Early childhood poverty and adult achievement, employment and health

You are in an archived section of the AIFS website

December 2013

Download Family Matters article

Abstract

In the United States, children from poor families begin school well behind their more affluent peers and, if anything, lose ground during their school years. New research in this article also shows that - furthermore - poor children go on to complete less schooling, work and earn less, and are less healthy in adulthood. Using data from the Panel Study of Income Dynamics (PSID), the article looks at the impact of low income in childhood - from the prenatal period through to 15 years - on school completion, adult earnings, hours worked, use of food stamps, police record, non-marital child bearing, and health outcomes such as obesity, hypertension, and diabetes. In conclusion, the article draws attention to the need for policy interventions aimed at addressing deep and persistent poverty during early childhood - a time of particular vulnerability.

Using a poverty line of about US$23,000 for a family of four, the United States Census Bureau counted more than 16 million US children living in poor families in 2011. Poor children begin school academically and behaviourally well behind their more affluent peers and, if anything, lose ground during their school years. On average, poor US kindergarten children have lower levels of reading and mathematics skills and are rated by their teachers as less well-behaved than their more affluent counterparts. As we show in this essay, children from poor families also go on to complete less schooling, work and earn less, and are less healthy. Understanding the origins and persistence of these differences in fortunes is a vital step toward ensuring the prosperity of future generations.

Our focus is on what low income in childhood, particularly early childhood, means for health and a successful career later in life. Identifying causal effects is tricky, since poverty is associated with a cluster of disadvantages that may be detrimental to children. To determine how children would be affected by a policy that increased family incomes but did nothing else, we focus on distinguishing the effects of family income from those of other sources of disadvantage. In policy terms, this approach enables us to address the following question: To what extent are successes in adulthood affected by a policy, such as the US earned income tax credit, which boosts the family incomes of low-income parents with children but does not directly change any other characteristic of their parents' or families' environments?1

Social scientists have been investigating links between family poverty and subsequent child outcomes for decades (see Mayer, 1997, for a review). As in many research areas, early empirical studies were typically based on point-in-time cross-sectional data. The creation of nationally representative longitudinal datasets in the late 1960s and 1970s enabled researchers to test more refined and dynamic models of links between children's poverty experiences and later outcomes, which predicted, for example, that persistent poverty is more harmful than transient poverty. Importantly, large-scale random-assignment social experiments that manipulated family income were conducted in the United States in the 1970s; however, most of them focused on the question of how additional income affected adult work effort rather than its effect on child wellbeing (Maynard & Murnane, 1979).

Almost universally neglected in the poverty scholarship is the timing of economic hardship across childhood and adolescence. Emerging research in neuroscience, social epidemiology and developmental psychology suggests that poverty early in a child's life may be particularly harmful. Not only does the astonishingly rapid development of young children's brains leave them sensitive (and vulnerable) to environmental conditions, but the family context (as opposed to the school or peer context) dominates children's everyday lives.

We begin by briefly reviewing the scope of childhood poverty in the United States, possible mechanisms linking early poverty to adult outcomes and some of the experimental and non-experimental empirical literature. We then highlight emerging research based on newly available data linking poverty measured as early as the prenatal year to adult health and labour market outcomes measured in the fourth decade of life. We conclude with thoughts about how policy attention might focus on deep and persistent poverty occurring early in childhood.

Poverty in the United States and elsewhere

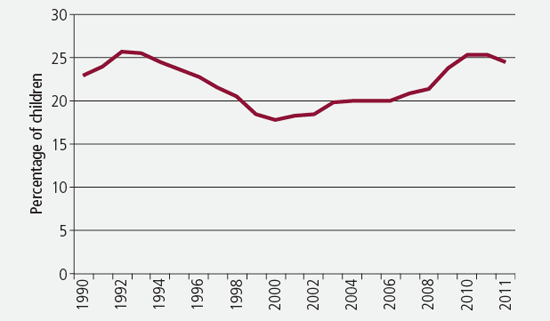

The official US definition of poverty is based on a comparison of a household's total income with a threshold level of income that varies with family size and inflation. The 2011 poverty line was drawn at US$18,123 for a single parent living with two children and at US$22,811 for a four-person family with two children. Over the last 20 years, the fraction of young children classified as poor has ranged from about 18% to 26%; the recent US recession has pushed the number of poor young children to their highest levels since 1994 (Figure 1).

