared care. The other parent, however, would have little likelihood of securing work that would fit in with that schedule. When one parent is working full-time, an expectation may fall on the other to be available within working hours when the child is unable to attend school and to attend school events. Again, the pattern of work and care during cohabitation may be significant in terms of how these arrangements are struck, particularly if the non-resident parent has not re-partnered. We suspect, based on anecdotal evidence, that many current "shared care" arrangements are indeed based around the work patterns of the person who was the primary earner before separation, with ad hoc care needs (such as sick days and the like) being picked up by the other parent.

This question of how care is shared and its true impact on the sharing of the costs of children is beyond the scope of this paper, but it is clearly a crucial issue that needs to be addressed in assessing the overall impact on families of recent family law reforms (of which the child support reforms form a major part). It is an issue that goes beyond the question of single-parent families, which is the focus here; however, in light of our findings about the interaction of these reforms with the WTW reforms, there seems little doubt that special attention needs to be paid to the possibility of increased poverty within these families.

Conclusion

Our research shows that the combined effect of the WTW and child support reforms in child support cases whose circumstances roughly match those of our case studies will be to increase the potential for women and children to experience poverty, in contradiction to the original policy goal of the child support scheme. The reforms do shift the burden away from the state, but this is transferred to the resident mother who, by all measures, is economically disadvantaged. As the evidence after the introduction of the child support scheme points to single mothers whose circumstances roughly match those of our case studies continuing to be worse off than fathers post-separation, the argument that the changes result in a fairer sharing of costs is hard to sustain.

As the only way out of poverty for many mothers, apart from re-partnering, will be to work full-time, we question whether these changes will motivate that move. The existing research literature suggests that mothers are already motivated to work, but are restricted by a raft of social and infrastructural barriers, such as entrenched parenting arrangements, absence from a skilled workforce, and a limit in available hours for work. We would suggest that reducing their disposable income, whether through child support or welfare supports, is therefore not a necessary or reasonable strategy. We predict that the reforms will do little to effect real social change because they are not accompanied by a package of reforms that would permit equal workforce participation for women and they provide disincentives to work, with increased EMTRs.

The potentially negative consequences of the reforms arguably arise from a failure of reformers to appreciate the broader social context - that there is not a level playing field between mothers and fathers in the employment market and that we are not yet in a world of meaningful shared care arrangements. We suggest that the use of the economic stick on single-parent mothers will do little to effect structural change unless reforms are developed in the context of this broader social framework.

Endnotes

1 Poverty studies in Australia have traditionally utilised a relative income poverty line approach based either on the Henderson Poverty Line, as originally defined in the 1973 Commonwealth Commission of Inquiry into Poverty, or on a 50% (or 60%) of median income measure. More recently, relative deprivation approaches to the measurement of poverty in Australia have been utilised. Irrespective of the method used to measure poverty, it remains the case that the incidence of poverty is particularly high in sole-parent households and among large families, thus affecting many children from such households. For a review of the issues and a recent study, see Saunders, Naidoo, and Griffiths (2007).

2 See Cabinet Sub-Committee on Maintenance (1986). The reforms followed the then Prime Minister's promise that by 1990 no child should live in poverty. Fehlberg and Maclean (2007) argued, by reference to the views of the designers of the scheme, that the dual aims ensured support from all stakeholders. See also Ministerial Taskforce on Child Support (2005).

3 These changes may also impact on families not accessing the child support scheme, but those families are by definition difficult to identify.

4 Detailed in the Parkinson Report (Ministerial Taskforce on Child Support, 2005). See also Part 5, Child Support (Assessment) Act 1989, as amended.

5 Six years for Parenting Payment Partnered: s 500D(1) Social Security Act 1991 (Cth); 8 years for Parenting Payment Single: s 500D(2); 7 years for existing Parenting Payment beneficiaries as at 1 July 2006: s 500D(3).

6 Our modelling uses tax and benefit figures available as at 1 July 2007. Some relevant 2007 CSA data were not available at the time of writing, so available information was used, adjusted as appropriate.

