Understanding the Child Care Subsidy

June 2023

Download Research snapshot

Overview

This snapshot presents findings from the 2018–2021 evaluation of the Australian Government's Child Care Package.

The Child Care Subsidy (CCS) was introduced in July 2018 as part of the Child Care Package. The CCS helps cover the cost of child care for Australian families, with the subsidy amount varying with family income, and the number of hours that can be subsidised determined by the activity test. The focus of this snapshot is families' understanding and experiences of access to the CCS. The findings from the evaluation indicate that there was widespread understanding, and most families did not experience significant difficulties accessing CCS. However, concerns remained that a lack of understanding or other difficulties may have resulted in some families not applying for CCS even if they were eligible for it.

The Child Care Subsidy

The Child Care Subsidy was introduced in July 2018, replacing the previous 2 forms of child care support, the Child Care Benefit and Child Care Rebate. In addition to the CCS, families can access additional support through the Additional Child Care Subsidy (ACCS) if their family or children meet specific criteria indicating a higher level of support is appropriate.1 (See the Additional Child Care Subsidy snapshot.)

Most Australian families are eligible for the CCS if they have an arrangement with an approved child care service that means they are liable to pay child care fees.2 The CCS is usually paid to the child care service and the balance of the fee payable for child care is charged to the family.3,4 The CCS amount that families receive will depend on:

- hourly rate caps that are the maximum hourly rate the Government subsidises for each service type

- the percentage rate of the CCS families are eligible for, as determined by the income test. The subsidy rate commences at a rate of 85% of the fees paid, up to the hourly rate cap, and then is tapered, in stages, as family income increases, becoming zero for families with income at or above an annual income of $352,453 (in 2019-20).

- the annual cap, which is the maximum amount of CCS that will be paid to a family in any one financial year. In 2019-20 it was $10,373 per child per annum. The annual cap only applies to families with an annual income over $188,163 (2019-20).

- how many hours of subsidised care they are entitled to, which is dependent on the activity test (see the Activity Test snapshot).

Within the December 2019 quarter, there were 936,141 families (comprising 1,330,205 children) who were using some approved child care. Of these, 94% of families and 94% of children accessed the CCS at some time.5

Families using approved child care but receiving no CCS include those who are not eligible for the CCS, those who are eligible but have not applied for the CCS, and those who have applied but are eligible for zero hours (because they do not meet the activity test) or zero percentage (because their family income exceeds the high income cut-off). Some families may decide not to apply for the CCS because they know their income or activity levels will result in their receiving no CCS.

Parents (or carers) apply for the CCS through myGov, and this includes providing information about family income and activity levels. This is in addition to their enrolment with a child care service. Although these processes are connected, part of the application process for the CCS is a 'confirmation of enrolment' with a child care service.

Understanding the Child Care Subsidy

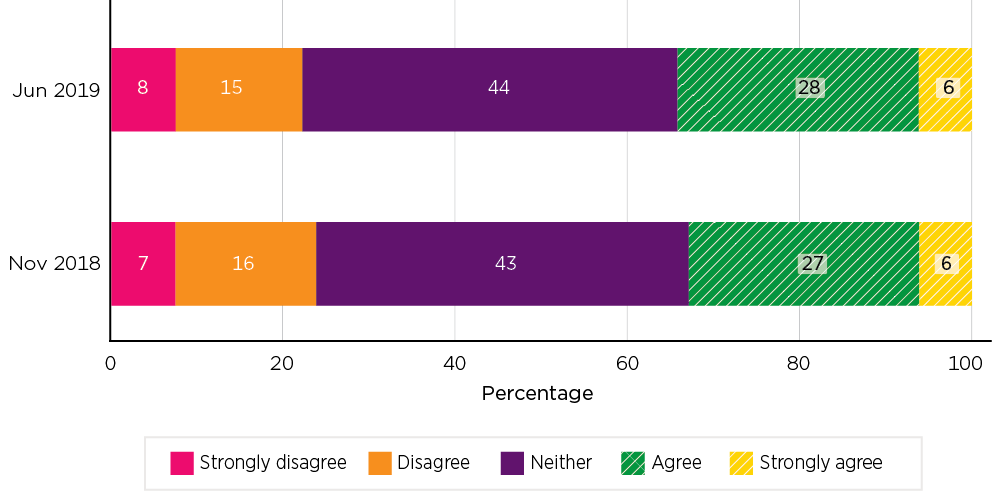

The November 2018 and June 2019 DESE/ORIMA parent surveys asked parents about their agreement with a statement: 'The new child care subsidy is easier to understand than the old Child Care Benefit and Child Care Rebate'.6 As shown in Figure 1, the proportion agreeing that the new subsidy is easier to understand (34% in June 2019) was higher than the proportion disagreeing (23% in June 2019). The most common response was that people neither agreed nor disagreed with the statement.