Figure 1: Poverty rate for children less than 6 years old, 1990-2011

Source: US Census Bureau

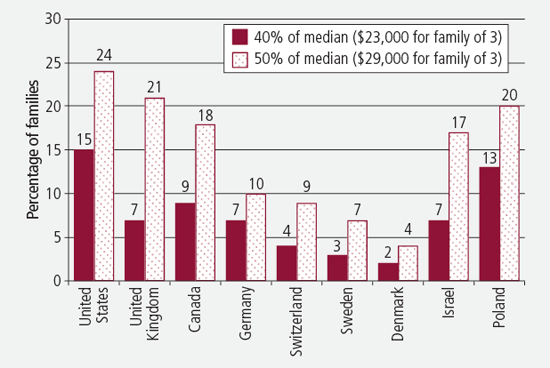

Based on a poverty line defined as a disposable household income of less than 50% of a country's median (size-adjusted) household disposable income (about $29,000 for a family of three), nearly one-quarter of US children under the age of 6 are classified as poor (Figure 2).2 While higher than that of any other developed country, the US rate is only a few points above rates in the United Kingdom, Canada and Poland.3 When the poverty threshold is set at a more austere 40% of median disposable household income (about US$23,000 for a family of three), the cross-country differences are more striking: the 15% U.S poverty rate is more than half again as high as that of any country other than Poland. Thus, deep poverty among children is considerably more pervasive in the United States than in most other Western industrialised countries.

Figure 2: Poverty rates for families with young children, by 40% and 50% poverty thresholds, 2000

Source: Gornick & Jantti (2009)

Why poverty may hinder development

What are the consequences of growing up in a poor household? Economists, sociologists, developmental psychologists, neuroscientists and social epidemiologists emphasise different pathways by which poverty may influence children's development.

Economic models of child development focus on what money can buy (see Becker, 1981). They view families with greater economic resources as being better able to purchase or produce important "inputs" into their young children's development (for example, nutritious meals, enriched home learning environments and child care settings outside the home, safe and stimulating neighbourhood environments) and, with older children, higher quality schools and post-secondary education.

Psychologists and sociologists point to the quality of family relationships to explain poverty's detrimental effects on children. Their theoretical models emphasise the role of higher incomes in improving parents' psychological wellbeing and family processes, in particular the quality of parents' interactions with their children (Chase-Lansdale & Pittman, 2002; McLoyd, 1990; McLoyd, Jayartne, Ceballo, & Borquez, 1994). Poverty and economic insecurity take a toll on a parent's mental health, which may be an important cause of low-income parents' non-supportive parenting (McLoyd, 1990). Depression and other forms of psychological distress can profoundly affect parents' interactions with their children (Zahn-Waxler, Duggal, & Gruber, 2002). A long line of research has found that low-income parents, as compared with middle-class parents, are more likely to employ an authoritarian and punitive parenting style and less likely to provide their children with stimulating learning experiences in the home. Prevailing theoretical models describe the role of income in affecting parenting style as an indirect one that operates through parents' mental health (McLoyd, 1990).