7 Child Support Agency data refer to children aged under 13 years, whereas we assume the children are aged between 6 and 12 or 8 and 12 to accommodate the WTW reforms. The figures show stage 2 cases only. See Child Support Agency (2006).

8 This is the annualised figure of $875.10 per week, representing "All Employees Total Earnings", average weekly earnings, trend estimate for August 2007. See ABS (2007b).

9 Indexed in line with CPI-weighted average, all groups (1.9% change), September 2006 to September 2007 (ABS, 2007c). The average child support income of CSA payers, as of June 2006, was $29,677 (Child Support Agency, 2006). The child support income (known as the "adjusted taxable income" post-reform) is the income used in calculating child support, which may differ from a parent's taxable income.

10 This is consistent with overseas studies, which find that the age of children is also a negative determinant. See the UK and US literature review of Ridge, O'Flaherty, and Deasley (2007).

11 These families have already been identified as a vulnerable group economically; see Cox and Priest (n.d.).

12 Child Support (Assessment) Act 1989, s 117(3A).

13 As noted in ABS (2007d), 55% of lone parents of children under 15 years are divorced or separated from a registered marriage. Separation from de facto relationships would increase this number significantly.

14 According to the ABS (2007d), 63% of lone fathers are employed, compared with 51% of sole-parent women.

15 See Family Court of Australia (2009). In many cases, this arises from a change in application of the new formula rather than a change in the number of nights of care. The Australian Institute of Family Studies (AIFS) is undertaking research on the effects of the family law reforms on families, which is likely to disclose if there are changes to the care arrangements in post-separation families (AIFS, 2007).

References

- Attorney-General's Department. (1984). A maintenance agency for Australia: The report of the National Maintenance Inquiry. Canberra: AGPS.

- Australian Bureau of Statistics. (2007a). Australian social trends 2007 (Cat. No. 4102.0). Canberra: ABS.

- Australian Bureau of Statistics. (2007b). Average weekly earnings, August 2007 (Cat. No. 6302.0). Canberra: ABS.

- Australian Bureau of Statistics. (2007c). Consumer price index, September 2007 (Cat. No. 6401.0). Canberra: ABS.

- Australian Bureau of Statistics. (2007d). Year book of Australia (Cat. No. 1301.0). Canberra: ABS.

- Australian Council of Social Services. (2005). Response to the government's "Welfare to Work" proposals, July 2005 (ACOSS Info 378). Strawberry Hills, NSW: ACOSS. Retrieved 19 June 2009, from <www.acoss.org.au/upload/publications/papers/292__info%20378_welfare%20reform%20joint.pdf>.

- Australian Government. (2006). Budget measures 2006-07 (Budget Paper No. 2). Canberra: Commonwealth of Australia. Retrieved 19 June 2009, from <www.budget.gov.au/2006-07/bp2/download/bp2.pdf>.

- Australian Institute of Family Studies. (2007). A framework for the evaluation of the family law reform package. Melbourne: AIFS.

- Cabinet Sub-Committee on Maintenance. (1986). Child support: A discussion paper on child maintenance. Canberra: AGPS.

- Cass, B. (1986). Income support for families with children (Social Security Review Issues Paper No. 1). Canberra: AGPS.

- Chapman, B., Dunlop, Y., Gray, M., Liu, A., & Mitchell, D. (1999). The foregone earnings from child rearing revised (Discussion Paper No. 47). Canberra: Centre for Economic Policy Research, Australian National University.

- Child Support Agency. (2006). Child Support Scheme: Facts and figures 2005-06. Belconnen, ACT: Child Support Agency, Department of Human Services. Retrieved 10 June 2009, from <www.csa.gov.au/publications/pdf/ff06.pdf>.

- Cox, E., & Priest, T. (n. d.). Welfare to Work: At what cost to parenting? Retrieved 19 June 2009, from <www.women.nsw.gov.au/PDF/Welfare_to_Work_At_what_cost_to_parenting.pdf>.

- Department of Families, Housing, Community Services and Indigenous Affairs. (2008). Report on the population impact of the new child support formula. Canberra: FaHCSIA. Retrieved 8 September 2009 from <www.fahcsia.gov.au/our-responsibilities/families-and-children/publications-articles/report-on-the-population-impact-of-the-new-child-support-formula>.