Figure 1: Parents' agreement with 'The new child care subsidy is easier to understand than the old Child Care Benefit and Child Care Rebate'

Source: DESE/ORIMA parent surveys November 2018 and June 2019

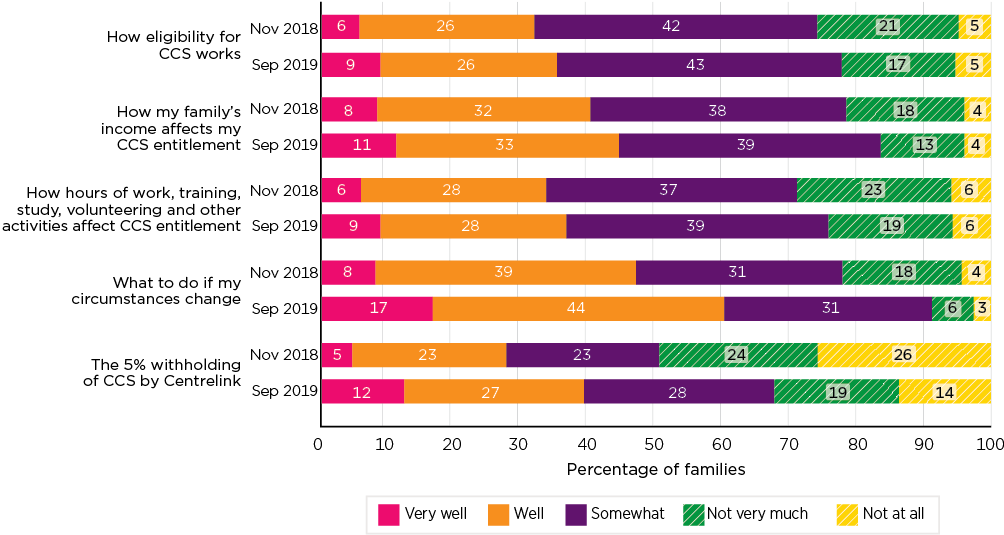

Another perspective on understanding comes from the Child Care Package Family Survey (CCPFamS) in which parents reported on their understanding of how eligibility for the CCS works7 (see details in Figure 2).

- In November 2018, 32% said they understood this 'very well' or 'well'. Another 42% reported they understood it 'somewhat', while 26% said they understood it 'not very much' or 'not at all'.

- When this same question was asked in September 2019, responses were similar, although with a little more understanding reported: 35% said they understood how eligibility to the CCS works 'very well' or 'well'.

This survey also asked questions about understanding specific elements of the Child Care Package (see Figure 2). As described previously, the amount of CCS is dependent on an income test and an activity test, which were asked about in these questions.

- Parents were quite positive about their understanding of the income test - with 44% of those surveyed in September 2019 saying they understood well or very well how their income affects their CCS entitlement. This understanding also showed a bit of an improvement from the earlier November 2018 survey.

- There was somewhat less reported understanding of the activity test, with 25% of parents in September 2019 rating their understanding as 'not very much' or 'not at all' for 'how hours of work, training, study, volunteering and other activities affect CCS entitlement'. Parent-reported understanding of this did improve, however, between November 2018 and September 2019.

See the Activity Test snapshot for more insights on family experiences of the activity test.

Families are required to keep income and activity details up-to-date to ensure their CCS amount is accurate. In the survey parents were asked if they knew what to do if their circumstances changed. Of all aspects, according to parents' reports, this was the one that was best understood, particularly at September 2019 when 61% reported they understood this well or very well.

The least well understood aspect of the Child Care Package, according to parents' reports, was the withholding percentage (see footnote 2), although understanding improved between the 2 surveys.