Emerging evidence from neuroscience and social epidemiology suggests that the timing of child poverty matters, and that for some outcomes later in life, particularly those related to attainment and health, poverty early in a child's life may be particularly harmful. Both human and animal studies highlight the critical importance of early childhood for brain development and for establishing the neural functions and structures that will shape future cognitive, social, emotional and health outcomes (Knudsen, Heckman, Cameron, & Shonkoff, 2007; Sapolsky, 2004). Essential properties of most of the brain's architecture are established very early in life by genes and, importantly, early experience. Young children's brains are especially open to learning and enriching influences. But the negative aspect of the plasticity of early brain development is that young children's brains are more vulnerable to developmental problems should their environment be deprived or characterised by traumatic stress (Nelson et al., 2007). Traumatic stress that arises from child maltreatment, for example, produces measurable changes in brain structure and is likely to impart longlasting disadvantages for adult mental and physical health and labour market functioning.

Based on insights from this emerging neuroscience literature, Cunha, Heckman, Lochman, and Masterov (2005) proposed an economic model of development in which preschool cognitive and socio-emotional capacities are key ingredients for human capital acquisition during the school years. In their model, "skill begets skill" and early capacities can affect the likelihood that later school-age human capital investments will be successful and productive. This model predicts that economic deprivation in early childhood creates disparities in school readiness and early academic success that widen over the course of childhood.

Complementary studies in psychology and social epidemiology illustrate that both in utero environments and early childhood experiences can have long-term effects on adult physical and mental health (Barker, Forsén, Eriksson, & Osmond, 2002; Danese, Pariante, Caspi, Taylor, & Poulton, 2007; Poulton, & Caspi, 2005). The "fetal origins hypothesis" posits a programming process whereby nutritional deficits and impaired growth occurring during the prenatal period have longlasting implications for physiology and disease risk (Strauss, 1997). Chronic stress from growing up poor could also alter long-term hormonal and immune functions in ways that predict disease later in life. For example, Evans and Schamberg (2009) showed that childhood poverty increases allostatic load, a biological index of the cumulative wear and tear on the body, during the teenage years. Moreover, the longer the children had lived in poverty, the higher their allostatic load.

Allostatic load is caused by the mobilisation of multiple physiological systems in response to chronic stressors in the environment. This biological wear and tear accumulates over time among children sustaining adverse events or stressors, leading in turn to maladaptive physiologic responses that increase disease risk and undermine health. Childhood poverty may actually "reset" the immune system in a manner that increases stress-related impairments in immune function, rates of infectious and chronic diseases, or blood pressure and cardiovascular disease incidence (Miller et al., 2009).

Methods for assessing causal effects of poverty

Regardless of the timing of low income, isolating its causal effects on children's wellbeing is very difficult. Since poverty is associated with other experiences of disadvantage, it is difficult to determine whether it is poverty per se that really matters or, instead, other related experiences. The best way to identify how much money itself really matters is to conduct an experiment that compares families that receive some additional money with families that are otherwise similar but do not receive such money. The only large-scale randomised interventions to alter family income directly were the US negative income tax experiments, which were conducted between 1968 and 1982 with the primary goal of identifying the influence of guaranteed income on parents' labour force participation. Researchers found that elementary (primary) school children in the experimental group (whose families experienced a 50% boost in their income) exhibited higher levels of early academic achievement and school attendance than the control group (Maynard & Murnane, 1979). No test score differences were found for adolescents, although youth in the experimental group did have higher rates of high school completion and educational attainment (Salkind & Haskins, 1982). This suggests that higher income may indeed cause higher achievement, although even in this case it is impossible to distinguish the effects of income from the possible benefits to children of the reductions in parental work time that accompanied the income increases.

Providing income support to working poor parents through wage supplements has been shown to improve children's achievement, according to data from experimental welfare reform evaluation studies undertaken during the 1990s. One study analysed data from seven random-assignment welfare and antipoverty programs; all of them increased parental employment but only some increased family income (Morris, Huston, Duncan, Crosby, & Bos, 2001). Preschool and elementary (primary) school children's academic achievement was improved by programs that boosted both income and parental employment, but not by programs that only increased employment. The school achievement of adolescents did not appear to benefit from either kind of program.4 A separate analysis of the data on younger children suggests that a US$3,000 increase in annual income is associated with a gain of about one-fifth of a standard deviation in achievement test scores (Duncan, Morris, & Rodrigues, 2011).