- Department of Families, Housing, Community Services and Indigenous Affairs. (2009). Update to the population impact of the new child support formula. Canberra: FaHCSIA. Retrieved 8 September 2009 from <www.fahcsia.gov.au/our-responsibilities/families-and-children/publications-articles/updated-report-on-the-population-impact-of-the-new-child-support-formula-july-2009>.

- Family Court of Australia. (2009). Shared parental responsibility. Canberra: FCoA. Retrieved 25 August 2009, from <www.familycourt.gov.au/wps/wcm/connect/FCOA/home/about/Court/Admin/Business/Statistics/SPR/>.

- Fehlberg, B., & Maclean, M. (2007, 25-28 July). "Changing priorities": Current child support agendas in Australia, England and Wales. Paper presented at the Law and Society Conference, Humboldt University, Berlin.

- Flatau, P., & Dockery, M. (2001). How do income support recipients engage with the labour market? (Policy Research Paper No. 12). Canberra: Department of Family and Community Services. Retrieved 10 June 2009, from <www.facsia.gov.au/research/prp12/PRP_No_12.pdf>.

- Gillespie, R. (1989). Campaign for economic justice: Women, poverty traps, and the "caddie" effect. Collingwood: Campaign for Economic Justice.

- Hall, P. (2003). Work and family issues: Trends and projections. Update of presentation made to Catalyst Seminar, 28 March 2000.

- Harding, A., Vu, Q. N., Percival, R., & Beer, G. (2005). The distributional impact of the proposed Welfare-to-Work reforms upon sole parents: Report to the National Foundation for Australian Women. Canberra: National Centre for Social and Economic Modelling, University of Canberra. Retrieved 19 June 2009, from <www.security4women.com/NATSEMwelfaretowork-soleparentsFINAL.pdf>.

- Henman, P., Percival, R., Harding, A., & Gray, M. (2007). Costs of children: Research commissioned by the Ministerial Taskforce on Child Support (Occasional Paper No. 18). Canberra: Department of Families, Community Services and Indigenous Affairs. Retrieved 10 June 2009, from <www.fahcsia.gov.au/about-fahcsia/publications-articles/research-publications/occasional-paper-series/number-18-costs-of-children-research-commissioned-by-the-ministerial-taskforce-on-child-support>.

- Human Rights and Equal Opportunity Commission. (2005). Striking the balance: Women, men, work and family (Discussion Paper). Sydney: HREOC.

- McDonald, P. (1994). Household and family trends in Australia. In Australian Bureau of Statistics, Year book Australia, 1994 (Cat. No. 1301.0). Canberra: AGPS.

- Ministerial Taskforce on Child Support. (2005). In the best interests of children: Reforming the child support scheme. Report of the Ministerial Taskforce on Child Support. Canberra: Commonwealth of Australia. Retrieved 10 June 2009, from <www.fahcsia.gov.au/our-responsibilities/families-and-children/publications-articles/in-the-best-interests-of-children-reforming-the-child-support-scheme-report-of-the-ministerial-taskforce-on-child-support>.

- Overington, C. (2006, 11 May). No benefits to working. The Australian, p. 7.

- Ridge, M., O'Flaherty, D., & Deasley, S. (2007). Child support and work incentives (Research Report No. 402). London: Department for Work and Pensions.

- Saunders, P., Naidoo, Y., & Griffiths, M. (2007). Towards new indicators of disadvantage: Deprivation and social exclusion in Australia. Sydney: Social Policy Research Centre, University of New South Wales.

- Smyth, B., & Weston, R. (2000). Financial living standards after divorce: A recent snapshot (Research Paper No. 23). Melbourne: Australian Institute of Family Studies.

- Workplace Authority. (2009). Find a pay scale summary. Canberra: Workplace Authority. Retrieved 19 June 2009, from <www.workplaceauthority.gov.au/rates-of-pay/find-pay-scale.asp>.

Summerfield, T., Young, L., Harman, J., & Flatau, P. (2010). Child support and Welfare to Work reforms: The economic consequences for single-parent families. Family Matters, 84, 68-78.