Figure 2: Parents' reports of understanding of the Child Care Package

Note: N = 503-506

Source: Child Care Package Family Survey, Waves 1 and 2 (November 2018 and September 2019)

In terms of both the impacts of the activity test and the income test and what happens when circumstances change, one issue that arose in parents' reports was that some found it difficult to estimate how much child care was costing them. Comments included:

CCS is very hard to predict. Once I started working more, I didn't know how much I'd need to budget until my first direct debit from day care came in. It seems arbitrary and all the calculations, for a working parent, are ridiculous. Create a calculator that a parent can access online, that would help greatly.

Family using centre-based day care (CBDC), October 2019

I think because I went back to work more hours, it increased the percentage I had to pay. It wasn't a huge debt … Annoying though … It was far easier when it was the 50%. Life is busy enough, without constantly thinking about changing my income and work details. I do not have the time for that.

Family using CBDC, October 2019

Having access to a user-friendly calculator that assists families to work out their child care costs, and to estimate costs under different scenarios, was expressed by parents as something they wished to have access to, as had been available to them in the time leading up to the transition to the Child Care Package.

Access to and understanding of information

An important insight into parents' understanding of the CCS was gained by considering their reports of their access to and understanding of information.

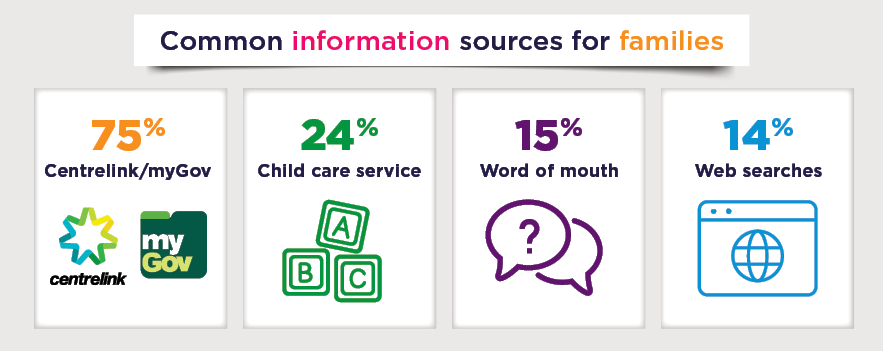

To access information about child care assistance, families could go online for general information, with information provided on Services Australia and Department of Education, Skills and Employment websites, as well as being available from different child care providers and stakeholders. Parents could also contact Centrelink by phone or in person. In the November 2019 ORIMA/DESE survey, the common information source for families using paid child care was Centrelink/myGov (75% reported this as an information source). This compared to:

- 24% getting information from their child care service

- 15% getting information via word of mouth; for example, family, friends, work colleagues, etc.

- 14% sourcing information from general web searches.

Other sources of information were MyChild/Child Care Finder (5%) and advertising (1%).

Given that Centrelink was cited as a main source of information, it is not surprising that in reporting about access to the CCS, families often reported on this experience. In the September 2019 CCPFamS, comments about Services Australia/Centrelink centred on some key themes about difficulties related to customer service and long waiting times for assistance from Centrelink, information being difficult to understand, difficulties navigating myGov and long waiting times for end of financial year balancing.

Overall, Figure 3 shows that parents often did not find information about child care assistance easy to understand, with more disagreeing than agreeing. However, these survey findings indicated some improvement in the ease of understanding the Child Care Package since its introduction, with the proportion in agreement being higher (29%) in November 2019 than in June 2018 (23%).

Figure 3: Parents' agreement that 'It is easy to understand Government information about child care assistance', June 2018 and November 2019

Source: DESE/ORIMA parent surveys, November 2018 and June 2019.

Service and stakeholder concerns

Overall, reporting by child care services indicated that the move from 2 separate subsidies to a single subsidy was more streamlined for families and that, aside from initial issues during the transition, most families had become competent at navigating myGov, updating their income and hours of activity, and managing enrolments.

However, throughout the evaluation, child care services spoke of the CCS application process remaining confusing for some families who were new to the process, and voiced concerns that these processes posed particular challenges for disadvantaged or vulnerable families. Services and stakeholders reported that such families sometimes had difficulties understanding or following the application process, and services needed to provide assistance to ensure these families completed the necessary steps. In particular, some families did not understand the two-step process of applying for CCS and confirming their enrolment with their child care service. It was also observed that difficulties arose when families' circumstances changed or involved having to make complex calculations, for example, calculating hours of activity when a parent engaged in casual or intermittent work.