Convincing evidence can sometimes be derived from non-experimental studies that are careful to compare families that differ in terms of income but are otherwise similar. One such study took advantage of the fact that between 1993 and 1997, the maximum earned income tax credit for working poor families increased by more than US$2,000 for a family with two children (Dahl & Lochner, 2012). The authors compared the school achievement of children before and after this generous increase. They found improvements in low-income children's achievement in middle childhood that coincided with the policy change. A second study, based in Canada, found similar results when it took advantage of variation across Canadian provinces in the generosity of their National Child Benefit program to estimate income effects on child achievement (Milligan & Stabile, 2008).

Linking early poverty to adult outcomes

Although these experimental data have provided important insights into the causal effects of poverty, neither they nor any other studies in the past income literature has been able to relate family income early in a child's life to adult attainments, largely because no single study had collected data on both early childhood income and later adult outcomes. However, our recent research has made this link using data from the Panel Study of Income Dynamics (PSID), which has followed a nationally representative sample of US families and their children since 1968 (Duncan, Ziol-Guest, & Kalil, 2010). The study is based on children born between 1968 and 1975 and collected information on their economic outcomes between ages 25 and 37. Health conditions were assessed in 2006, when these individuals were between the ages of 30 and 37.

One of the many merits of the PSID is that it measured income in every year of a child's life from the prenatal period through age 15. This enabled us to measure poverty across several distinct periods of childhood, distinguishing income early in life (prenatal through fifth year) from income in middle childhood and adolescence (Duncan et al., 2010). We used the PSID's high-quality edited measure of annual total family income, inflated to 2005 levels using the consumer price index. The simple associations between income early in life and adult outcomes are striking (Table 1).5 Compared with children whose families had incomes of at least twice the poverty line during their early childhood, poor children completed two fewer years of schooling and, as adults, earned less than half as much, worked 451 fewer hours per year, and received US$826 per year more in food stamps. Males who grew up in poverty were twice as likely to be arrested. For females, poverty was associated with a more than five-fold increase in the likelihood of bearing a child out of wedlock prior to age 21. As for health, poor children were nearly three times as likely to report poor overall health as adults, were more than twice as likely to report various activity-limiting health conditions, and were 19 percentage points more likely to be overweight.

| Early childhood income in relation to official US poverty line | |||

|---|---|---|---|

| Below poverty line (mean or %) | 1-2 × poverty line (mean or %) | 2 × poverty line (mean or %)--> > 2 × poverty line (mean or %) | |

| Completed schooling (years) | 11.8 | 12.7 | 14.0 |

| Adult earnings between ages 25 and 37 (in US$10,000) | $17.9 | $26.8 | $39.7 |

| Annual work hours between ages 25 and 37 | 1,512 | 1,839 | 1,963 |

| Food stamps between ages 25 and 37 | $896 | $337 | $70 |

| Ever arrested (men only) | 26% | 21% | 13% |

| Non-marital birth (women only) | 50% | 28% | 9% |

| Poor health in 2005 | 13% | 13% | 5% |

| Obese in 2005 (BMI > 30) | 45% | 32% | 26% |

| Hypertension in 2005 | 25% | 10% | 9% |

| Arthritis in 2005 | 7% | 7% | 3% |

| Diabetes in 2005 | 4% | 6% | 2% |

| Work-limiting hypertension in 2005 | 4% | 2% | 2% |

Note: The sample consists of individuals born between 1968 and 1975 in the PSID. Earnings and food stamp values are in 2005 dollars.

Looking beyond these simple correlations, Duncan and colleagues (2010) regressed the adult outcomes listed in Table 1 on three childhood stage-specific measures of family income - average income between the prenatal year and age 5, average income between ages 6 and 10, and average income between ages 11 and 15 - plus an extensive list of background controls.6 To account for the possibility that income effects are nonlinear, two coefficients were estimated for each childhood stage, the first reflecting the estimated effect of an additional US$3,000 of annual income7 in the given stage for children whose income during that stage averaged less than US$25,000 and the second reflecting comparable effects for higher income children (all three sets of income variables, plus other controls, are included in all regressions).

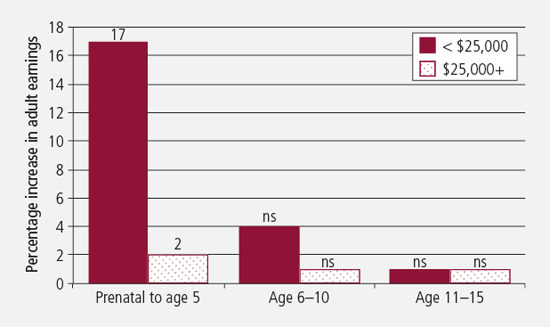

Turning first to their central measure of labour market productivity - average annual earnings between ages 25 and 37 - Duncan and colleagues (2010) found that for children growing up in families with average early childhood incomes below US$25,000, a US$3,000 annual boost to family income between the prenatal year and age 5 was associated with a 17% increase in adult earnings (Figure 3). For children growing up in higher income households (more than US$25,000 per year), a US$3,000 boost to family income was statistically significant but was estimated to increase adult earnings by only about 2%. None of the income increments later in childhood was estimated to have statistically significant effects on later earnings.

Figure 3: Percentage increase in adult earnings associated with a $3,000 annual increase in childhood income, for incomes under and over $25,000

Note: "n. s." means not statistically significant at p < .10

Source: Duncan et al. (2010)

Results for work hours are broadly similar to those for earnings, showing a highly significant estimated effect of early, but not later, childhood income. In this case, a US$3,000 annual increase in the average income of low-income families from prenatal to age 5 is associated with 152 additional work hours per year after age 25. This is shown as the first bar in Figure 4. Other results presented in Figure 4 show that the boost in adult productivity associated with additional income in early childhood also led to significantly lower amounts of food stamp receipts (expressed in US dollars per year).

Figure 4: Effects on various adult outcomes associated with a $3,000 annual increase in prenatal to age 5 income, for incomes < $25,000

[[{"fid":"182","view_mode":"full","fields":{"format":"full","field_file_image_alt_text[und][0][value]":"Figure 4: Effects on various adult outcomes associated with a $3,000 annual increase in prenatal to age 5 income, for incomes less than $25,000 - as described in text. ","field_file_image_title_text[und][0][value] ":" "},"type ":"media ","attributes ":{"class ":"media-element file-full"}}]]

Earnings are the product of work hours and the hourly wage rate. There is clearly a strong relationship between early income and work hours, but it is also important to determine how important early income is for the hourly wage rate. In results not shown, Duncan and colleagues (2010) found no connection between early income and hourly earnings; virtually all of the earnings effect was carried by increases in labour supply rather than the wage rate. Accordingly, it is perhaps not surprising that early income was not significantly related to completed schooling, the most potent determinant of hourly wage rates.8 Nor were there significant effects of early poverty on problem behaviour - being arrested or incarcerated (for males) or having a non-marital (ex-nuptial) birth (for females). Family income during adolescence seemed to matter more for these outcomes.

So, if neither the human capital (schooling and wage rates) nor the behavioural (lack of arrests or non-marital births) outcomes account for links between early income and adult labour market productivity, what does? Consistent with the "early origins " work in social epidemiology and neuroscience, it appears that early income has long-term effects on work-limiting health conditions.