Services, themselves, often reported having experienced some difficulties with the transition to the Child Care Package, and some specific aspects of the Package posed challenges. They also expressed that problems were not easily resolved through the DESE helpdesk support. However, it was supporting certain cohorts of families in their enrolment and access to the CCS that, in particular, continued to be referred to beyond the initial transition period.

Summary

Overall, the evaluation found that parents largely understood the CCS and the income and activity test requirements. But parents were only weakly supportive of the system being easier to understand than the previous system, with the largest group neither agreeing nor disagreeing that the CCS system was simpler. Most specific aspects of the Child Care Package were reported by parents to be understood to some extent, although this understanding was less apparent for the withholding percentage.

There continued to be some challenges for parents in understanding information about child care assistance. There was a small increase in parents' views that information on child care assistance was easy to understand, although on balance parents continued to disagree with this, and there was no change in their perception of how easy it was to obtain information.

A specific part of the application process that remained challenging was the two-stage process associated with agreeing the Complying Written Agreement and then confirming the enrolment. Concerns were also raised about the functionality and ease of use of the Centrelink calculator relative to that produced by DESE prior to the transition. The evaluation also found that parents had some difficulties in going through Centrelink for their CCS applications.

Services and stakeholders expressed some concerns that more disadvantaged and vulnerable families continued to face difficulties with the new arrangements, including the steps involved in the application process. Services themselves experienced challenges in supporting families' applications, with part of this related to their not being able to satisfactorily resolve issues through the DESE Helpdesk.

1 The policy settings described in this snapshot refer to those that applied at the time of the evaluation. There have been some updates to policy settings since this time, and the Department of Education, Skills and Employment (DESE) is now the Department of Education.

2 There are some restrictions around Australian residency and, in the case of separated families, the proportion of nights per fortnight the child stays with each parent. There are further requirements related to immunisations, school attendance and child age, although some exemptions apply for children with a disability or who need supervision at older ages. See Child Care Subsidy - Who can get it - Services Australia.

3 In most cases, the actual subsidy paid to a provider is 95% of the amount of CCS the parent is eligible for, as 5% of the entitlement is initially withheld by government (the 'withholding amount'). After annual reconciliation, this withholding amount is either paid to the family or is used to offset any debt they may have to the Commonwealth; in particular, where an underestimation of annual income has resulted in the subsidy being paid at an incorrect, and higher, rate.

4 Families without the CCS would typically be required to pay full fees, although services may put different arrangements in place to support vulnerable families. This would especially be likely within services that are in receipt of Community Child Care Fund grant funding.

5 This slightly undercounts the total number of children, as it only counts one child per family if the family is using in home care. In the December 2019 quarter, 1,126 families used in home care.

6 DESE/ORIMA Parent Surveys were managed and designed by the Department and conducted on the Department's behalf by ORIMA Research. Results were provided to the evaluation as the main source of data on parents' experience and views. The surveys were conducted twice-yearly from June 2018, and in all but the November 2019 survey included a sample of parents not using child care. We refer to respondents as parents but a small number were grandparents or other carers.

7 This survey was conducted by AIFS for the evaluation, with respondents being a subset of the DESE/ORIMA Parent Survey respondents. It was conducted in November 2018 and 2019.

Child Care Package evaluation

In July 2018 the Australian Government introduced the Child Care Package. The Australian Institute of Family Studies in association with the Social Research Centre, the UNSW Social Policy Research Centre and the ANU Centre for Social Research and Methods were commissioned by the Australian Government Department of Education, Skills and Employment to undertake an independent evaluation of the new Child Care Package. Findings presented here are based on data collected and analysed for the Child Care Package evaluation. The evaluation commenced in December 2017 prior to the introduction of the Package and reported on data collected up to December 2019. The evaluation was impacted by external events, particularly COVID-19, which resulted in the suspension of the child care funding system for a period during 2020. As a result, the evaluation only draws on data to the end of 2019 and does not include data from 2020.

Australian Institute of Family Studies. (2023). The 2018–2021 Child Care Package Evaluation: Understanding the Child Care Subsidy. (Findings from the Child Care Package evaluation). Melbourne: Australian Institute of Family Studies.