Regression results are shown in Figure 5. As with earnings and work hours, each of the health conditions was regressed on stage-specific childhood income and demographic control variables. As before, the income associations are allowed to be nonlinear, with one linear segment fit across average annual incomes within a given childhood stage up to US$25,000 and another fit to incomes above US$25,000. Only the coefficients on the low-income segment for early childhood are shown in Figure 5.9 Given the dichotomous nature of the health outcomes, we estimated these models with logistic regression. The bars in Figure 5 represent the percentage reductions in the odds of a given condition associated with a US$3,000 increase in annual income between the prenatal year and age 5.

Figure 5: Percentage reductions in odds of various health conditions associated with a $3,000 annual increase in prenatal to age 5 income, for family income < $25,000, 2006

[[{"fid":"2323","view_mode":"full","fields":{"format":"full","field_file_image_alt_text[und][0][value]":"Figure 5: Percentage reductions in odds of various health conditions associated with a $3,000 annual increase in prenatal to age 5 income, for family income less than $25,000, 2006 - as described in text.","field_file_image_title_text[und][0][value]":""},"type":"media","attributes":{"alt":"Figure 5: Percentage reductions in odds of various health conditions associated with a $3,000 annual increase in prenatal to age 5 income, for family income less than $25,000, 2006 - as described in text.","class":"media-element file-full"}}]]

Figure 5 shows a remarkable pattern of effects on emerging (mid- to late 30s) adult health problems. Although increments to early income do not appear to affect self-rated overall adult health or diabetes, US$3,000 increments to low income early in life are associated with a 20% reduction in the odds of being obese, a 29% reduction in the odds of reporting hypertension, a 46% reduction in the odds of reporting arthritis, and a 33% reduction in the odds of reporting a health-related work limitation. Although more research is obviously needed, these health pathways involving stress and inflammation appear to be very promising linkages between poverty early in life and adult labour market productivity. These results are consistent with the hypothesis that the early years represent a sensitive period during which social processes become embedded in biology and that modifications in gene expression or cellular phenotype could be responsible for these associations.

Some policy implications

Early childhood is a particularly sensitive period in which economic deprivation may compromise children's health and employment opportunities. This research suggests that greater policy attention should be given to remediating situations involving deep and persistent poverty in utero and occurring early in childhood. In terms of indicators, it is crucial to track rates of poverty among children - especially deep poverty occurring early in childhood - to inform policy discussions regarding children's wellbeing.

In the case of welfare policies, imposing sanctions and other regulations that deny benefits to families with very young children would appear to be particularly harmful. Not only do young children appear to be most vulnerable to the consequences of deep poverty, but mothers with very young children are also least able to support themselves through employment in the labour market.

More effective would be income transfer policies that provided more income to families with young children. In the case of work support programs like the earned income tax credit, this might mean extending more generous credits to families with young children. In the case of child tax credits, this could mean making the credit refundable and also providing larger credits to families with young children. Interestingly, several European countries gear the time-limited benefits provided by their assistance programs to the age of children. In Germany, a modest parental allowance is available to a mother working fewer than 20 hours per week until her child is 18 months old. France guarantees a minimum income to most of its citizens, including families with children of all ages. Supplementing this basic support is the allocation de parent isolé (API) program for lone parents with children under age 3. In effect, the API program acknowledges a special need for income support during this period, especially if a parent wishes to care for very young children and forgo income from employment.

Australia has historically had far more generous and long-term income support policies for lone mothers than the US. However, at the time of writing, the Australian Government had implemented budget cuts to such programs as part of its austerity program. In January 2013, the Federal Government imposed tighter restraints on parenting pensions, resulting in more single parents (mostly mothers) being moved onto a lower unemployment allowance once their youngest child turns 8 years old (Australian Council of Social Services, 2012).

In emphasising the potential importance of policies to boost income in early childhood, we do not mean to suggest that this is the only policy path worth pursuing. Obviously investments later in life and those that provide direct services to children and families may also be well advised. Economic logic requires a comparison of the costs and benefits of the various programs that seek to promote the development of disadvantaged children throughout the life course. In this context, expenditures on income transfer and service delivery programs should be placed side by side and judged by their benefits and society's willingness to pay for the outcomes they produce, relative to their costs.

Endnotes

1 The EITC is a refundable federal income tax credit for low to moderate income working individuals and families. The US Congress originally approved the tax credit legislation in 1975, in part to offset the burden of social security taxes and to provide an incentive to work. When the EITC exceeds the amount of taxes owed, it results in a tax refund to those who claim and qualify for the credit. For the tax year 2011, the maximum credit for a single person or a couple with one child was $3,094 and for a single person or couple with two children was $5,112.

2 These data are drawn from Gornick and Jantti (2009), who draw from the Luxembourg Income Study (LIS) Wave 5, which is centred on the year 2000.

3 Data on young children in Australia were not included in Gornick and Jantti (2009) due to incomplete information on children's ages. However, the data for all children (under 18) are available and show that using the 50% median income threshold 22% of US children are poor. The corresponding figure for Australia is 12%.

4 Though leveraging experimental data, the analysis itself is not an experiment, as families were not randomly assigned across types of treatments.

5 Data on all but the last four health conditions appear in Duncan et al. (2010). Data on health conditions come from additional calculations using the same PSID-based sample.

6 "Background controls " consist of birth year, race, sex, whether the child's parents were married and living together at the time of the birth, mother's age at birth, region, number of siblings, parent schooling, parent test score, cleanliness of the house, parents' expectations for child, parent achievement motivation, parent locus of control and parent risk avoidance. The regression then - for example, for earnings - regressed average earnings between ages 25 and 37, averaged over as many of these years as possible, on average annual income between the prenatal year and age 5, between ages 6 and 10 and between age 11 and 15, plus these background variables. See Duncan et al. (2010) for additional technical detail.

7 The US$3,000 amount was chosen for the interpretation of coefficients because it is well within the range of an actual US policy - the earned income tax credit. Given that a linear function was fit to the entire income range up to US$25,000, estimated effects of income increments smaller or larger than US$3,000 can be obtained with proportionate reductions or increases in the effects shown in the figures.

8 The completed schooling picture is a bit more complicated. Although early income did not matter for eventual completed schooling, it did have a significant effect on completed schooling by age 21. Thus, it appears that early income may matter more for the "on time " completion of schooling by the end of adolescence than for the sporadic increases in schooling that often occur later.

9 These regression results do not appear in Duncan et al. (2010) but use the same sample. In only one case - for incomes above US$25,000 for ages 11 to 15 in the diabetes regression - was the coefficient more than twice its standard error.

References

- Australian Council of Social Service. (2012). Briefing notes on cuts to payments for sole parents. Strawberry Hills, NSW: ACOSS. Retrieved from <www.acoss.org.au/images/uploads/Formatted%20briefing%20note%20sole%20parents%2021%20May%202012.pdf>.

- Barker, D., Forsén, T., Eriksson, J., & Osmond, C. (2002). Growth and living conditions in childhood and hypertension in adult life: A longitudinal study. Journal of Hypertension, 20(10), 1951-1956.

- Becker, G. (1981, January). A treatise on the family. Cambridge, MA: Harvard University Press.

- Chase-Lansdale, P.L., & Pittman, L. (2002). Welfare reform and parenting: Reasonable expectations. Future of Children, 12, 167-186.

- Cunha, F., Heckman, J. J., Lochner, L., & Masterov, D. (2005). Interpreting the evidence on life cycle skill formation. In E. Hanushek, & F. Welch (Eds.), Handbook of the economics of education. Amsterdam: North Holland.

- Dahl, G., & Lochner, L. (2012). The impact of family income on child achievement. American Economic Review, 102(5), 1927-1956.

- Danese, A., Pariante, C., Caspi, A., Taylor, A., & Poulton, R. (2007). Childhood maltreatment predicts adult inflammation in a life-course study. Proceedings of the National Academy of Sciences 23, 104(4), 1319-1324.

- Duncan, G., Morris, P., & Rodrigues, C. (2011). Does money matter? Estimating impacts of family income on young children's achievement with data from random-assignment experiments. Developmental Psychology, 47(5), 1263-1279.

- Duncan, G., Ziol-Guest, K., & Kalil, A. (2010). Early childhood poverty and adult attainment, behavior and health, Child Development, 81(1), 306-325.

- Evans, G., & Schamberg, M. (2009). Childhood poverty, chronic stress, and adult working memory. Proceedings of the National Academy of Sciences, 106, 6545-6549.

- Gornick, J., & Jantti, M. (2009). Child poverty in upper-income countries: Lessons from the Luxembourg Income Study. In S. B. Kamerman, S. Phipps & A. Ben-Arieh (Eds.), From child welfare to child wellbeing: An international perspective on knowledge in the service of making policy (pp. 339-370). Dordrecht: Springer Publishing Company.

- Knudsen, E., Heckman, J., Cameron, J., & Shonkoff, J. (2006). Economic, neurobiological, and behavioral perspectives on building America's future workforce. Proceedings of the National Academy of Sciences, 103, 10155-10162.

- Mayer, S. (1997). What money can't buy: The effect of parental income on children's outcomes. Cambridge, MA: Harvard University Press.

- Maynard, R., & Murnane, R. (1979). The effects of a negative income tax on school performance: Results of an experiment. Journal of Human Resources, 14(4), 463-476.

- McLoyd, V. (1990). The impact of economic hardship on black families and children: Psychological distress, parenting and socioeconomic development. Child Development,61, 311-346.

- McLoyd, V. C., Jayaratne, T. E., Ceballo, R., & Borquez, J. (1994). Unemployment and work interruption among African American single mothers: Effects on parenting and adolescent socioemotional functioning. Child Development, 65, 562-589.

- Miller, G. E., Chen, E., Fok, A. K., Walker, H., Lim, A., Nicholls, E. F. et al. (2009). Low early-life social class leaves a biological residue manifested by decreased glucocorticoid and increased proinflammatory signaling. Proceedings of the National Academy of Sciences, 106, 14716-14721.

- Milligan, K., & Stabile, M. (2008). Do child tax benefits affect the wellbeing of children? Evidence from Canadian child benefit expansions (NBER Working Paper No. 14264). American Economic Journal: Economic Policy, 3(3), 175-205.

- Morris, P., Huston, A., Duncan, G., Crosby, D., & Bos, H. (2001). How welfare and work policies affect children: A synthesis of research. New York: MDRC.

- Nelson, C. A., Zeanah, C. H., Fox, N. A., Marshall, P. J., Smyke, A. T., & Guthrie, D. (2007). Cognitive recovery in socially deprived young children: The Bucharest early intervention project. Science, 318(5858), 1937-1940.

- Poulton, R., & Caspi, A. (2005). Commentary: How does socioeconomic disadvantage during childhood damage health in adulthood? Testing psychosocial pathways. International Journal of Epidemiology, 34(2), 344-345.

- Salkind, N., & Haskins, R. (1982) Negative income tax: The impact on children from low-income families. Journal of Family Issues, 3, 165-180.

- Sapolsky, R. (2004). Mothering style and methylation. Nature Neuroscience, 7, 791-792.

- Strauss, R. (1997). Effects of the intrauterine environment on childhood growth. British Medical Bulletin, 53(1), 81-95.

- Zahn-Waxler, C., Duggal, S., & Gruber, R. (2002). Parental psychopathology. In M. H. Bornstein (Ed.), Handbook of parenting (2nd ed., vol. 4, pp. 95-328). Mahwah, NJ: Lawrence Erlbaum Associates, Inc.

Duncan, G. J., Kalil A., & Ziol-Guest, K. M. (2013). Early childhood poverty and adult achievement, employment and health. Family Matters, 93, 27-35.